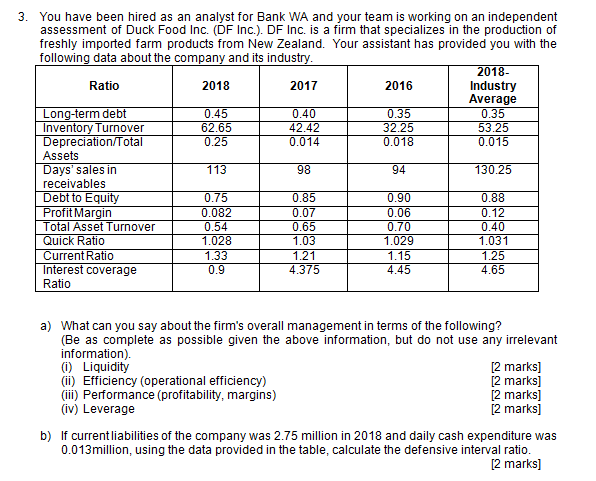

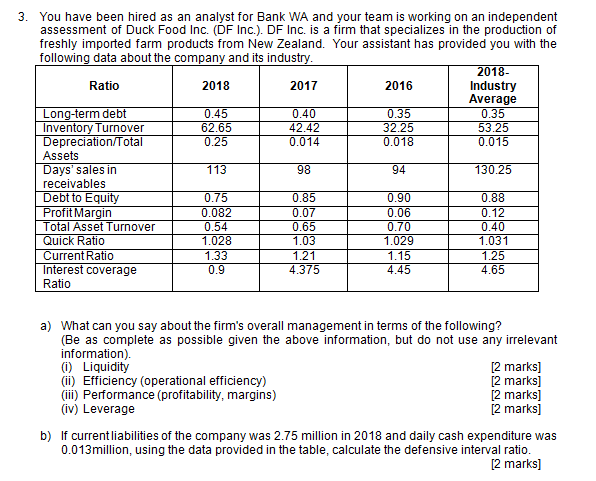

3. You have been hired as an analyst for Bank WA and your team is working on an independent assessment of Duck Food Inc. (DF Inc.). DF Inc. is a firm that specializes in the production of freshly imported farm products from New Zealand. Your assistant has provided you with the following data about the company and its industry. 2018- Ratio 2018 2017 2016 Industry Average Long-term debt 0.45 0.40 0.35 0.35 Inventory Turnover 62.65 42.42 32.25 53.25 Depreciation/Total 0.25 0.014 0.018 0.015 Assets Days' sales in 113 98 94 130.25 receivables Debt to Equity 0.75 0.85 0.90 0.88 Profit Margin 0.082 0.07 0.06 0.12 Total Asset Turnover 0.54 0.65 0.70 0.40 Quick Ratio 1.028 1.03 1.029 1.031 Current Ratio 1.33 1.21 1.15 1.25 Interest coverage 0.9 4.375 4.45 4.65 Ratio a) What can you say about the firm's overall management in terms of the following? (Be as complete as possible given the above information, but do not use any irrelevant information). (i) Liquidity [2 marks] (ii) Efficiency (operational efficiency) [2 marks] (iii) Performance (profitability, margins) [2 marks] (iv) Leverage [2 marks] b) If current liabilities of the company was 2.75 million in 2018 and daily cash expenditure was 0.013 million, using the data provided in the table, calculate the defensive interval ratio. [2 marks] 3. You have been hired as an analyst for Bank WA and your team is working on an independent assessment of Duck Food Inc. (DF Inc.). DF Inc. is a firm that specializes in the production of freshly imported farm products from New Zealand. Your assistant has provided you with the following data about the company and its industry. 2018- Ratio 2018 2017 2016 Industry Average Long-term debt 0.45 0.40 0.35 0.35 Inventory Turnover 62.65 42.42 32.25 53.25 Depreciation/Total 0.25 0.014 0.018 0.015 Assets Days' sales in 113 98 94 130.25 receivables Debt to Equity 0.75 0.85 0.90 0.88 Profit Margin 0.082 0.07 0.06 0.12 Total Asset Turnover 0.54 0.65 0.70 0.40 Quick Ratio 1.028 1.03 1.029 1.031 Current Ratio 1.33 1.21 1.15 1.25 Interest coverage 0.9 4.375 4.45 4.65 Ratio a) What can you say about the firm's overall management in terms of the following? (Be as complete as possible given the above information, but do not use any irrelevant information). (i) Liquidity [2 marks] (ii) Efficiency (operational efficiency) [2 marks] (iii) Performance (profitability, margins) [2 marks] (iv) Leverage [2 marks] b) If current liabilities of the company was 2.75 million in 2018 and daily cash expenditure was 0.013 million, using the data provided in the table, calculate the defensive interval ratio. [2 marks]