Question

The following are the Statements of Financial Position of Portland Limited, Hanover Limited and Manchester Limited, as at the 31 December 2020. The three companies

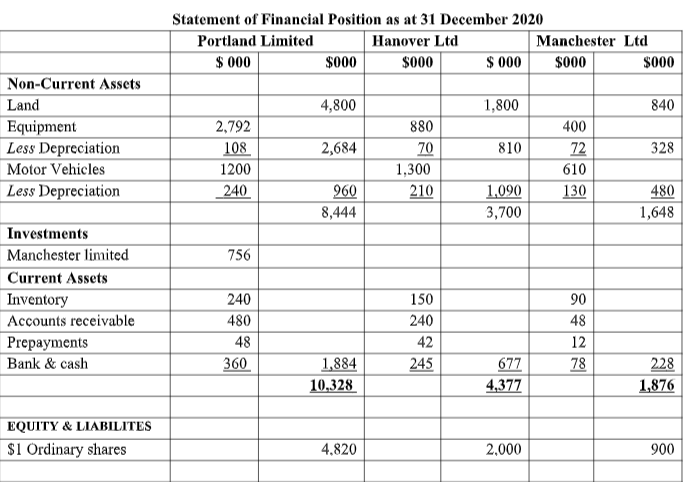

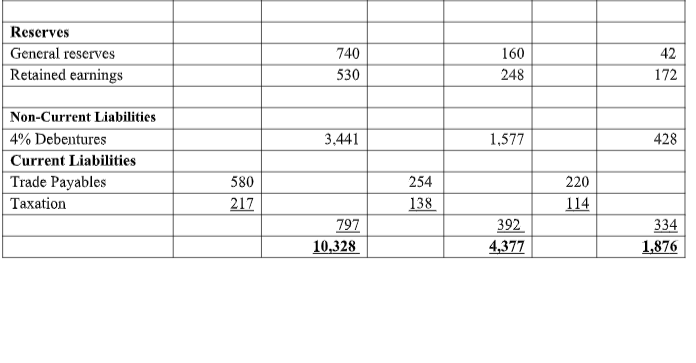

The following are the Statements of Financial Position of Portland Limited, Hanover Limited and Manchester Limited, as at the 31 December 2020. The three companies are major players in the automotive industry. Portland Limited acquired 60% of the shares in Hanover Limited on January 1 2018 when the reserve balances were as follows: General reserves: $16,000 and retained earnings $40 000.

Hanover Limiteds acquisition consisted of a deferred cash payment of $1,200,000 and a share exchange of 3 shares in Portland Limited for every 5 shares acquired in Hanover Limited. The deferred cash payment was to be made on 1 January 2020 and the relevant cost of capital is 12%. The market price for a Portland Limited share at that date was $4.70. The transactions related to the acquisition of Hanover Limited has not been recorded.

On 1 January 2020 Portland Limited acquired 270,000 shares in Manchester Limited for cash at a price of $2.80 per share. At the date of acquisition, the retained earnings of Manchester Limited totaled $62,000 and general reserve was $42,000.

a. Prepare the Consolidated Balance Sheet for the Portland Limited Group as at 31 December 2020.

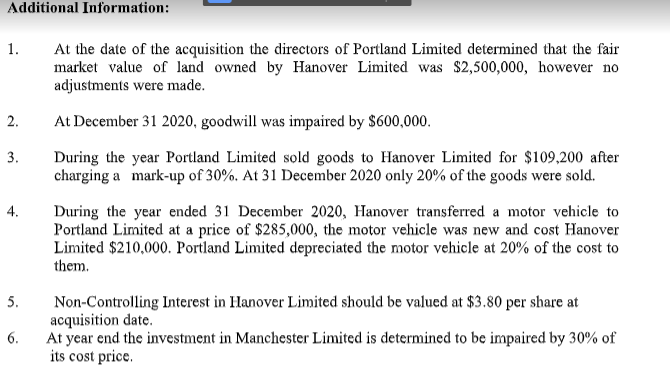

Statement of Financial Position as at 31 December 2020 1. At the date of the acquisition the directors of Portland Limited determined that the fair market value of land owned by Hanover Limited was $2,500,000, however no adjustments were made. 2. At December 312020 , goodwill was impaired by $600,000. 3. During the year Portland Limited sold goods to Hanover Limited for $109,200 after charging a mark-up of 30%. At 31 December 2020 only 20% of the goods were sold. 4. During the year ended 31 December 2020, Hanover transferred a motor vehicle to Portland Limited at a price of $285,000, the motor vehicle was new and cost Hanover Limited $210,000. Portland Limited depreciated the motor vehicle at 20% of the cost to them. 5. Non-Controlling Interest in Hanover Limited should be valued at $3.80 per share at acquisition date. 6. At year end the investment in Manchester Limited is determined to be impaired by 30% of its cost priceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started