Answered step by step

Verified Expert Solution

Question

1 Approved Answer

30 year mortage Change the interest rate to 3.5% and also make this a variable rate with 7 years fixed interest. Variable rate ARM loans

30 year mortage

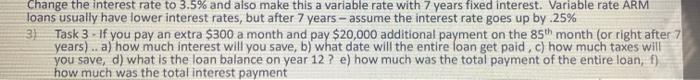

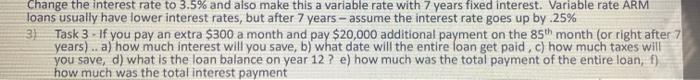

Change the interest rate to 3.5% and also make this a variable rate with 7 years fixed interest. Variable rate ARM loans usually have lower interest rates, but after 7 years - assume the interest rate goes up by .25% 3) Task 3 - If you pay an extra $300 a month and pay $20,000 additional payment on the 85th month (or right after 7 years).. a) how much interest will you save, b) what date will the entire loan get paid, c) how much taxes will you save, d) what is the loan balance on year 12 ? e) how much was the total payment of the entire loan, f) how much was the total interest payment Change the interest rate to 3.5% and also make this a variable rate with 7 years fixed interest. Variable rate ARM loans usually have lower interest rates, but after 7 years - assume the interest rate goes up by .25% 3) Task 3 - If you pay an extra $300 a month and pay $20,000 additional payment on the 85th month (or right after 7 years).. a) how much interest will you save, b) what date will the entire loan get paid, c) how much taxes will you save, d) what is the loan balance on year 12 ? e) how much was the total payment of the entire loan, f) how much was the total interest payment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started