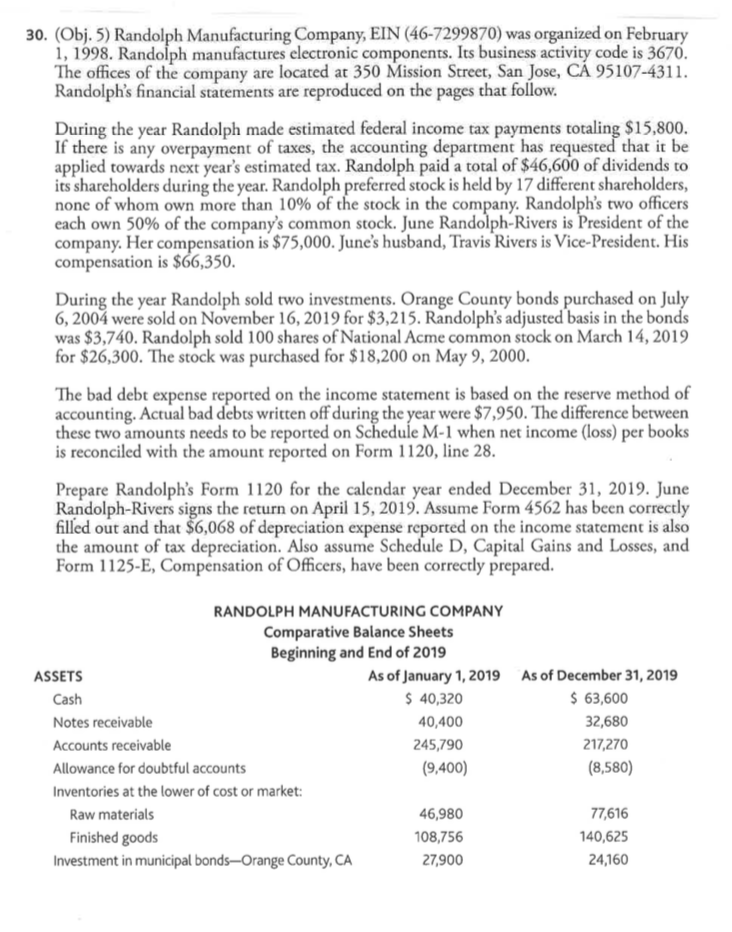

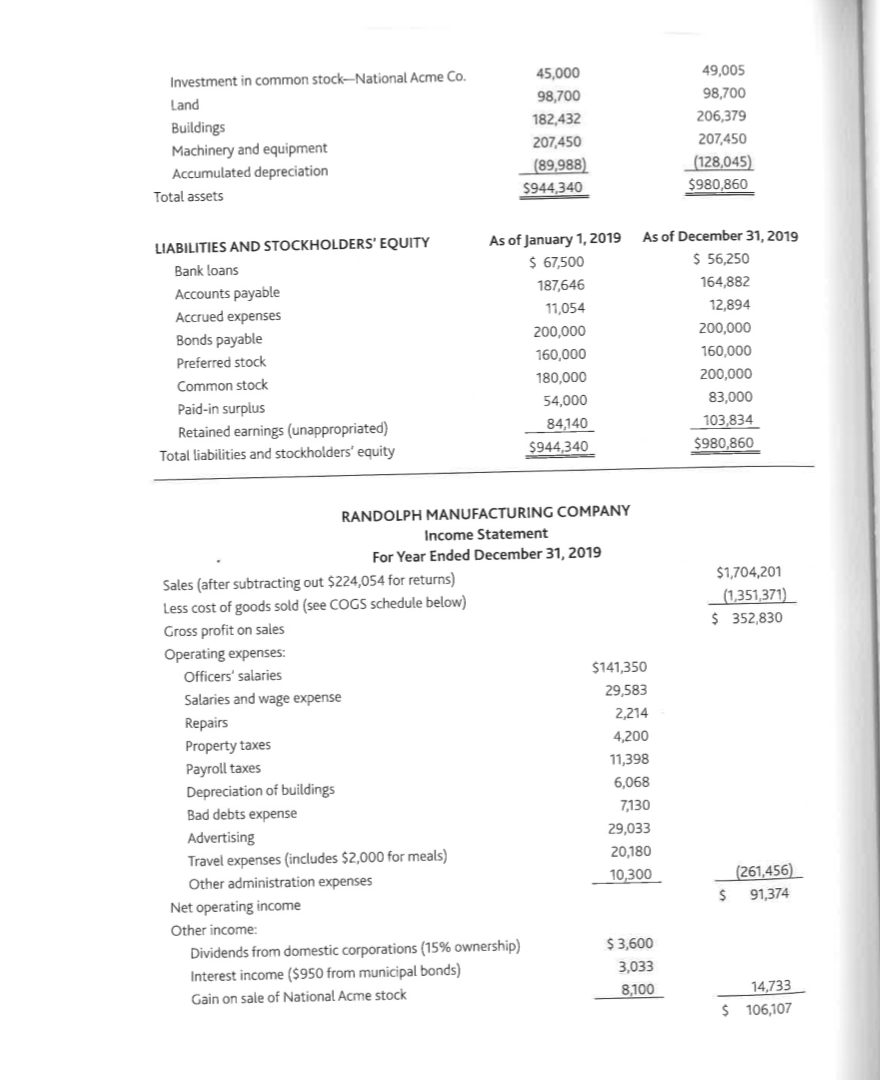

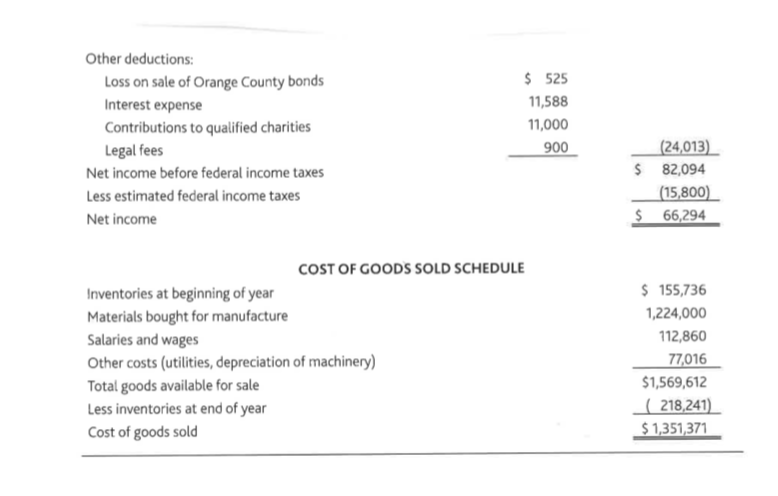

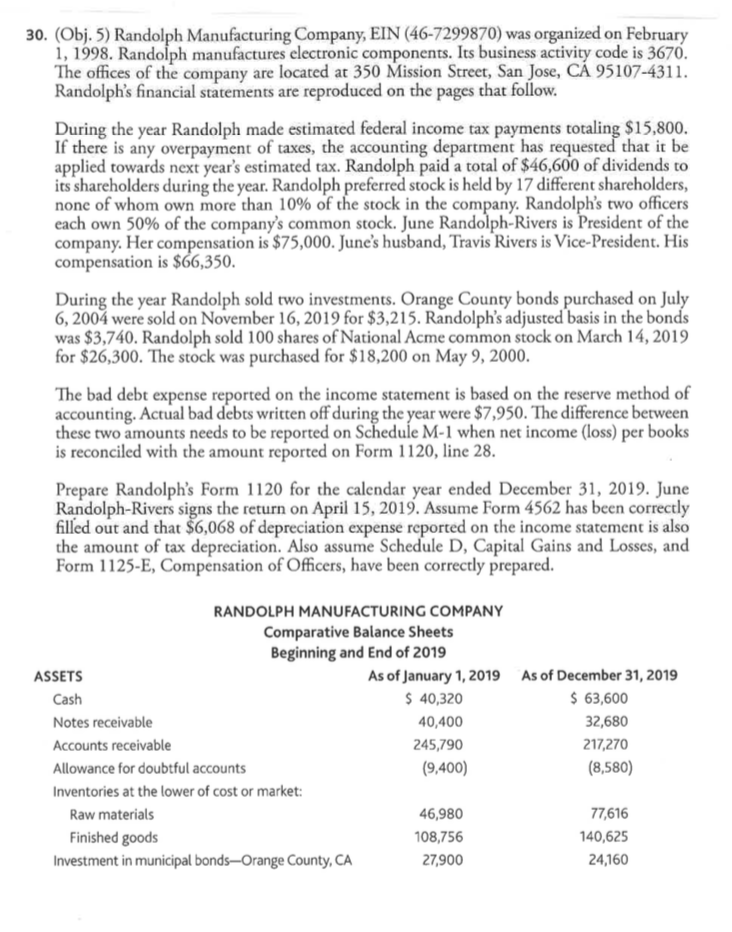

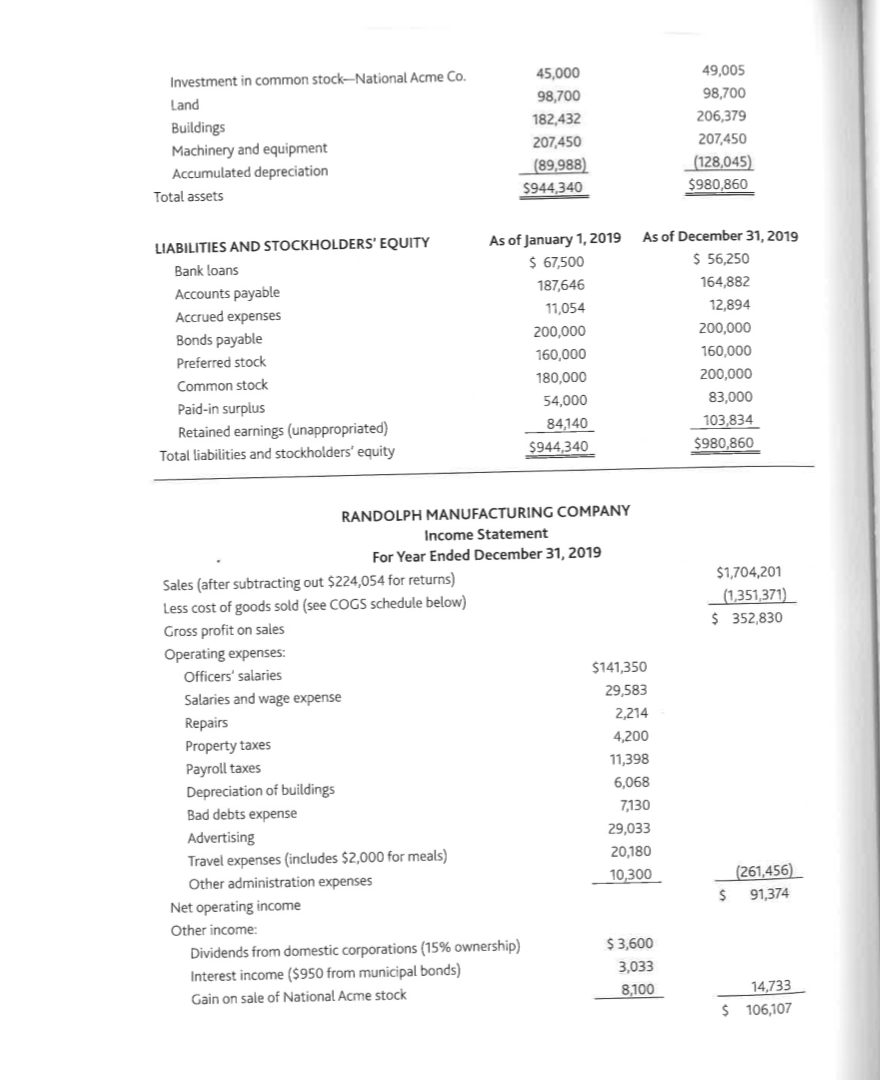

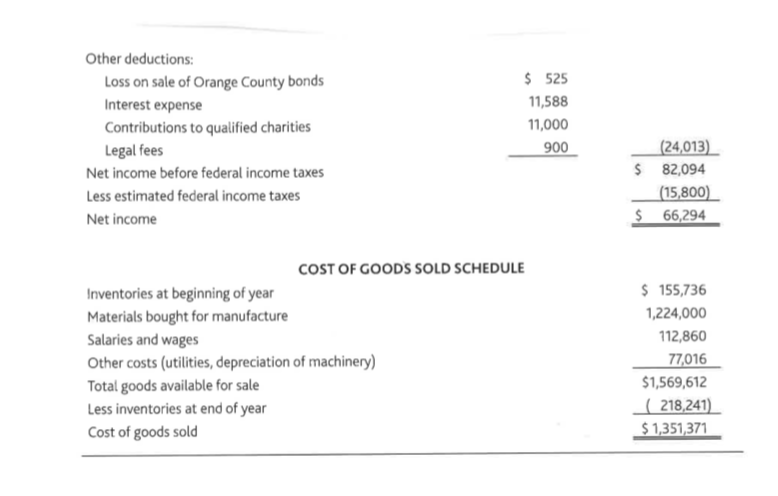

30. (Obj. 5) Randolph Manufacturing Company, EIN (46-7299870) was organized on February 1, 1998. Randolph manufactures electronic components. Its business activity code is 3676. The offices of the company are located at 350 Mission Street, San Jose, CA 95107-4311. Randolph's financial statements are reproduced on the pages that follow. During the year Randolph made estimated federal income tax payments totaling $15,800. If there is any overpayment of taxes, the accounting department has requested that it be applied towards next year's estimated tax. Randolph paid a total of $46,600 of dividends to its shareholders during the year. Randolph preferred stock is held by 17 different shareholders, none of whom own more than 10% of the stock in the company. Randolph's two officers each own 50% of the company's common stock. June Randolph-Rivers is President of the company. Her compensation is $75,000. June's husband, Travis Rivers is Vice-President. His compensation is $66,350. During the year Randolph sold two investments. Orange County bonds purchased on July 6, 2004 were sold on November 16, 2019 for $3,215. Randolph's adjusted basis in the bonds was $3,740. Randolph sold 100 shares of National Acme common stock on March 14, 2019 for $26,300. The stock was purchased for $18,200 on May 9, 2000. The bad debt expense reported on the income statement is based on the reserve method of accounting. Actual bad debts written off during the year were $7,950. The difference between these two amounts needs to be reported on Schedule M-1 when net income (loss) per books is reconciled with the amount reported on Form 1120, line 28. Prepare Randolph's Form 1120 for the calendar year ended December 31, 2019. June Randolph-Rivers signs the return on April 15, 2019. Assume Form 4562 has been correctly filled out and that $6,068 of depreciation expense reported on the income statement is also the amount of tax depreciation. Also assume Schedule D, Capital Gains and Losses, and Form 1125-E, Compensation of Officers, have been correctly prepared. RANDOLPH MANUFACTURING COMPANY Comparative Balance Sheets Beginning and End of 2019 ASSETS As of January 1, 2019 As of December 31, 2019 Cash $ 40,320 $ 63,600 Notes receivable 40,400 32,680 Accounts receivable 245,790 217,270 Allowance for doubtful accounts (9,400) (8,580) Inventories at the lower of cost or market: Raw materials 46,980 77,616 Finished goods 108,756 140,625 Investment in municipal bonds-Orange County, CA 27,900 24,160 Investment in common stock--National Acme Co. Land Buildings Machinery and equipment Accumulated depreciation Total assets 45,000 98,700 182,432 207,450 (89,988) $944,340 49,005 98,700 206,379 207,450 (128,045) $980,860 LIABILITIES AND STOCKHOLDERS' EQUITY Bank loans Accounts payable Accrued expenses Bonds payable Preferred stock Common stock Paid-in surplus Retained earnings (unappropriated) Total liabilities and stockholders' equity As of January 1, 2019 $ 67,500 187,646 11,054 200,000 160,000 180,000 54,000 84,140 $944,340 As of December 31, 2019 $ 56,250 164,882 12,894 200,000 160,000 200,000 83,000 103,834 $980,860 $1,704,201 (1,351,371) $ 352,830 RANDOLPH MANUFACTURING COMPANY Income Statement For Year Ended December 31, 2019 Sales (after subtracting out $224,054 for returns) Less cost of goods sold (see COGS schedule below) Gross profit on sales Operating expenses: Officers' salaries $141,350 Salaries and wage expense 29,583 Repairs 2,214 Property taxes 4,200 Payroll taxes 11,398 Depreciation of buildings 6,068 Bad debts expense 7,130 Advertising 29,033 Travel expenses (includes $2,000 for meals) 20,180 Other administration expenses 10,300 Net operating income Other income: Dividends from domestic corporations (15% ownership) $ 3,600 Interest income ($950 from municipal bonds) 3,033 Gain on sale of National Acme stock 8,100 (261,456) 91,374 $ 14,733 $ 106,107 Other deductions: Loss on sale of Orange County bonds Interest expense Contributions to qualified charities Legal fees Net income before federal income taxes Less estimated federal income taxes Net income $ 525 11,588 11,000 900 (24,013) $ 82,094 (15,800) $ 66,294 COST OF GOODS SOLD SCHEDULE Inventories at beginning of year Materials bought for manufacture Salaries and wages Other costs (utilities, depreciation of machinery) Total goods available for sale Less inventories at end of year Cost of goods sold $ 155,736 1,224,000 112,860 77,016 $1,569,612 ( 218,241) $ 1,351,371 30. (Obj. 5) Randolph Manufacturing Company, EIN (46-7299870) was organized on February 1, 1998. Randolph manufactures electronic components. Its business activity code is 3676. The offices of the company are located at 350 Mission Street, San Jose, CA 95107-4311. Randolph's financial statements are reproduced on the pages that follow. During the year Randolph made estimated federal income tax payments totaling $15,800. If there is any overpayment of taxes, the accounting department has requested that it be applied towards next year's estimated tax. Randolph paid a total of $46,600 of dividends to its shareholders during the year. Randolph preferred stock is held by 17 different shareholders, none of whom own more than 10% of the stock in the company. Randolph's two officers each own 50% of the company's common stock. June Randolph-Rivers is President of the company. Her compensation is $75,000. June's husband, Travis Rivers is Vice-President. His compensation is $66,350. During the year Randolph sold two investments. Orange County bonds purchased on July 6, 2004 were sold on November 16, 2019 for $3,215. Randolph's adjusted basis in the bonds was $3,740. Randolph sold 100 shares of National Acme common stock on March 14, 2019 for $26,300. The stock was purchased for $18,200 on May 9, 2000. The bad debt expense reported on the income statement is based on the reserve method of accounting. Actual bad debts written off during the year were $7,950. The difference between these two amounts needs to be reported on Schedule M-1 when net income (loss) per books is reconciled with the amount reported on Form 1120, line 28. Prepare Randolph's Form 1120 for the calendar year ended December 31, 2019. June Randolph-Rivers signs the return on April 15, 2019. Assume Form 4562 has been correctly filled out and that $6,068 of depreciation expense reported on the income statement is also the amount of tax depreciation. Also assume Schedule D, Capital Gains and Losses, and Form 1125-E, Compensation of Officers, have been correctly prepared. RANDOLPH MANUFACTURING COMPANY Comparative Balance Sheets Beginning and End of 2019 ASSETS As of January 1, 2019 As of December 31, 2019 Cash $ 40,320 $ 63,600 Notes receivable 40,400 32,680 Accounts receivable 245,790 217,270 Allowance for doubtful accounts (9,400) (8,580) Inventories at the lower of cost or market: Raw materials 46,980 77,616 Finished goods 108,756 140,625 Investment in municipal bonds-Orange County, CA 27,900 24,160 Investment in common stock--National Acme Co. Land Buildings Machinery and equipment Accumulated depreciation Total assets 45,000 98,700 182,432 207,450 (89,988) $944,340 49,005 98,700 206,379 207,450 (128,045) $980,860 LIABILITIES AND STOCKHOLDERS' EQUITY Bank loans Accounts payable Accrued expenses Bonds payable Preferred stock Common stock Paid-in surplus Retained earnings (unappropriated) Total liabilities and stockholders' equity As of January 1, 2019 $ 67,500 187,646 11,054 200,000 160,000 180,000 54,000 84,140 $944,340 As of December 31, 2019 $ 56,250 164,882 12,894 200,000 160,000 200,000 83,000 103,834 $980,860 $1,704,201 (1,351,371) $ 352,830 RANDOLPH MANUFACTURING COMPANY Income Statement For Year Ended December 31, 2019 Sales (after subtracting out $224,054 for returns) Less cost of goods sold (see COGS schedule below) Gross profit on sales Operating expenses: Officers' salaries $141,350 Salaries and wage expense 29,583 Repairs 2,214 Property taxes 4,200 Payroll taxes 11,398 Depreciation of buildings 6,068 Bad debts expense 7,130 Advertising 29,033 Travel expenses (includes $2,000 for meals) 20,180 Other administration expenses 10,300 Net operating income Other income: Dividends from domestic corporations (15% ownership) $ 3,600 Interest income ($950 from municipal bonds) 3,033 Gain on sale of National Acme stock 8,100 (261,456) 91,374 $ 14,733 $ 106,107 Other deductions: Loss on sale of Orange County bonds Interest expense Contributions to qualified charities Legal fees Net income before federal income taxes Less estimated federal income taxes Net income $ 525 11,588 11,000 900 (24,013) $ 82,094 (15,800) $ 66,294 COST OF GOODS SOLD SCHEDULE Inventories at beginning of year Materials bought for manufacture Salaries and wages Other costs (utilities, depreciation of machinery) Total goods available for sale Less inventories at end of year Cost of goods sold $ 155,736 1,224,000 112,860 77,016 $1,569,612 ( 218,241) $ 1,351,371