Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. Weir Inc. is considering the purchase of a new production machine for $100,000. Although the purchase of this machine will not produce any

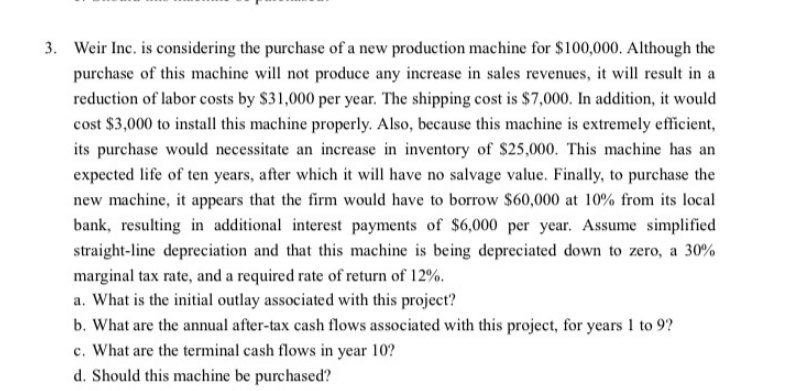

3. Weir Inc. is considering the purchase of a new production machine for $100,000. Although the purchase of this machine will not produce any increase in sales revenues, it will result in a reduction of labor costs by $31,000 per year. The shipping cost is $7,000. In addition, it would cost $3,000 to install this machine properly. Also, because this machine is extremely efficient, its purchase would necessitate an increase in inventory of $25,000. This machine has an expected life of ten years, after which it will have no salvage value. Finally, to purchase the new machine, it appears that the firm would have to borrow $60,000 at 10% from its local bank, resulting in additional interest payments of $6,000 per year. Assume simplified straight-line depreciation and that this machine is being depreciated down to zero, a 30% marginal tax rate, and a required rate of return of 12%. a. What is the initial outlay associated with this project? b. What are the annual after-tax cash flows associated with this project, for years 1 to 9? c. What are the terminal cash flows in year 10? d. Should this machine be purchased?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started