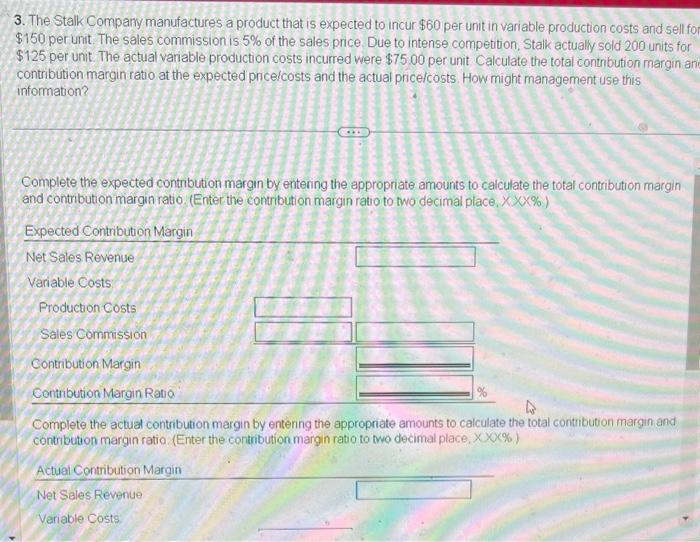

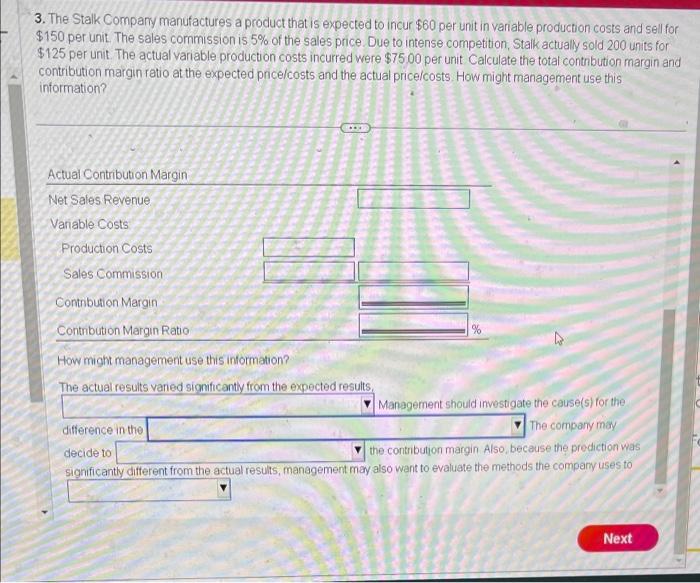

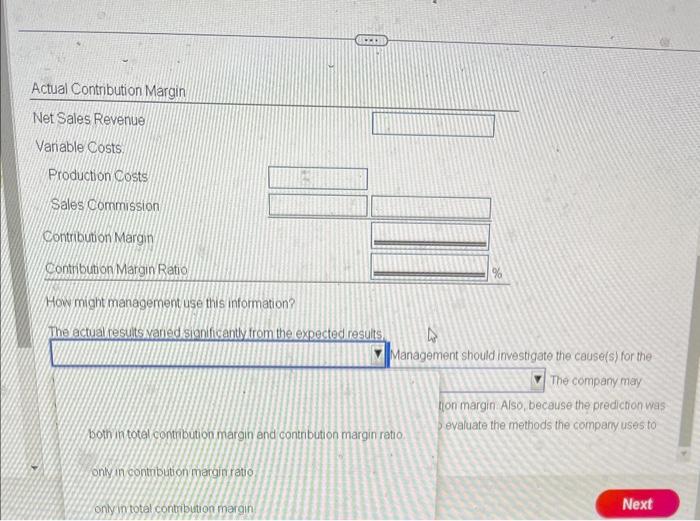

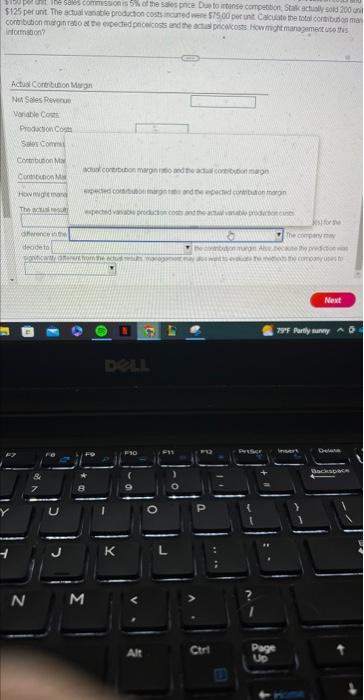

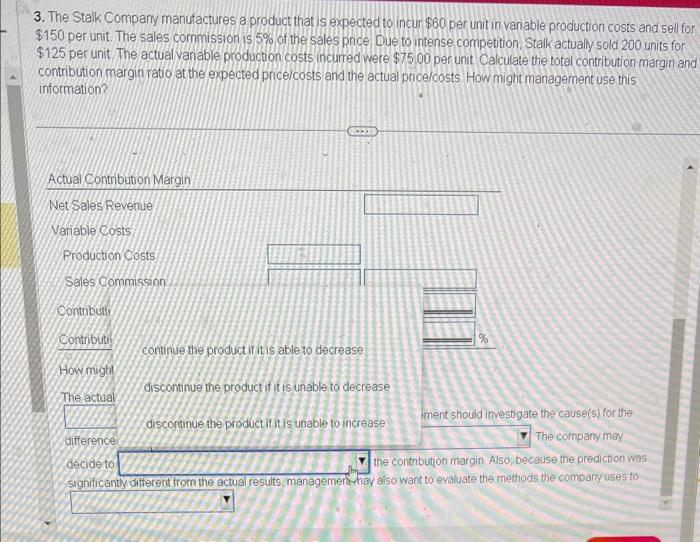

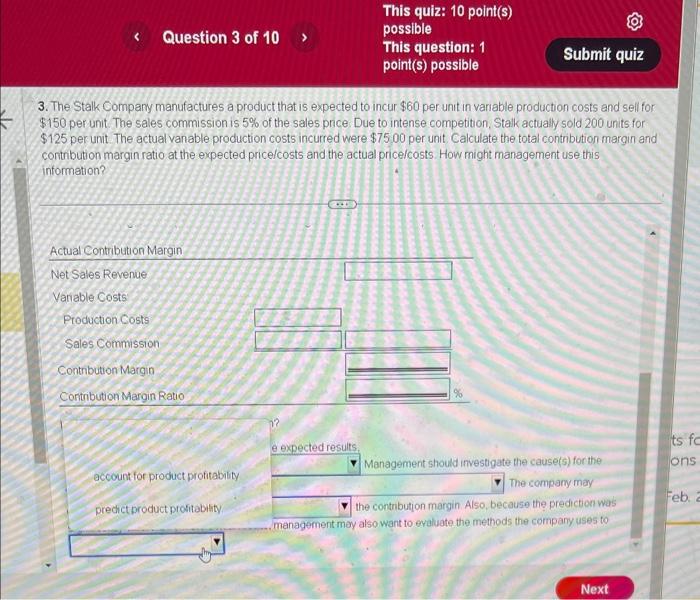

3. The Stalk Company manufactures a product that is expected to incur $60 per unit in variable production costs and sell fo $150 per unit. The sales commission is 5% of the sales price. Due to intense competition, Stalk actually sold 200 units for $125 per unit. The actual variable production costs incurred were $7500 per unit Calculate the total contnbution margin an contribution margin ratio at the expected pricelcosts and the actual pricelcosts. How might management use this information? Complete the expected contribution margin by entering the appropriate amounts to calculate the total contribution margin and contribution margin ratio. (Enter the contribution margin ratio to two decimal place, X% ) Complete the actual contribution margin by entenng the appropriate amounts to calculate the total contribution margin and contrbution margin ratio (Enter the contribution margin ratio to two decimal place, X% ) 3. The Stalk Company manufactures a product that is expected to incur $60 per unit in variable production costs and sell for $150 per unit. The sales cornmission is 5% of the sales price. Due to intense competition, Stalk actually sold 200 units for $125 per unit. The actual variable production costs incurred were $75,00 per unit Calculate the total contnbution margin and contribution margin ratio at the expected pricelcosts and the actual price/costs. How might management use this information? How might management use this information? The actuai rasults vanad sionificantiv from the exnected results. Management should investigate the cause(s) for the differencr compary may decide to the contribution margin Also, because the prediction was sianificantiv different from the actual results, manegement may also want to evaluate the methods the compary uses to flon margin Also, because the prediction was sevaluate the methods the compary uses to informeach? 3. The Stalk Company manufactures a product that is expected to incur $60 per unit in vanable production costs and sell for $150 per unit. The sales commission is 5% of the sales price. Due to intense competition. Stalk actually sold 200 units for $125 per unit. The actual vanable production costs incured were $7500 per unit Calculate the total contribution margin and contribution margin ratio at the expected price/costs and the actual price/costs. How might management use this information? gate the cause(s) for the The company may aecidero vir cumunumumuarym ruay because the prediction was sionificantwoitrerent trom ne actuai resuits; managemern-niay also want to evaluate the methods the company uses to 3. The Stalk Company manufactures a product that is expected to incur $60 per unit in variable production costs and sell for $150 per unit. The sales commission is 5% of the sales price. Due to intense competition, Stalk actually sold 200 units for $125 per unit. The actual vanable production costs incurred were $7500 per unit. Calculate the total contribution margin and contribution margin ratio at the expected price/costs and the actual pricelcosts. How might management use this intormation