Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3 . What intrinsic value would you assign to a 30-year corporate bond with a default rating of AA, a coupon rate of 6%, a

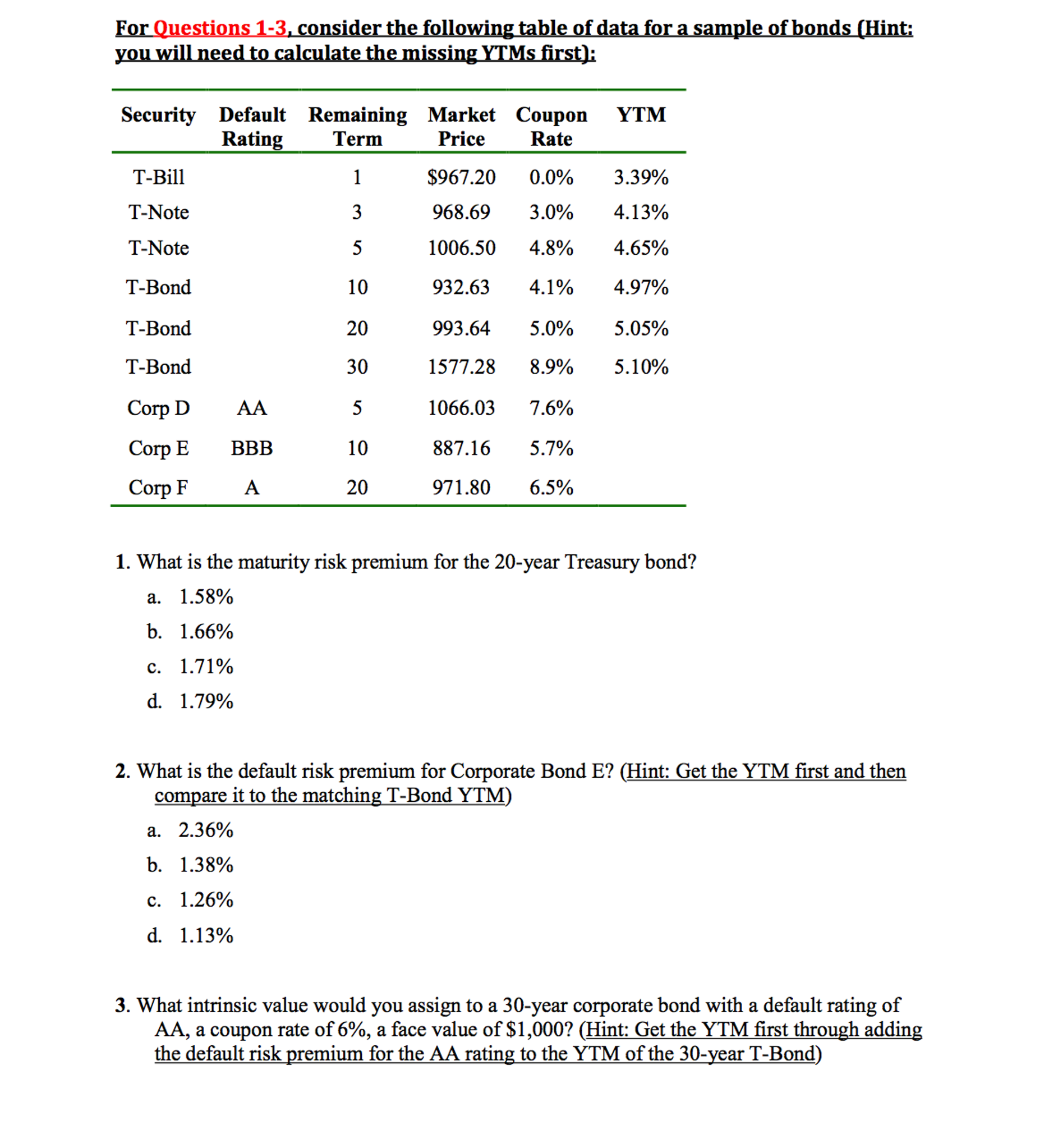

3. What intrinsic value would you assign to a 30-year corporate bond with a default rating of AA, a coupon rate of 6%, a face value of $1,000? (Hint: Get the YTM first through adding the default risk premium for the AA rating to the YTM of the 30-year T-Bond)

a. $943.44 b. $953.57 c. $947.22 d. $937.19

sider the followin ing table of data for a sample of Security Default Remaining Market Coupon YTM Rating PriceRate $967.20 0.0% 968.69 3.0% 1006.50 4.8% 932.63 4.1% 993.64 5.0% 1577.28 8.9% 1066.03 7.6% 887.16 5.7% 971.80 6.5% Term T-Bill T-Note T-Note T-Bond T-Bond T-Bond Corp DAA Corp EBBB 3.39% 4.13% 4.65% 4.97% 5.05% 5.10% 10 20 30 10 0 20 1. What is the maturity risk premium for the 20-year Treasury bond? 1.58% 1.66% 1.71% 1.79% b. d. 2. What is the default risk premium for Corporate Bond E? (Hint: Get the YTM first and then compare it to the matching T-Bond YTMM a. 2.36% b. 1.38% c. 1.26% d. 1.13% 3. What intrinsic value would you assign to a 30-year corporate bond with a default rating of AA, a coupon rate of 6%, a face value of $1,000? (Hint: Get the YTM first through adding the default risk premium for the AA rating to the YTM of the 30-year T-BondStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started