30 to 34 please if you cannot answer please leave it for someone else ! Brief solution. Meets policy of four questions. I do not want comments !!! More information is not required!!

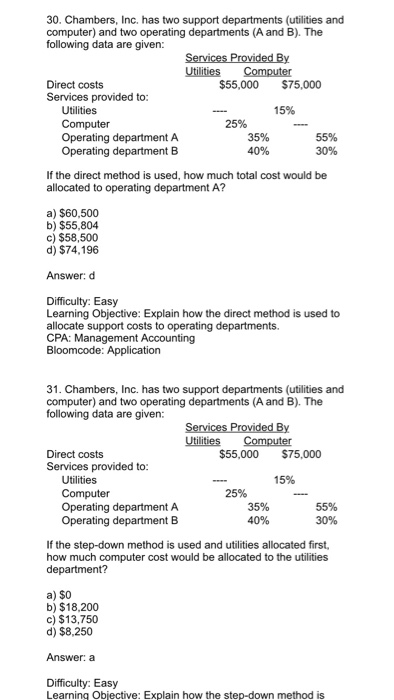

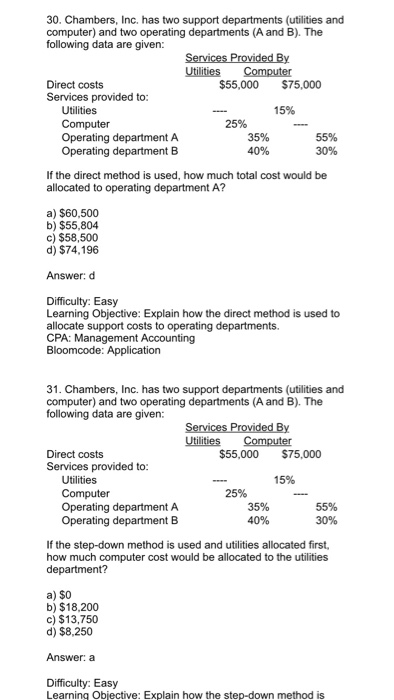

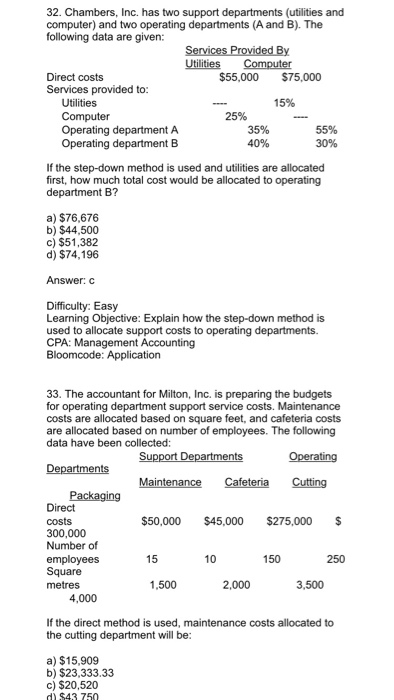

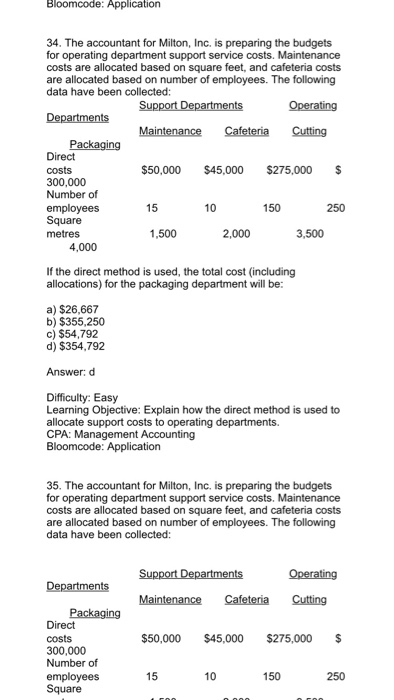

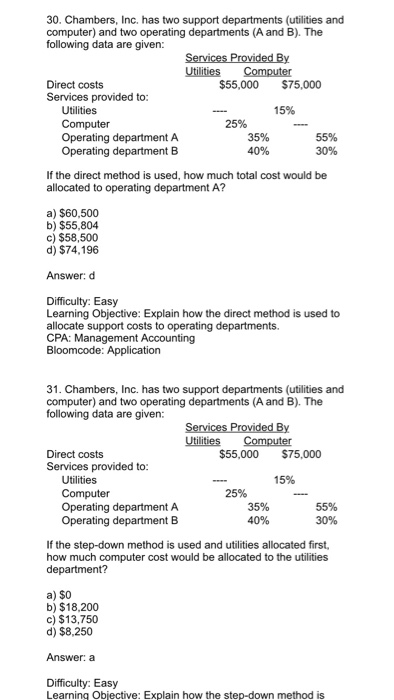

30. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer Direct costs Services provided to: $55,000 $75,000 Utilities Computer 15% 25% 35% 40% 55% 30% If the direct method is used, how much total cost would be allocated to operating department A? a) $60,500 b) $55,804 c) $58,500 d) $74,196 Answer: d Difficulty: Easy Learning Objective: Explain how the direct method is used to allocate support costs to operating departments. CPA: Management Accounting 31. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer Direct costs Services provided to: $55,000 $75,000 Utilities Computer 15% 25% 35% 40% 55% 30% If the step-down method is used and utilities allocated first, how much computer cost would be allocated to the utilities a) $0 b) $18,200 c) $13,750 d) $8,250 Answer: a Difficulty: Easy Learning Objective: Explain how the step-down method is 32. Chambers, Inc. has two support departments (utilities and computer) and two operating departments (A and B). The following data are given: Utilities Computer Direct costs Services provided to: $55,000 $75,000 15% Utilities Computer 25% 35% 40% 30% If the step-down method is used and utilities are allocated first, how much total cost would be allocated to operating a) $76,676 b) $44,500 c) $51,382 d) $74,196 Answer: C Difficulty: Easy Learning Objective: Explain how the step-down method is used to allocate support costs to operating departments. CPA: Management Accounting 33. The accountant for Milton, Inc. is preparing the budgets for operating department support service costs. Maintenance costs are allocated based on square feet, and cafeteria costs are allocated based on number of employees. The following data have been collected Operating Maintenance Cafea Cutting Direct costs 300,000 Number of employees Square metres $50,000 $45.000 $275,000 $ 10 150 250 1.500 2,000 3,500 4,000 If the direct method is used, maintenance costs allocated to the cutting department will be a) $15,909 b) $23,333.33 c) $20,520 d $43 750 34. The accountant for Milton, Inc. is preparing the budgets for operating department support service costs. Maintenance costs are allocated based on square feet, and cafeteria costs are allocated based on number of employees. The following data have been collected: Operating Maintenance Cafeteria Cutting Direct costs 300,000 Number of employees Square metres $50,000 $45,000 $275,000 S 15 10 150 250 1,500 2,000 3,500 4,000 If the direct method is used, the total cost (including allocations) for the packaging department will be: a) $26,667 b) $355,250 c) $54,792 d) $354,792 Answer: d Difficulty: Easy Learning Objective: Explain how the direct method is used to allocate support costs to operating departments. CPA: Management Accounting 35. The accountant for Milton, Inc. is preparing the budgets for operating department support service costs. Maintenance costs are allocated based on square feet, and cafeteria costs are allocated based on number of employees. The following data have been collected: Operating Maintenance Cafeteria Cutting Direct costs 300,000 Number of employees Square $50,000 $45,000 $275,000 $ 15 10 150 250