Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. What amount did Celgene include in pre-combination service compensation in the total consideration transferred? What support is provided for this treatment in the Accounting

3. What amount did Celgene include in pre-combination service compensation in the total consideration transferred? What support is provided for this treatment in the Accounting Standards Codification (see ASC 805-30-30, PARAGRAPHS 9-13)?

3. What amount did Celgene include in pre-combination service compensation in the total consideration transferred? What support is provided for this treatment in the Accounting Standards Codification (see ASC 805-30-30, PARAGRAPHS 9-13)?

4. What allocations did Celgene make to the assets acquired and liabilities assumed in the acquisition? Provide a calculation showing how Celgene determined the amount allocated to goodwill.

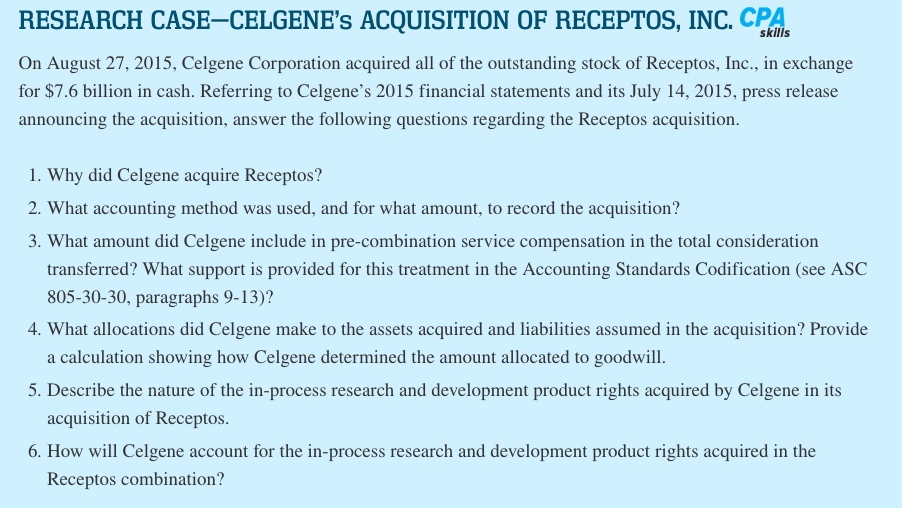

RESEARCH CASE-CELGENE's ACQUISITION OF RECEPTOS, INC. CP On August 27, 2015, Celgene Corporation acquired all of the outstanding stock of Receptos, Inc.,. in exchange for $7.6 billion in cash. Referring to Celgene's 2015 financial statements and its July 14, 2015, press release announcing the acquisition, answer the following questions regarding the Receptos skills acquisition 1. Why did Celgene acquire Receptos? 2. What accounting method was used, and for what amount, to record the acquisition? 3. What amount did Celgene include in pre-combination service compensation in the total consideration transferred? What support is provided for this treatment in the Accounting Standards Codification (see ASC 4. What allocations did Celgene make to the assets acquired and liabilities assumed in the acquisition? Provide S. Describe the nature of the in-process research and development product rights acquired by Celgene in its 6. How will Celgene account for the in-process research and development product rights acquired in the 805-30-30, paragraphs 9-13)? a calculation showing how Celgene determined the amount allocated to goodwill. acquisition of Receptos Receptos combinationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started