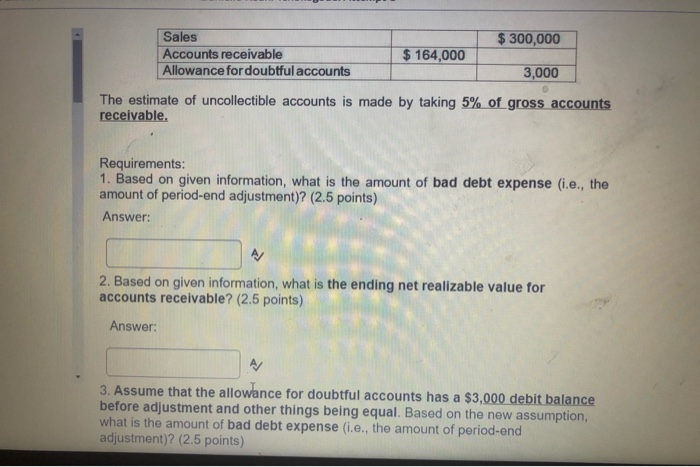

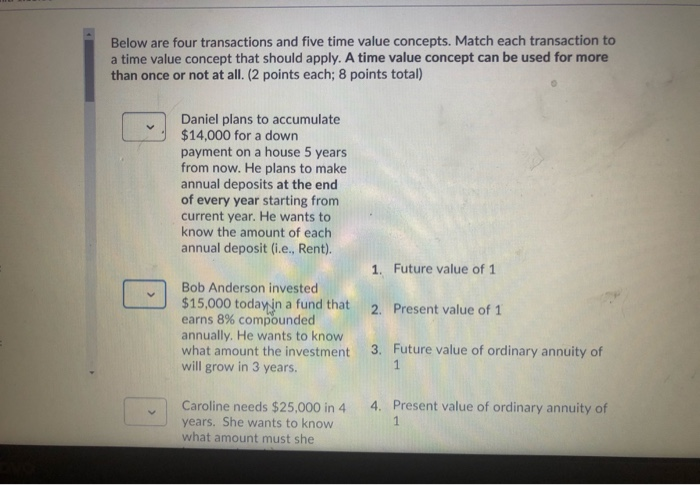

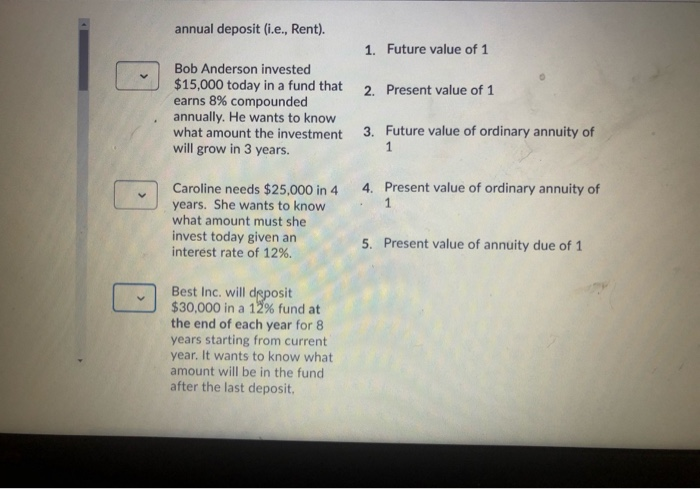

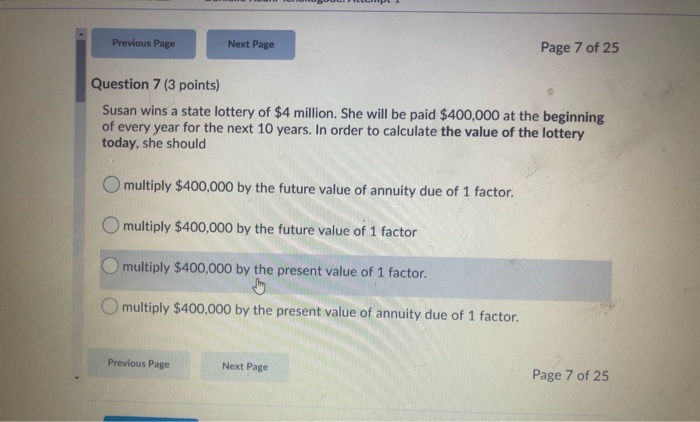

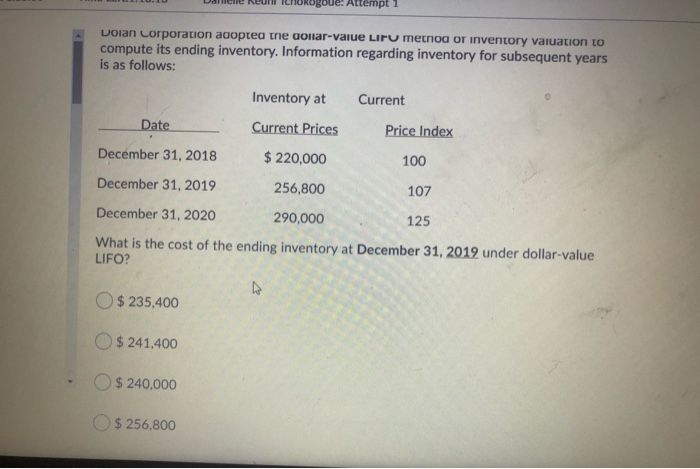

$ 300,000 Sales Accounts receivable Allowance for doubtful accounts $ 164,000 3,000 The estimate of uncollectible accounts is made by taking 5% of gross accounts receivable. Requirements: 1. Based on given information, what is the amount of bad debt expense (i.e., the amount of period-end adjustment)? (2.5 points) Answer: 2. Based on given information, what is the ending net realizable value for accounts receivable? (2.5 points) Answer: 3. Assume that the allowance for doubtful accounts has a $3,000 debit balance before adjustment and other things being equal. Based on the new assumption, what is the amount of bad debt expense (i.e., the amount of period-end adjustment)? (2.5 points) Below are four transactions and five time value concepts. Match each transaction to a time value concept that should apply. A time value concept can be used for more than once or not at all. (2 points each; 8 points total) Daniel plans to accumulate $14,000 for a down payment on a house 5 years from now. He plans to make annual deposits at the end of every year starting from current year. He wants to know the amount of each annual deposit (i.e., Rent). 1. Future value of 1 2. Present value of 1 Bob Anderson invested $15,000 today in a fund that earns 8% compounded annually. He wants to know what amount the investment will grow in 3 years. 3. Future value of ordinary annuity of 1 4. Present value of ordinary annuity of Caroline needs $25,000 in 4 years. She wants to know what amount must she 1 annual deposit (i.e., Rent). 1. Future value of 1 2. Present value of 1 Bob Anderson invested $15,000 today in a fund that earns 8% compounded annually. He wants to know what amount the investment will grow in 3 years 3. Future value of ordinary annuity of 1 4. Present value of ordinary annuity of 1 Caroline needs $25,000 in 4 years. She wants to know what amount must she invest today given an interest rate of 12%. 5. Present value of annuity due of 1 Best Inc. will deposit $30,000 in a 12% fund at the end of each year for 8 years starting from current year. It wants to know what amount will be in the fund after the last deposit. Previous Page Next Page Page 7 of 25 Question 7 (3 points) Susan wins a state lottery of $4 million. She will be paid $400,000 at the beginning of every year for the next 10 years. In order to calculate the value of the lottery today, she should O multiply $400,000 by the future value of annuity due of 1 factor. O multiply $400,000 by the future value of 1 factor multiply $400,000 by the present value of 1 factor. multiply $400,000 by the present value of annuity due of 1 factor. Previous Page Next Page Page 7 of 25 goue. Attempt 1 Loian Corporation adopted the collar-value Lir method or inventory valuation to compute its ending inventory. Information regarding inventory for subsequent years is as follows: Inventory at Current Date Current Prices Price Index December 31, 2018 $ 220,000 100 December 31, 2019 256,800 107 December 31, 2020 290,000 125 What is the cost of the ending inventory at December 31, 2019 under dollar-value LIFO? $ 235,400 $ 241,400 $ 240,000 $ 256.800