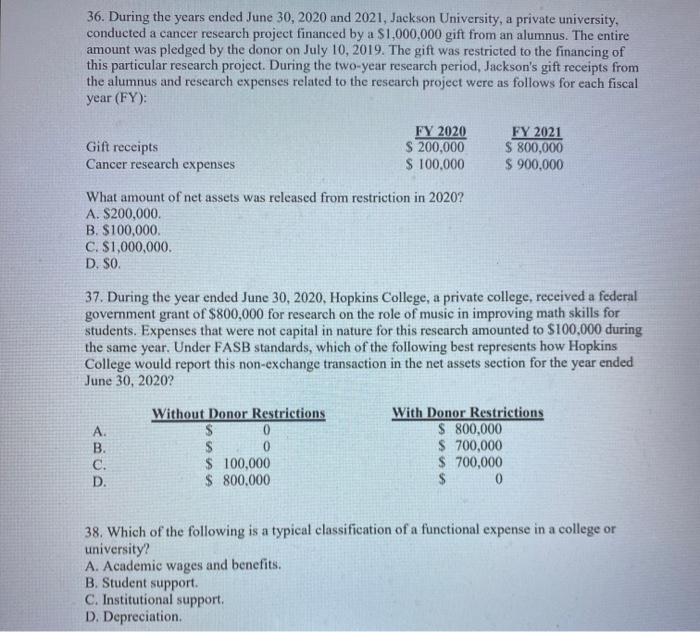

31. Cactus College, a small private college, received a research grant from NACUBO to study whether service efforts and accomplishments measures improve institutional performance. In accordance with FASB standards the grant would be reported as an increase in: A. Net assets without donor restrictions. B. Net assets with donor restrictions. C. Deferred revenue. D. Board-designated net assets. 32. An example of an increase in net assets for a not-for-profit organization that would be labeled revenue rather than support is: A. An unconditional promise to give. B. Investment income. C. A restricted gift. D. An allocation of funds from the local United Way organization. 33. A college has collected returnable dormitory room deposits from students. How would these deposits be reported by the college? A. A current liability. B. Unrestricted revenue. C. Restricted revenue. D. A long-term liability. 34. Tuition scholarships for which there is no intention of performance from the student should be classified by a private university as A. Reductions of gross revenue to arrive at net revenue. B. Not recognized in the financial statement. C. Increases in expenditures. D. Reductions of gross revenue or as expenses provided they are consistently classified in the same manner from year to year. 35. An alumnus donates securities to a private college and stipulates that the principal be held in perpetuity and income from the securities be used for faculty travel. Dividends received from the securities should be recognized as increases in: A. Endowments. B. Net assets without donor restrictions. C. Deferred revenue. D. Net assets with donor restrictions. 36. During the years ended June 30, 2020 and 2021, Jackson University, a private university, conducted a cancer research project financed by a $1,000,000 gift from an alumnus. The entire amount was pledged by the donor on July 10, 2019. The gift was restricted to the financing of this particular research project. During the two-year research period, Jackson's gift receipts from the alumnus and research expenses related to the research project were as follows for each fiscal year (FY): Gift receipts Cancer research expenses FY 2020 $ 200,000 $ 100,000 FY 2021 $ 800,000 $ 900,000 What amount of net assets was released from restriction in 2020? A. S200,000. B. $100,000 C. $1,000,000 D. $0. 37. During the year ended June 30, 2020, Hopkins College, a private college, received a federal government grant of $800,000 for research on the role of music in improving math skills for students. Expenses that were not capital in nature for this research amounted to $100,000 during the same year. Under FASB standards, which of the following best represents how Hopkins College would report this non-exchange transaction in the net assets section for the year ended June 30, 2020? Without Donor Restrictions ne With Donor Restrictions $ 800,000 $ 700,000 $ 700,000 $ 100,000 $ 800,000 38. Which of the following is a typical classification of a functional expense in a college or university? A. Academic wages and benefits. B. Student support C. Institutional support D. Depreciation 39. The Academy, a private college, provided tuition waivers of $500,000. Of the amount $200,000 was for students teaching courses as graduate assistants and $300,000 was simply an award for scholastic accomplishments. Another $100,000 was given is tuition refunds. What amount would The Academy record as Tuition and Fees Discounts and Allowances? A. $200,000 B. $500,000. C. $400,000 D. $300,000 40. Contractual Adjustments is properly characterized as: A. An expense. B. An other financing use. C. A liability D. A contra revenue