Question

You are estimating the return on common share equity as the first step of updating the companys weighted average cost of capital. The current stock

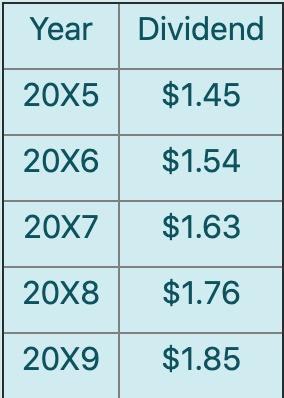

You are estimating the return on common share equity as the first step of updating the companys weighted average cost of capital. The current stock price is $19.30 and the annual dividend for 20X9 of $1.85 was declared and issued last week. What you dont know is the dividend growth rate. Fortunately, the annual dividend data is available in the table below. The company plans to grow the dividend at the same rate in the future if profits permit.

Calculate and input your solutions to the following questions (nearest 1/100 of one percent without % symbol, e.g. 13.00)

A) What was the annual dividend growth rate over the past 5 years?

B) What is the required return for the stock?

Year Dividend 20X5 $1.45 20X6 $1.54 20X7 $1.63 20X8 $1.76 20X9 $1.85Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started