Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. The following conditions exist in the foreign exchange market: Current spot rate: $1.80/pound Annualized interest rate on 90-day dollar-denominated bonds: 8% (2% for

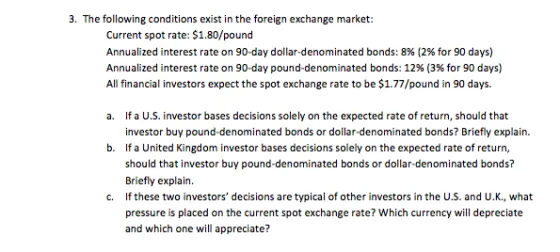

3. The following conditions exist in the foreign exchange market: Current spot rate: $1.80/pound Annualized interest rate on 90-day dollar-denominated bonds: 8% (2% for 90 days) Annualized interest rate on 90-day pound-denominated bonds: 12% ( 3% for 90 days) All financial investors expect the spot exchange rate to be $1.77/pound in 90 days. b. a. If a U.S. investor bases decisions solely on the expected rate of return, should that investor buy pound-denominated bonds or dollar-denominated bonds? Briefly explain. If a United Kingdom investor bases decisions solely on the expected rate of return, should that investor buy pound-denominated bonds or dollar-denominated bonds? Briefly explain. c. If these two investors' decisions are typical of other investors in the U.S. and U.K., what pressure is placed on the current spot exchange rate? Which currency will depreciate and which one will appreciate?

Step by Step Solution

★★★★★

3.48 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

a Based on expected return the US investor should buy pounddenominated bonds Heres why Dollardenomin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started