Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(3-12) Stinger Electrical has $468,000 in total current assets and its current ratio is 2.6. Inventory is $110,000. Current Ratio Management wants to borrow short-term

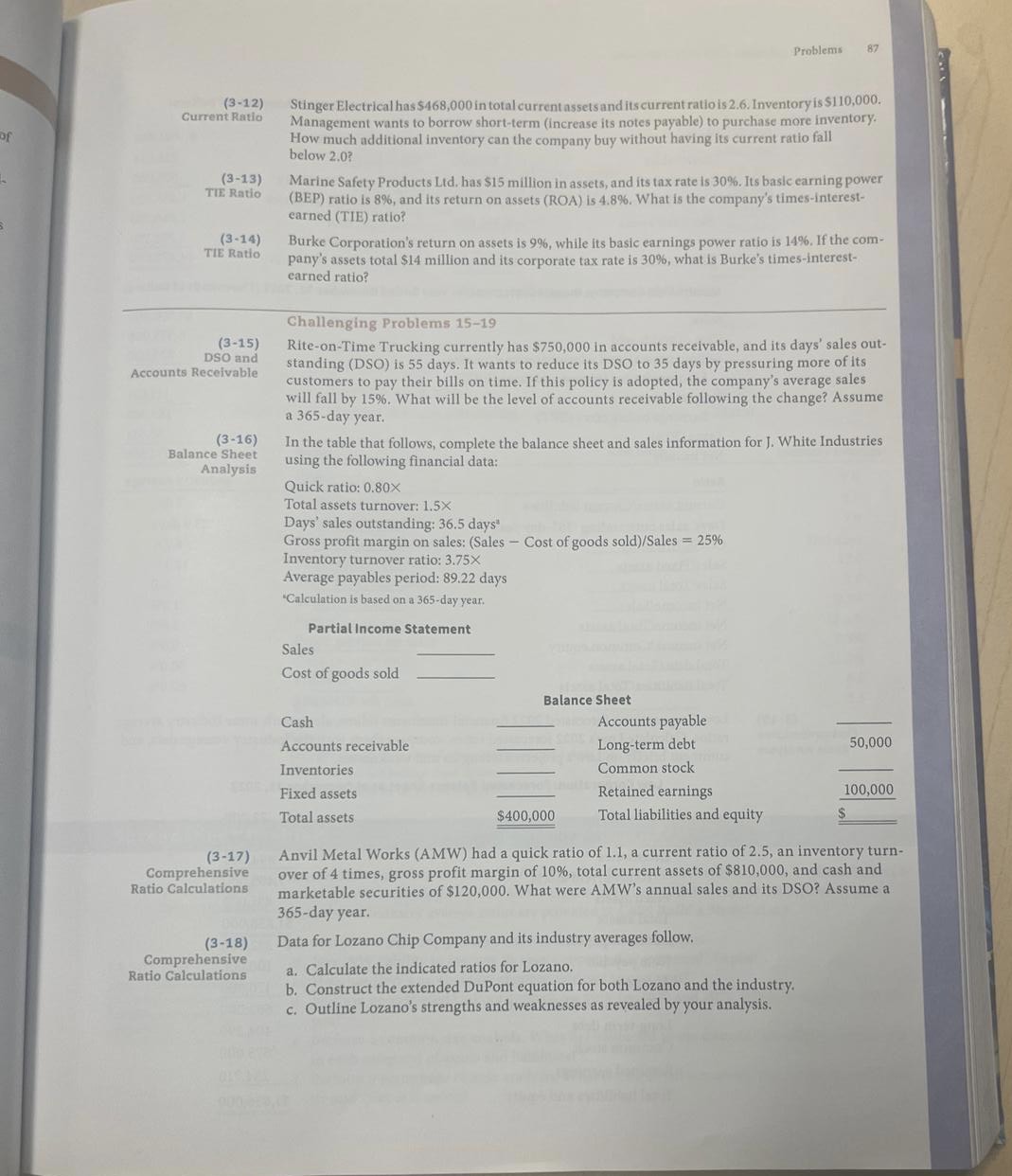

(3-12) Stinger Electrical has $468,000 in total current assets and its current ratio is 2.6. Inventory is $110,000. Current Ratio Management wants to borrow short-term (increase its notes payable) to purchase more inventory. How much additional inventory can the company buy without having its current ratio fall below 2.0 ? (3-13) Marine Safety Products Lid. has $15 million in assets, and its tax rate is 30%. Its baslc earning power (BEP) ratio is 8%, and its return on assets (ROA) is 4.8%. What is the company's times-interestearned (TIE) ratio? (3-14) Burke Corporation's return on assets is 9%, while its basic earnings power ratio is 14%. If the company's assets total $14 million and its corporate tax rate is 30%, what is Burke's times-interestearned ratio? Challenging Problems 15-19 (3-15) Rite-on-Time Trucking currently has $750,000 in accounts receivable, and its days' sales outDSO and standing (DSO) is 55 days. It wants to reduce its DSO to 35 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 15%. What will be the level of accounts receivable following the change? Assume a 365-day year. Balance Sheet In the table that follows, complete the balance sheet and sales information for J. White Industries Balance Sheet Analysis Quick ratio: 0.80 Total assets turnover: 1.5 Days' sales outstanding: 36.5 days 3 Gross profit margin on sales: (Sales - Cost of goods sold)/Sales =25% Inventory turnover ratio: 3.75 Average payables period: 89.22 days "Calculation is based on a 365-day year. Partiallncome Statement (3-17) Anvil Metal Works (AMW) had a quick ratio of 1.1 , a current ratio of 2.5 , an inventory turnover of 4 times, gross profit margin of 10%, total current assets of $810,000, and cash and marketable securities of $120,000. What were AMW's annual sales and its DSO? Assume a 365-day year. (3-18) Data for Lozano Chip Company and its industry averages follow. a. Calculate the indicated ratios for Lozano. b. Construct the extended DuPont equation for both Lozano and the industry. c. Outline Lozano's strengths and weaknesses as revealed by your analysis. (3-12) Stinger Electrical has $468,000 in total current assets and its current ratio is 2.6. Inventory is $110,000. Current Ratio Management wants to borrow short-term (increase its notes payable) to purchase more inventory. How much additional inventory can the company buy without having its current ratio fall below 2.0 ? (3-13) Marine Safety Products Lid. has $15 million in assets, and its tax rate is 30%. Its baslc earning power (BEP) ratio is 8%, and its return on assets (ROA) is 4.8%. What is the company's times-interestearned (TIE) ratio? (3-14) Burke Corporation's return on assets is 9%, while its basic earnings power ratio is 14%. If the company's assets total $14 million and its corporate tax rate is 30%, what is Burke's times-interestearned ratio? Challenging Problems 15-19 (3-15) Rite-on-Time Trucking currently has $750,000 in accounts receivable, and its days' sales outDSO and standing (DSO) is 55 days. It wants to reduce its DSO to 35 days by pressuring more of its customers to pay their bills on time. If this policy is adopted, the company's average sales will fall by 15%. What will be the level of accounts receivable following the change? Assume a 365-day year. Balance Sheet In the table that follows, complete the balance sheet and sales information for J. White Industries Balance Sheet Analysis Quick ratio: 0.80 Total assets turnover: 1.5 Days' sales outstanding: 36.5 days 3 Gross profit margin on sales: (Sales - Cost of goods sold)/Sales =25% Inventory turnover ratio: 3.75 Average payables period: 89.22 days "Calculation is based on a 365-day year. Partiallncome Statement (3-17) Anvil Metal Works (AMW) had a quick ratio of 1.1 , a current ratio of 2.5 , an inventory turnover of 4 times, gross profit margin of 10%, total current assets of $810,000, and cash and marketable securities of $120,000. What were AMW's annual sales and its DSO? Assume a 365-day year. (3-18) Data for Lozano Chip Company and its industry averages follow. a. Calculate the indicated ratios for Lozano. b. Construct the extended DuPont equation for both Lozano and the industry. c. Outline Lozano's strengths and weaknesses as revealed by your analysis

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started