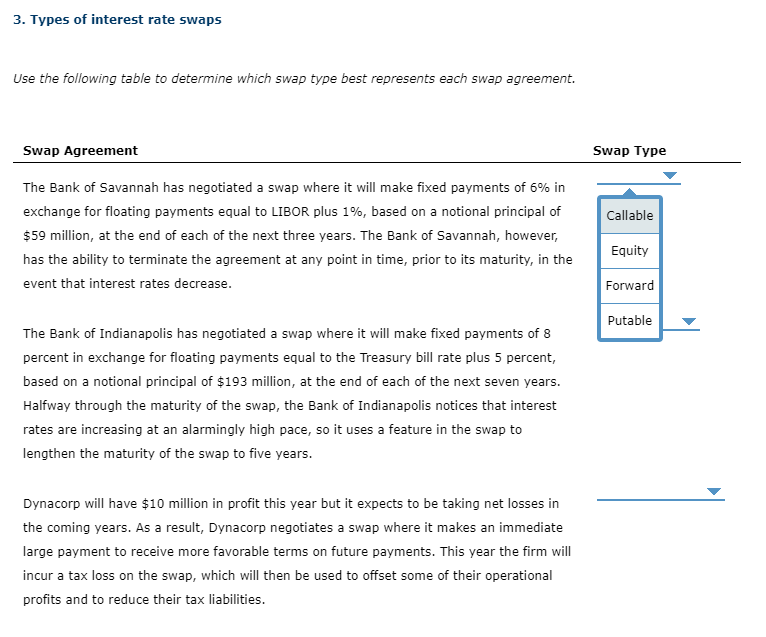

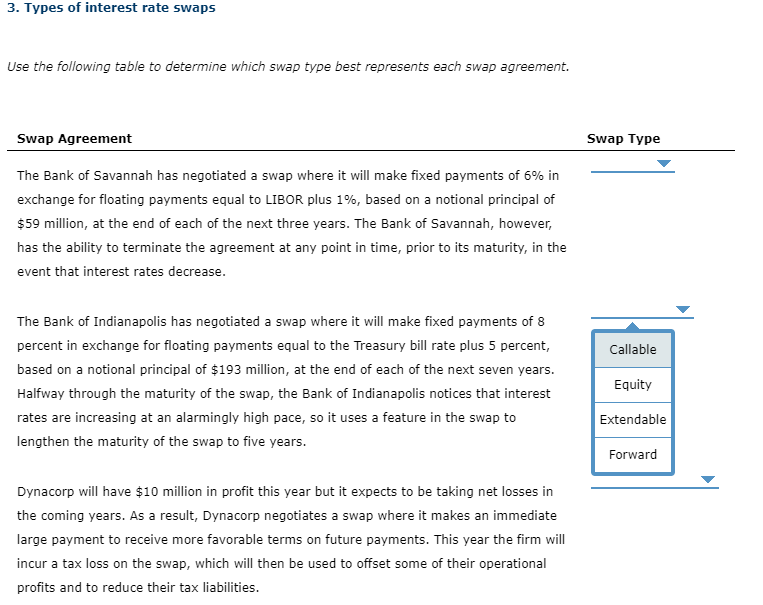

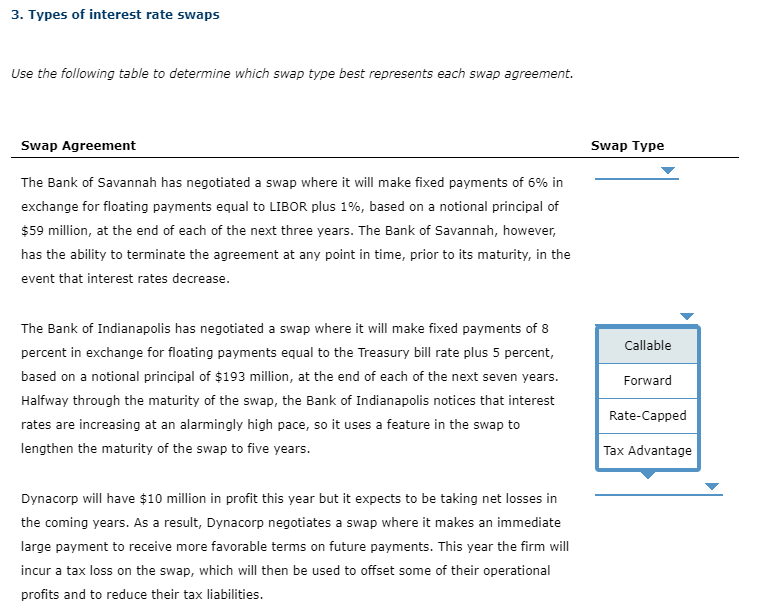

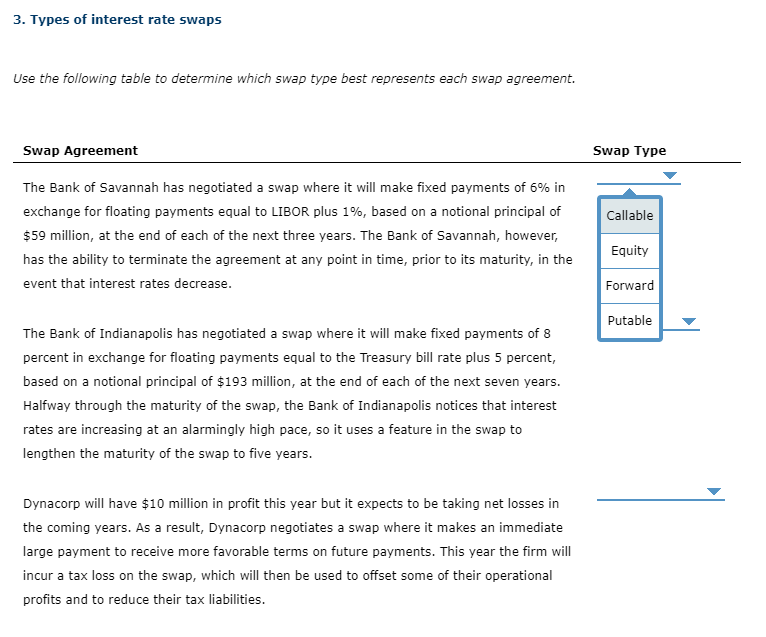

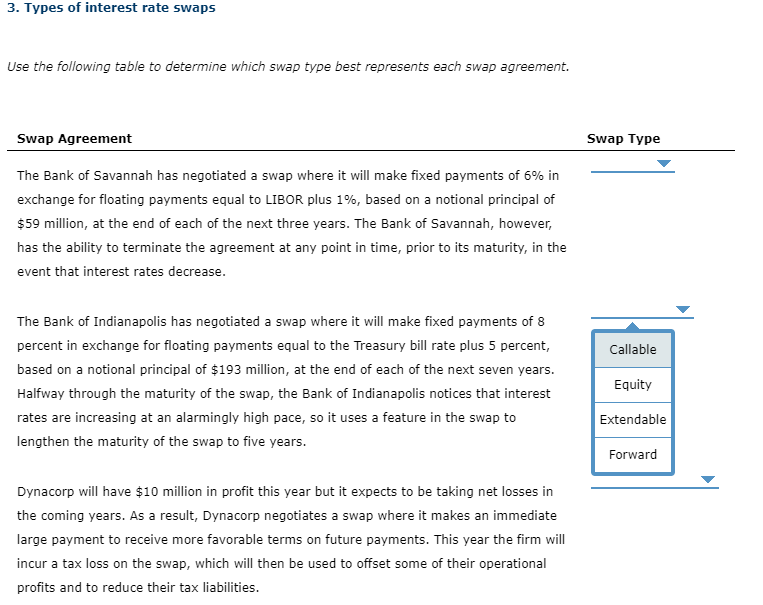

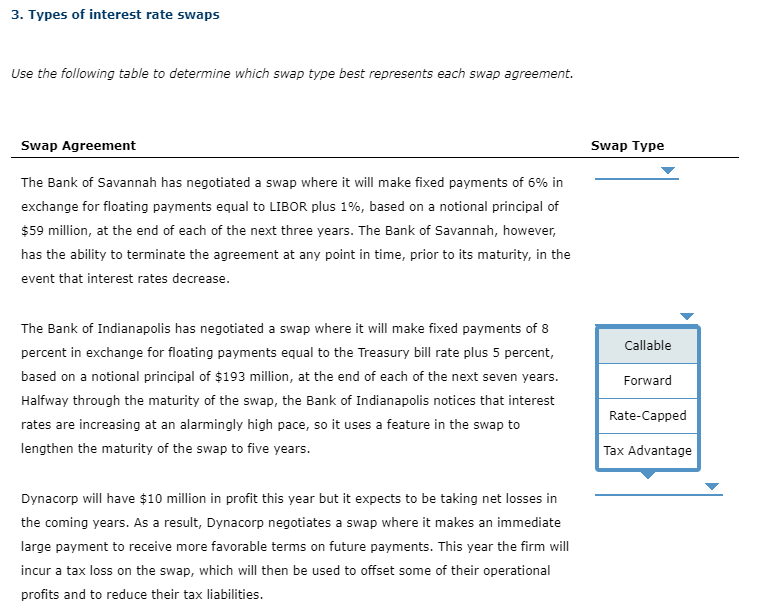

3. Types of interest rate swaps Use the following table to determine which swap type best represents each swap agreement. Swap Agreement Swap Type Callable The Bank of Savannah has negotiated a swap where it will make fixed payments of 6% in exchange for floating payments equal to LIBOR plus 1%, based on a notional principal of $59 million, at the end of each of the next three years. The Bank of Savannah, however, has the ability to terminate the agreement at any point in time, prior to its maturity, in the event that interest rates decrease. Equity Forward Putable The Bank of Indianapolis has negotiated a swap where it will make fixed payments of 8 percent in exchange for floating payments equal to the Treasury bill rate plus 5 percent, based on a notional principal of $193 million, at the end of each of the next seven years. Halfway through the maturity of the swap, the Bank of Indianapolis notices that interest rates are increasing at an alarmingly high pace, so it uses a feature in the swap to lengthen the maturity of the swap to five years. Dynacorp will have $10 million in profit this year but it expects to be taking net losses in the coming years. As a result, Dynacorp negotiates a swap where it makes an immediate large payment to receive more favorable terms on future payments. This year the firm will incur a tax loss on the swap, which will then be used to offset some of their operational profits and to reduce their tax liabilities. 3. Types of interest rate swaps Use the following table to determine which swap type best represents each swap agreement. Swap Agreement Swap Type The Bank of Savannah has negotiated a swap where it will make fixed payments of 6% in exchange for floating payments equal to LIBOR plus 1%, based on a notional principal of $59 million, at the end of each of the next three years. The Bank of Savannah, however, has the ability to terminate the agreement at any point in time, prior to its maturity, in the event that interest rates decrease. Callable The Bank of Indianapolis has negotiated a swap where it will make fixed payments of 8 percent in exchange for floating payments equal to the Treasury bill rate plus 5 percent, based on a notional principal of $193 million, at the end of each of the next seven years. Halfway through the maturity of the swap, the Bank of Indianapolis notices that interest rates are increasing at an alarmingly high pace, so it uses a feature in the swap to lengthen the maturity of the swap to five years. Equity Extendable Forward Dynacorp will have $10 million in profit this year but it expects to be taking net losses in the coming years. As a result, Dynacorp negotiates a swap where it makes an immediate large payment to receive more favorable terms on future payments. This year the firm will incur a tax loss on the swap, which will then be used to offset some of their operational profits and to reduce their tax liabilities. 3. Types of interest rate swaps Use the following table to determine which swap type best represents each swap agreement. Swap Agreement Swap Type The Bank of Savannah has negotiated a swap where it will make fixed payments of 6% in exchange for floating payments equal to LIBOR plus 1%, based on a notional principal of $59 million, at the end of each of the next three years. The Bank of Savannah, however, has the ability to terminate the agreement at any point in time, prior to its maturity, in the event that interest rates decrease. Callable Forward The Bank of Indianapolis has negotiated a swap where it will make fixed payments of 8 percent in exchange for floating payments equal to the Treasury bill rate plus 5 percent, based on a notional principal of $193 million, at the end of each of the next seven years. Halfway through the maturity of the swap, the Bank of Indianapolis notices that interest rates are increasing at an alarmingly high pace, so it uses a feature in the swap to lengthen the maturity of the swap to five years. Rate-Capped Tax Advantage Dynacorp will have $10 million in profit this year but it expects to be taking net losses in the coming years. As a result, Dynacorp negotiates a swap where it makes an immediate large payment to receive more favorable terms on future payments. This year the firm will incur a tax loss on the swap, which will then be used to offset some of their operational profits and to reduce their tax liabilities