Answered step by step

Verified Expert Solution

Question

1 Approved Answer

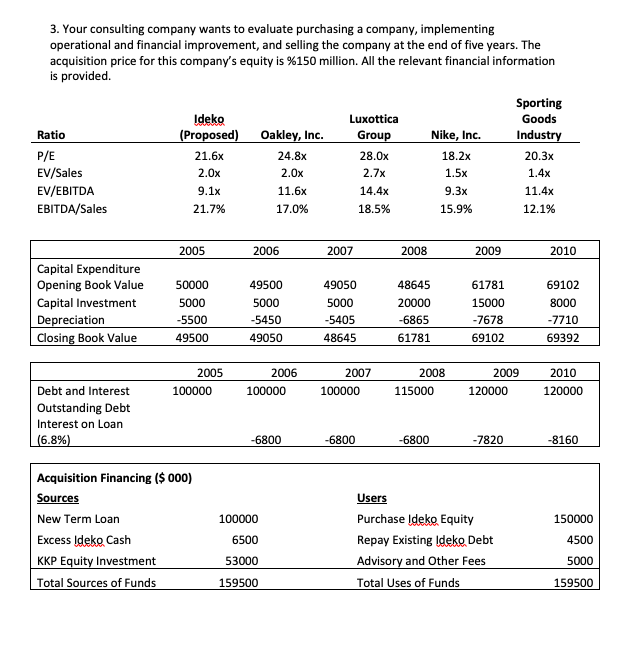

3. Your consulting company wants to evaluate purchasing a company, implementing operational and financial improvement, and selling the company at the end of five years.

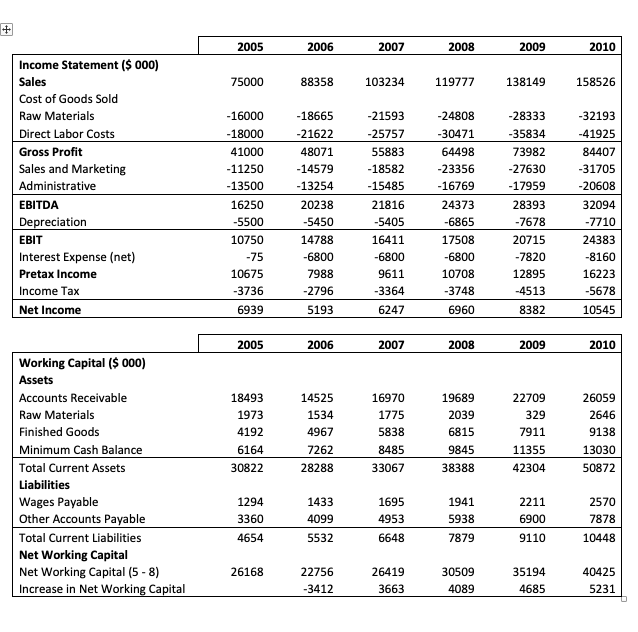

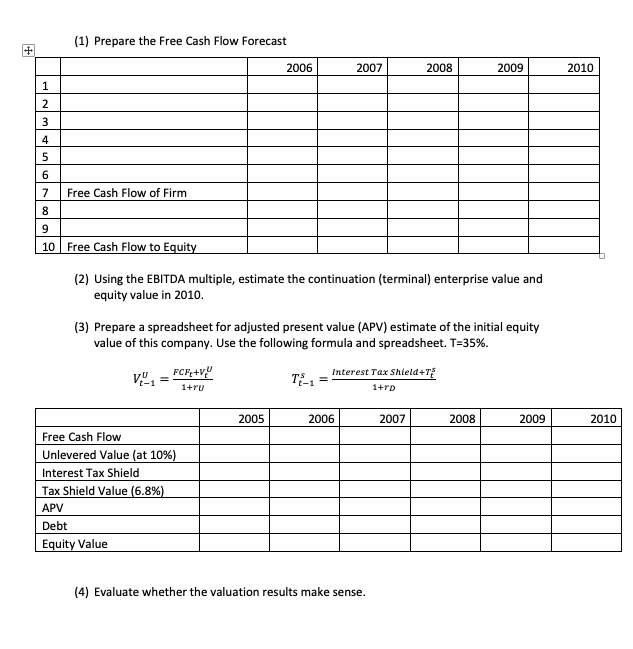

3. Your consulting company wants to evaluate purchasing a company, implementing operational and financial improvement, and selling the company at the end of five years. The acquisition price for this company's equity is %150 million. All the relevant financial information is provided. Sporting Goods ldekg Ratio P/E EV/Sales EV/EBITDA EBITDA/Sales sed Oakley, Inc 21.6x 2.0x 9.1x 21.7% 24.8x 2.0x 11.6x 17.0% Grou 28.0x 2.7x 14.4x 18.5% Nike, Inc. 18.2x 1.5x 9.3x 15.9% 20.3x 11.4x 12.1% 2005 2006 2007 2008 2009 2010 Capital Expenditure Opening Book Value Capital Investment Depreciation Closing Book Value 50000 5000 5500 49500 49500 5000 5450 49050 49050 5000 5405 48645 48645 20000 -6865 61781 61781 15000 7678 69102 69102 8000 7710 69392 2005 2006 2007 2008 2009 2010 Debt and Interest Outstanding Debt Interest on Loan 6.8% 100000 100000 100000 115000 7820 8160 Acquisition Financing ($ 000) Sources New Term Loan Excess ldeke Cash KKP Equity Investment Total Sources of Funds 100000 6500 53000 159500 Purchase ldeko Equity Repay Existing Ideko Debt Advisory and Other Fees Total Uses of Funds 150000 4500 5000 159500 2005 2010 Income Statement ($000) 75000 88358 103234 119777 138149 158526 es Cost of Goods Sold Raw Materials Direct Labor Costs Gross Profit Sales and Marketing Administrative EBITDA Depreciation 18665 21622 48071 14579 13254 20238 21593 25757 55883 18582 15485 21816 24808 30471 64498 23356 16769 24373 32193 41925 16000 41000 11250 13500 16250 28333 35834 73982 27630 17959 28393 31705 20608 32094 10750 75 10675 3736 14788 6800 7988 16411 6800 20715 24383 Interest Expense (net) Pretax Income Income Tax Net Income 6800 10708 12895 16223 6960 10545 2005 2010 Working Capital ($ 000) Assets Accounts Receivable Raw Materials Finished Goods Minimum Cash Balance Total Current Assets Liabilities 16970 1775 5838 19689 2039 6815 18493 22709 26059 1534 4967 11355 42304 13030 50872 30822 28288 33067 38388 1695 4953 6648 1294 2570 Other Accounts Payable Total Current Liabilities Net Working Capital Net Working Capital (5-8) Increase in Net Working Capital 5938 7879 4099 6900 4654 5532 9110 40425 5231 26168 22756 26419 3663 35194 (1) Prepare the Free Cash Flow Forecast 2006 2007 2008 2009 2010 4 6 7 Free Cash Flow of Firm 9 10 Free Cash Flow to Equit (2) Using the EBITDA multiple, estimate the continuation (terminal) enterprise value and equity value in 2010 (3) Prepare a spreadsheet for adjusted present value (APV) estimate of the initial equity value of this company. Use the following formula and spreadsheet. T-35% Interest Tax Shield+TS +rU 1+TD 2005 2006 2007 2008 2009 2010 Free Cash Flow unlevered Value (at 10% Interest Tax Shield Tax Shield Value (6.8% APV Debt Value (4) Evaluate whether the valuation results make sense

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started