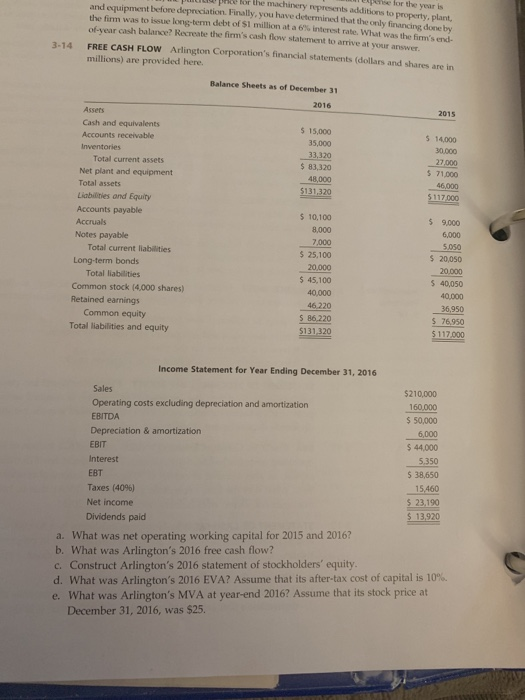

3-12 115 LUIU! STATEMENT OF CASH FLOWS Hampton Industries had $39,000 in cash at year-end 2015 and $11,000 in cash at year-end 2016. The firm invested in property, plant, and equipment totaling $210,000. Cash flow from financing activities totaled +$120,000. a. What was the cash flow from operating activities? b. If accruals increased by $15,000, receivables and inventories increased by $50,000, and depreciation and amortization totaled $25,000, what was the firm's net income? o ve for the year is lor the machinery represents addition to property, plant, and equipment before depreciation. Finally, you have determined that the only financing deb the firm was to issue long-term debt of Simion at a 6% interest rate. What was the firm's end r cash balance? Recreate the firm's cash flow statement to arrive at your answer FREE CASH FLOW Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 3-14 2016 $ 15,000 35,000 33320 $ 83,320 48 000 $131,320 $ 14,000 30.000 27.000 $ 71.000 $ 117.000 Cash and equivalents Accounts receivable Inventories Total current assets Net plant and equipment Total assets Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock (4,000 shares) Retained earnings Common equity Total liabilities and equity $ 10,100 8,000 7,000 $ 25,100 20,000 $ 45,100 40,000 46.220 S 86,220 $131320 $ 9.000 6,000 5.050 $ 20.050 20.000 $ 40,050 40.000 36,950 $ 76.950 $117.000 Income Statement for Year Ending December 31, 2016 6.000 EBT 15.460 Sales $210,000 Operating costs excluding depreciation and amortization 160.000 EBITDA $ 50,000 Depreciation & amortization EBIT $ 44,000 Interest 5.350 $ 38,650 Taxes (40%) Net Income $ 23,190 Dividends paid $ 13,920 a. What was net operating working capital for 2015 and 2016? b. What was Arlington's 2016 free cash flow? c. Construct Arlington's 2016 statement of stockholders' equity. d. What was Arlington's 2016 EVA? Assume that its after-tax cost of capital is 10% e. What was Arlington's MVA at year-end 2016? Assume that its stock price at December 31, 2016, was $25