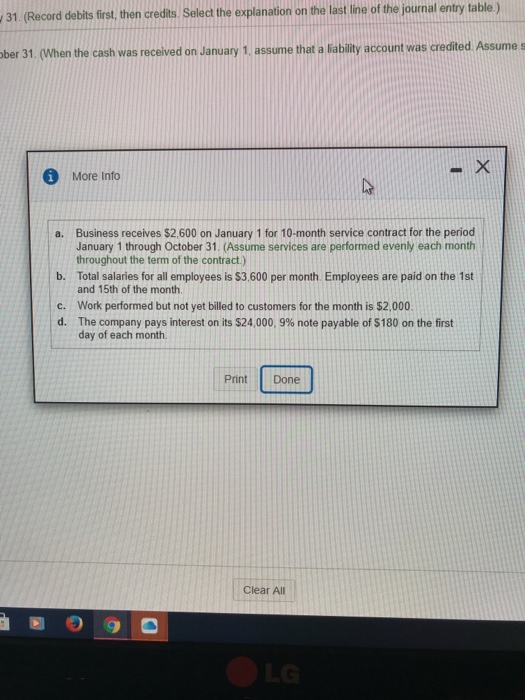

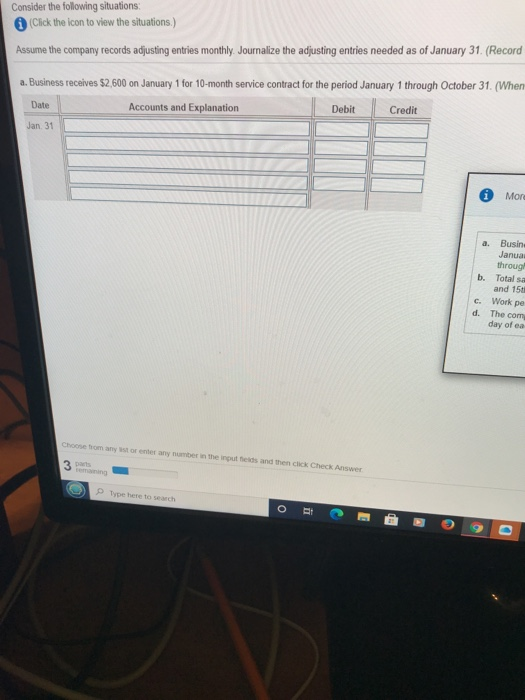

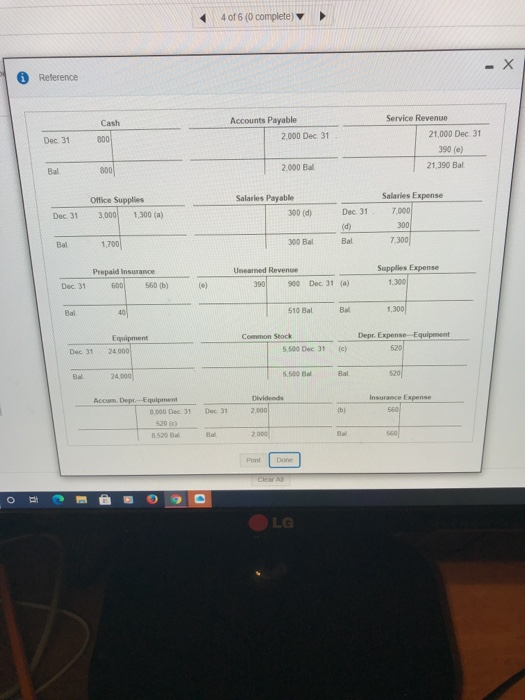

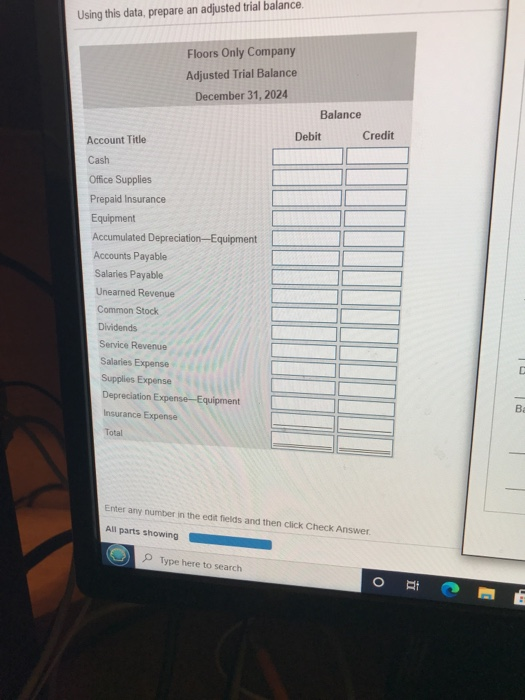

31. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) ober 31. (When the cash was received on January 1, assume that a liability account was credited. Assume s - X More Info a. Business receives $2,600 on January 1 for 10-month service contract for the period January 1 through October 31. (Assume services are performed evenly each month throughout the term of the contract.) b. Total salaries for all employees is $3,600 per month. Employees are paid on the 1st and 15th of the month c. Work performed but not yet billed to customers for the month is $2,000 d. The company pays interest on its $24,000,9% note payable of $180 on the first day of each month. Print Done Clear All LG Consider the following situations: Click the icon to view the situations.) Assume the company records adjusting entries monthly. Journalize the adjusting entries needed as of January 31. (Record a. Business receives $2,600 on January 1 for 10-month service contract for the period January 1 through October 31. (When Date Accounts and Explanation Debit Credit Jan. 31 More a. Busind Janual throug b. Total sa and 15 c. Work pe d. The com day of ea Choose to anyone number in the inputtets and then click Check Answer 3 pm Type here to search o D 4 of 6 (0 complete) - X Reference Cash Accounts Payable 2.000 Dec 31 Dec 31 800 Service Revenue 21,000 Dec 31 390 (0) 21,390 Bal Bal 800 2000 Bal Office Supplies 3,000 1.300() Salaries Payable 300 (d) Salaries Expense 7.000 300 Dec 31 Dec 31 (d) Bal Bal 1,700 300 Bal 7.300 Prepaid Insurance 600 560 b) Unearned Revenge 390 900 Supplies Expense 1,300 Dec 31 (0) Dec 31 ) Bal 40 510 Bal 1,300 Bal Equipment 24000 Common Stock 5.500 Dec 31 Depr. Expense Equipment 520 Dec 31 (c) Bal B 5.500 BM 520 24,000 Dividendes 2.000 Insurance Expense 560 Dec 31 b) Accum, Dept. Equipment 3.000 Dec 31 5200 8.520 Bal 2000 Print Done Clear o LG Using this data, prepare an adjusted trial balance. Floors Only Company Adjusted Trial Balance December 31, 2024 Balance Debit Credit Account Title Cash Office Supplies Prepaid Insurance Equipment Accumulated Depreciation-Equipment Accounts Payable Salaries Payable Unearned Revenue Common Stock Dividends Service Revenue Salaries Expense Supplies Expense Depreciation Expense-Equipment Insurance Expense Total BE Enter any number in the edit fields and then click Check Answer All parts showing Type here to search O RI Please answer the question in full if you know how to do it! Please allign the answers how the questions are so it's not confusing for me to figure out where it goes! Will give a thumbs up if the answer is correct! If you have trouble reading any of the images please let me know so I can post another picture