Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. You go the Al-Quds Bank and apply for a loan in the amount of $200,000 for 15 years at a 9% annual interest rate.

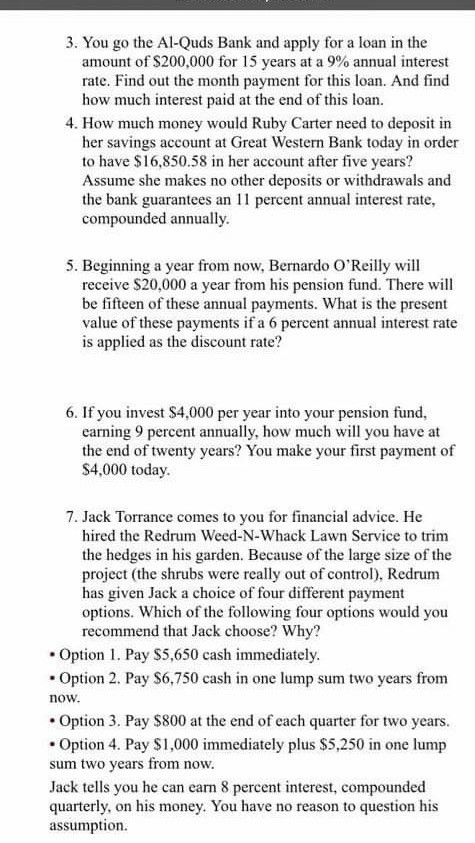

3. You go the Al-Quds Bank and apply for a loan in the amount of $200,000 for 15 years at a 9% annual interest rate. Find out the month payment for this loan. And find how much interest paid at the end of this loan. 4. How much money would Ruby Carter need to deposit in her savings account at Great Western Bank today in order to have $16,850.58 in her account after five years? Assume she makes no other deposits or withdrawals and the bank guarantees an 11 percent annual interest rate, compounded annually. 5. Beginning a year from now, Bernardo O'Reilly will receive $20,000 a year from his pension fund. There will be fifteen of these annual payments. What is the present value of these payments if a 6 percent annual interest rate is applied as the discount rate? 6. If you invest $4,000 per year into your pension fund, earning 9 percent annually, how much will you have at the end of twenty years? You make your first payment of $4,000 today. 7. Jack Torrance comes to you for financial advice. He hired the Redrum Weed-N-Whack Lawn Service to trim the hedges in his garden. Because of the large size of the project (the shrubs were really out of control), Redrum has given Jack a choice of four different payment options. Which of the following four options would you recommend that Jack choose? Why? Option 1. Pay $5,650 cash immediately. Option 2. Pay $6,750 cash in one lump sum two years from now. Option 3. Pay $800 at the end of each quarter for two years. Option 4. Pay $1,000 immediately plus $5,250 in one lump sum two years from now. Jack tells you he can earn 8 percent interest, compounded quarterly, on his money. You have no reason to question his assumption

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started