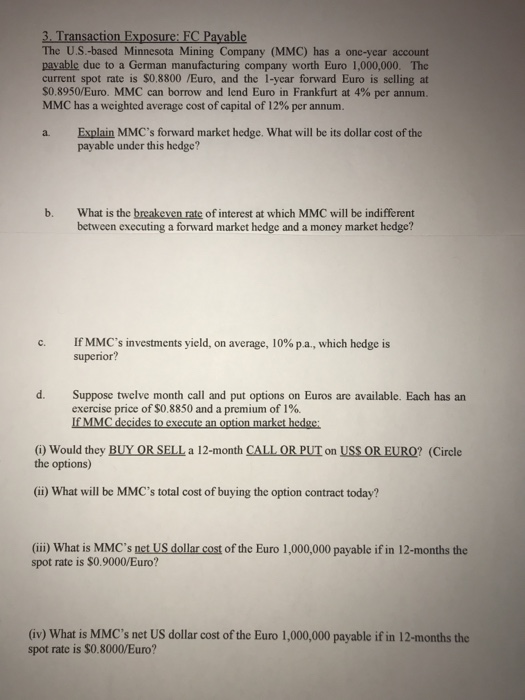

3. Transaction Exposure: FC Payable The U.S-based Minnesota Mining Company (MMC) has a one-year account payable due to a German manufacturing company worth Euro 1,000,000. The current spot rate is $0,8800 /Euro, and the 1-year forward Euro is selling at $0.8950/Euro. MMC can borrow and lend Euro in Frankfurt at 4% per annum. MMC has a weighted average cost of capital of 12% per annum. a. Explain MMC's forward market hedge. What will be its dollar cost of the payable under this hedge? b. What is the breakeven rate of interest at which MMC will be indifferent between executing a forward market hedge and a money market hedge? If MMC's investments yield, on average, 10% pa, which hedge is superior? d. Suppose twelve month call and put options on Euros are available. Each has an exercise price of $0.8850 and a premium of 1%. IfMMC decides to execute an option market hedse: i) Would they BUY OR SELL a 12-month CALL OR PUT on USS OR EURQ? (Circle the options) (ii) What will be MMC's total cost of buying the option contract today? (ii) What is MMC's net US dollar cost of the Euro 1,000,000 payable if in 12-months the spot rate is $0.9000/Euro? iv) What is MMC's net US dollar cost of the Euro 1,000,000 payable if in 12-months the spot rate is $0.8000/Euro? 3. Transaction Exposure: FC Payable The U.S-based Minnesota Mining Company (MMC) has a one-year account payable due to a German manufacturing company worth Euro 1,000,000. The current spot rate is $0,8800 /Euro, and the 1-year forward Euro is selling at $0.8950/Euro. MMC can borrow and lend Euro in Frankfurt at 4% per annum. MMC has a weighted average cost of capital of 12% per annum. a. Explain MMC's forward market hedge. What will be its dollar cost of the payable under this hedge? b. What is the breakeven rate of interest at which MMC will be indifferent between executing a forward market hedge and a money market hedge? If MMC's investments yield, on average, 10% pa, which hedge is superior? d. Suppose twelve month call and put options on Euros are available. Each has an exercise price of $0.8850 and a premium of 1%. IfMMC decides to execute an option market hedse: i) Would they BUY OR SELL a 12-month CALL OR PUT on USS OR EURQ? (Circle the options) (ii) What will be MMC's total cost of buying the option contract today? (ii) What is MMC's net US dollar cost of the Euro 1,000,000 payable if in 12-months the spot rate is $0.9000/Euro? iv) What is MMC's net US dollar cost of the Euro 1,000,000 payable if in 12-months the spot rate is $0.8000/Euro