Answered step by step

Verified Expert Solution

Question

1 Approved Answer

30 and 31 30. As of December 31, 2019, ABC Company owned the tangible fixed assets. These assets were equipment, furniture, and a lorry. To

30 and 31

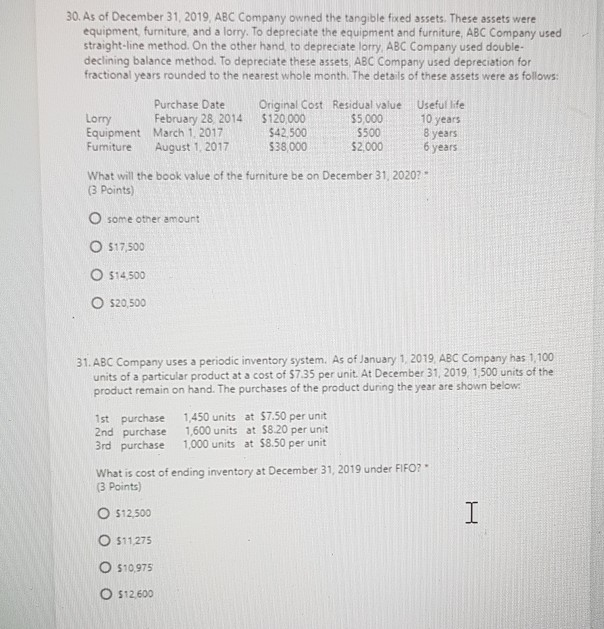

30. As of December 31, 2019, ABC Company owned the tangible fixed assets. These assets were equipment, furniture, and a lorry. To depreciate the equipment and furniture, ABC Company used straight-line method. On the other hand to depreciate lorry, ABC Company used double- declining balance method. To depreciate these assets, ABC Company used depreciation for fractional years rounded to the nearest whole month. The details of these assets were as follows: Purchase Date Original Cost Residual value Useful life Lorry February 28, 2014 $120,000 $5,000 Equipment March 1, 2017 $42.500 $500 8 years Furniture August 1, 2017 $38.000 $2.000 6 years What will the book value of the furniture be on December 31, 2020? (3 Points) 10 years O some other amount O 517.500 O $14.500 O 520 500 31. ABC Company uses a periodic inventory system. As of January 1 2019 ABC Company has 1100 units of a particular product at a cost of $735 per unit At December 31, 2019. 1,500 units of the product remain on hand. The purchases of the product during the year are shown below. 1st purchase 1,450 units at $7.50 per unit 2nd purchase 1,600 units at $8.20 per unit 3rd purchase 1,000 units at $8.50 per unit What is cost of ending inventory at December 31, 2019 under FIFO?" (3 Points) O 512,500 I O $11275 O $10.975 O 512,600Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started