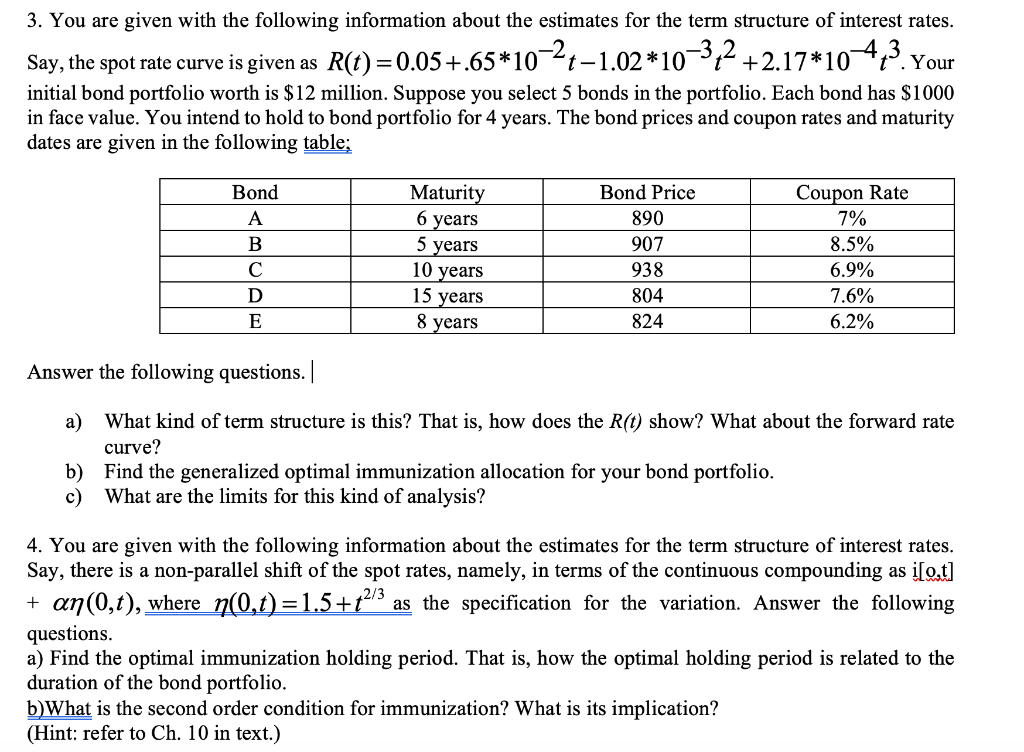

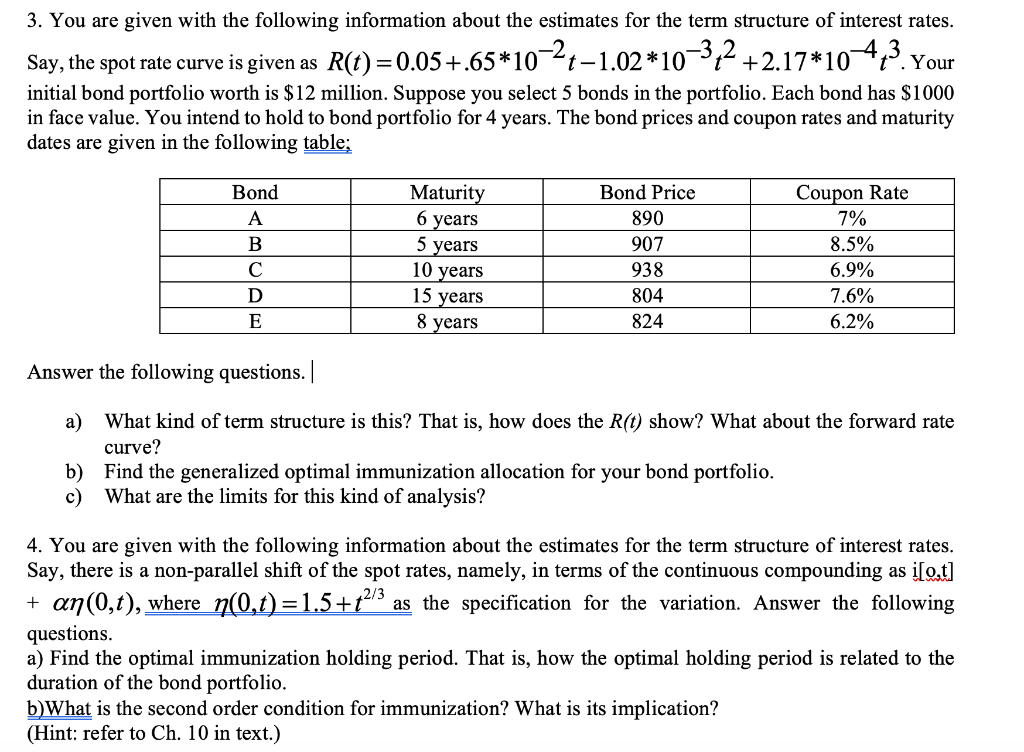

3. You are given with the following information about the estimates for the term structure of interest rates. Say, the spot rate curve is given as R(t)=0.05+.65*10-24-1.02 24-1.02*10-3,2 +2.17*10-4,3. Your initial bond portfolio worth is $12 million. Suppose you select 5 bonds in the portfolio. Each bond has $1000 in face value. You intend to hold to bond portfolio for 4 years. The bond prices and coupon rates and maturity dates are given in the following table; Bond A B D E Maturity 6 years 5 years 10 years 15 years 8 years Bond Price 890 907 938 804 Coupon Rate 7% 8.5% 6.9% 7.6% 6.2% 824 Answer the following questions. a) What kind of term structure is this? That is, how does the R(t) show? What about the forward rate curve? b) Find the generalized optimal immunization allocation for your bond portfolio. c) What are the limits for this kind of analysis? 4. You are given with the following information about the estimates for the term structure of interest rates. Say, there is a non-parallel shift of the spot rates, namely, in terms of the continuous compounding as i[0.t] + an(0,t), where n(0,t)=1.5+23 as the specification for the variation. Answer the following questions. a) Find the optimal immunization holding period. That is, how the optimal holding period is related to the duration of the bond portfolio. b)What is the second order condition for immunization? What is its implication? (Hint: refer to Ch. 10 in text.) 3. You are given with the following information about the estimates for the term structure of interest rates. Say, the spot rate curve is given as R(t)=0.05+.65*10-24-1.02 24-1.02*10-3,2 +2.17*10-4,3. Your initial bond portfolio worth is $12 million. Suppose you select 5 bonds in the portfolio. Each bond has $1000 in face value. You intend to hold to bond portfolio for 4 years. The bond prices and coupon rates and maturity dates are given in the following table; Bond A B D E Maturity 6 years 5 years 10 years 15 years 8 years Bond Price 890 907 938 804 Coupon Rate 7% 8.5% 6.9% 7.6% 6.2% 824 Answer the following questions. a) What kind of term structure is this? That is, how does the R(t) show? What about the forward rate curve? b) Find the generalized optimal immunization allocation for your bond portfolio. c) What are the limits for this kind of analysis? 4. You are given with the following information about the estimates for the term structure of interest rates. Say, there is a non-parallel shift of the spot rates, namely, in terms of the continuous compounding as i[0.t] + an(0,t), where n(0,t)=1.5+23 as the specification for the variation. Answer the following questions. a) Find the optimal immunization holding period. That is, how the optimal holding period is related to the duration of the bond portfolio. b)What is the second order condition for immunization? What is its implication? (Hint: refer to Ch. 10 in text.)