3-13 through 3-14 please

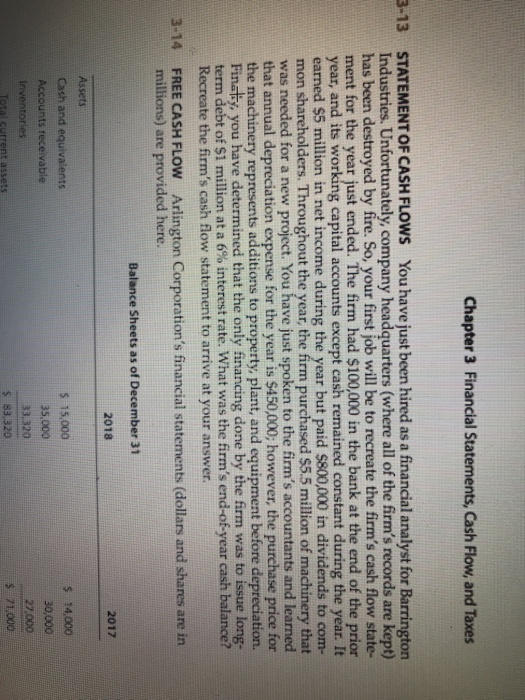

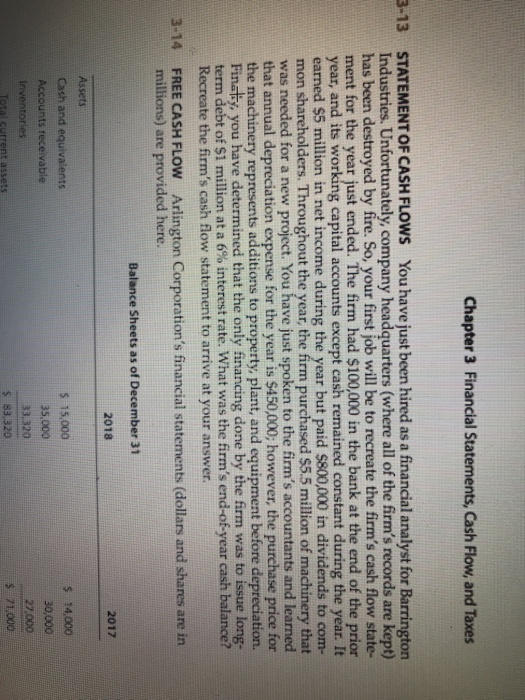

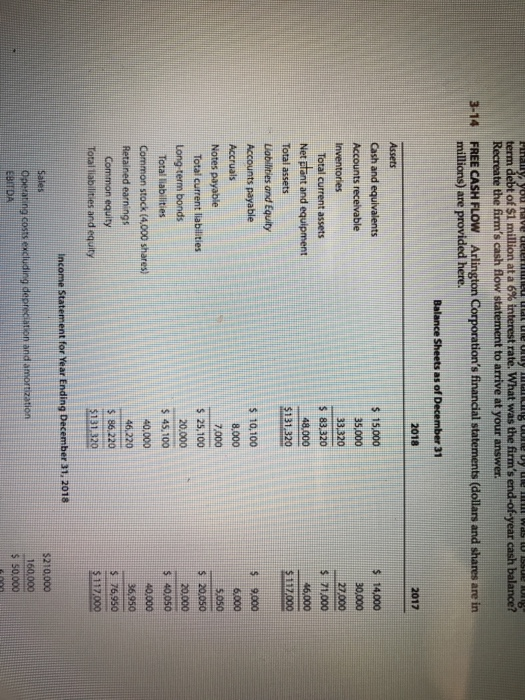

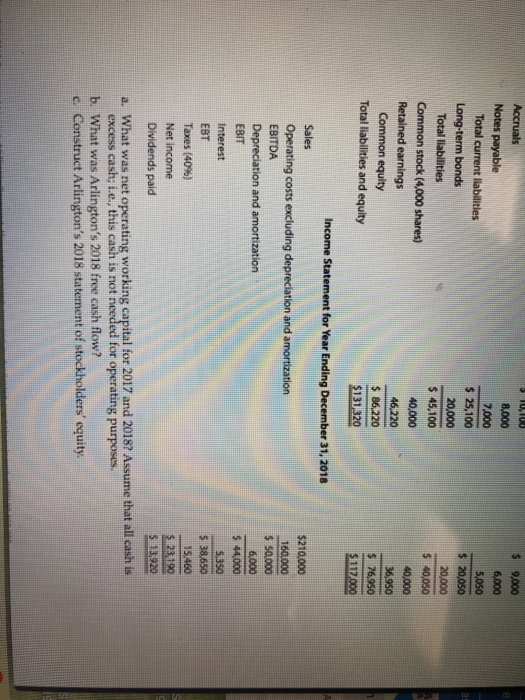

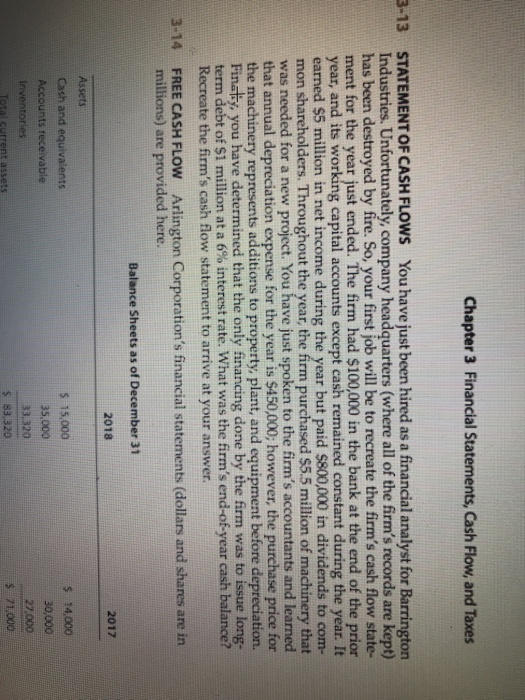

Chapter 3 Financial Statements, Cash Flow, and Taxes 3-13 STATEMENT OF CASH FLOWS You have just been hired as a financial analyst for Barrington Industries. Unfortunately, company headquarters (where all of the firm's records are kept) has been destroyed by fire. So, your first job will be to recreate the firm's cash flow state- ment for the year just ended. The firm had $100,000 in the bank at the end of the prior year, and its working capital accounts except cash remained constant during the year. It earned $5 million in net income during the year but paid $800,000 in dividends to com- mon shareholders. Throughout the year, the firm purchased $5.5 million of machinery that was needed for a new project. You have just spoken to the firm's accountants and learned that annual depreciation expense for the year is $450,000; however, the purchase price for the machinery represents additions to property, plant, and equipment before depreciation. Finaty, you have determined that the only financing done by the firm was to issue long- term debt of $1 million at a 6% interest rate. What was the firm's end-of-year cash balance? Recreate the firm's cash flow statement to arrive at your answer. 3-14 FREE CASH FLOW Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 2018 2017 Assets Cash and equivalents $ 15,000 $ 14,000 Accounts receivable 35.000 30,000 Inventories 33,320 27.000 Total surrent assets $ 83,320 $ 71.000 3-14 30.000 may You W y lang yu was lu Sung term debt of $1 million at a 6% interest rate. What was the firm's end-of-year cash balance? Recreate the firm's cash flow statement to arrive at your answer. FREE CASH FLOW Arlington Corporation's financial statements (dollars and shares are in millions) are provided here. Balance Sheets as of December 31 2018 2017 Assets Cash and equivalents $ 15,000 $ 14,000 Accounts receivable 35,000 Inventories 33,320 27,000 Total current assets $ 83,320 $ 71,000 Net plant and equipment 48.000 46,000 Total assets $131,320 $112.000 Liabilities and Equity Accounts payable $ 10,100 S 9.000 Accruals 8,000 6.000 Notes payable 7,000 5.050 Total current liabilities $ 25,100 $ 20.050 Long-term bonds 20.000 Total liabilities $ 45, 100 $40.050 Common stock (4.000 shares) 40.000 40,000 46.220 Retained earnings 36,950 Common equity $ 86.220 $ 76,950 Total ilabilities and equity $131 320 $112.000 20.000 Income Statement for Year Ending December 31, 2018 Sales Operating costs excluding depreciation and amortization EBITDA $210,000 160.000 $ 50.000 Accruals Notes payable Total current liabilities Long-term bonds Total liabilities Common stock (4,000 shares) Retained earnings Common equity Total liabilities and equity 1.10 8,000 7,000 $ 25,100 20.000 $ 45,100 40,000 46,220 S 86,220 $131,320 9,000 6,000 5,050 $ 20,050 20,000 $ 40,050 40,000 36,950 $ 76,950 $112.000 Income Statement for Year Ending December 31, 2018 Sales Operating costs excluding depreciation and amortization EBITDA Depreciation and amortization EBIT Interest EBT Taxes (40%) Net income Dividends pald $210,000 160.000 $ 50.000 6,000 $ 44,000 5.350 $ 38.650 15,460 $23.190 $ 13.920 a. What was net operating working capital for 2017 and 2018? Assume that all cash is excess cash; i.e., this cash is not needed for operating purposes. b. What was Arlington's 2018 free cash flow? c. Construct Arlington's 2018 statement of stockholders' equity