Answered step by step

Verified Expert Solution

Question

1 Approved Answer

31,34,39 DEF Company has two sources of funds: long term debt with a market value and book value of PIO million issued at an interest

31,34,39

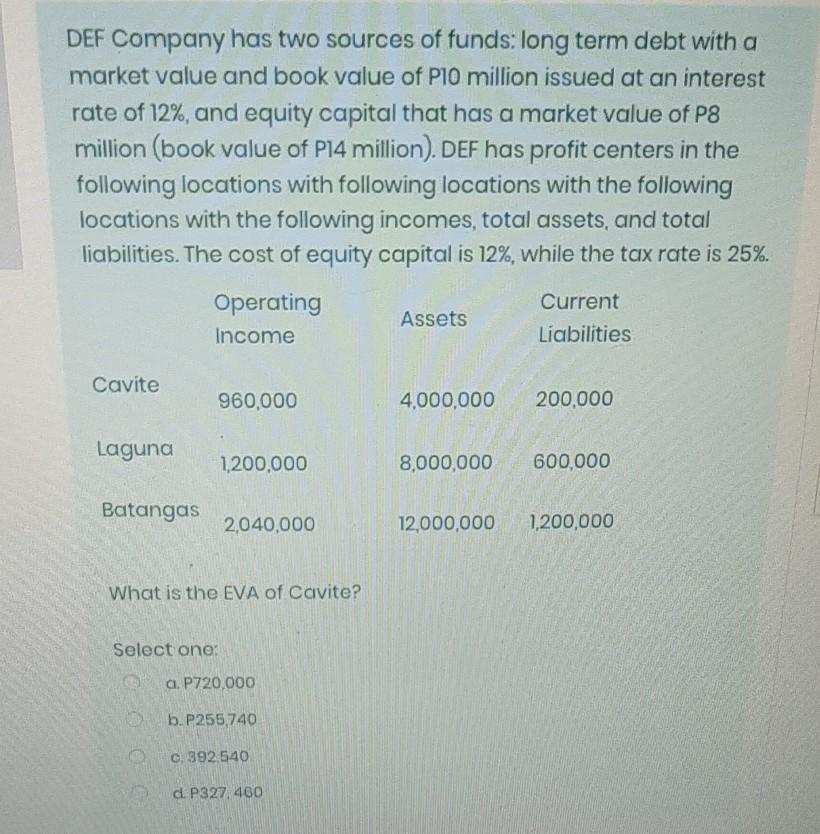

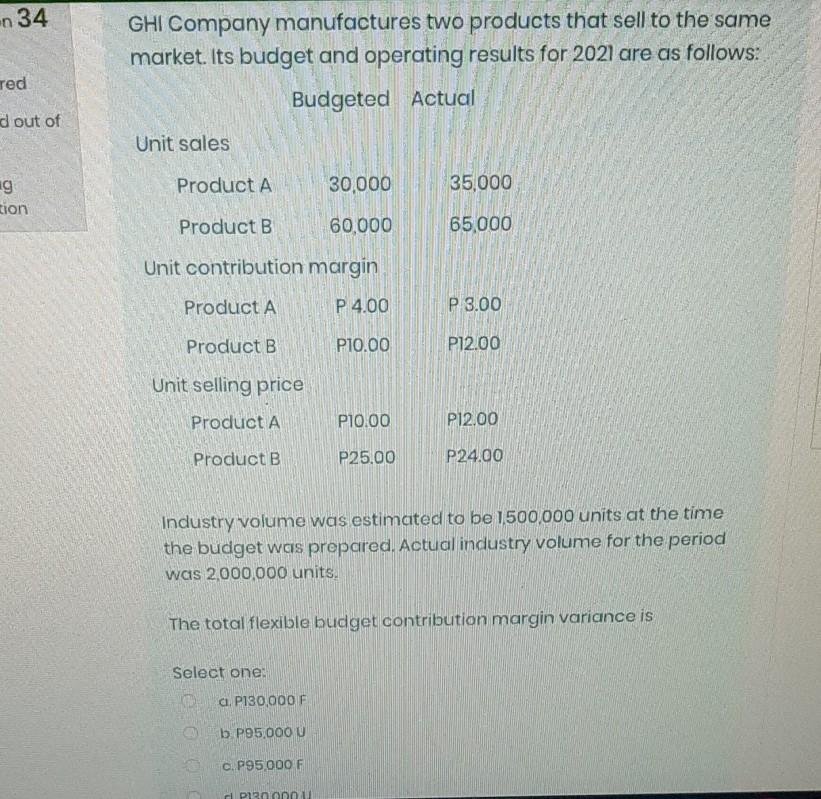

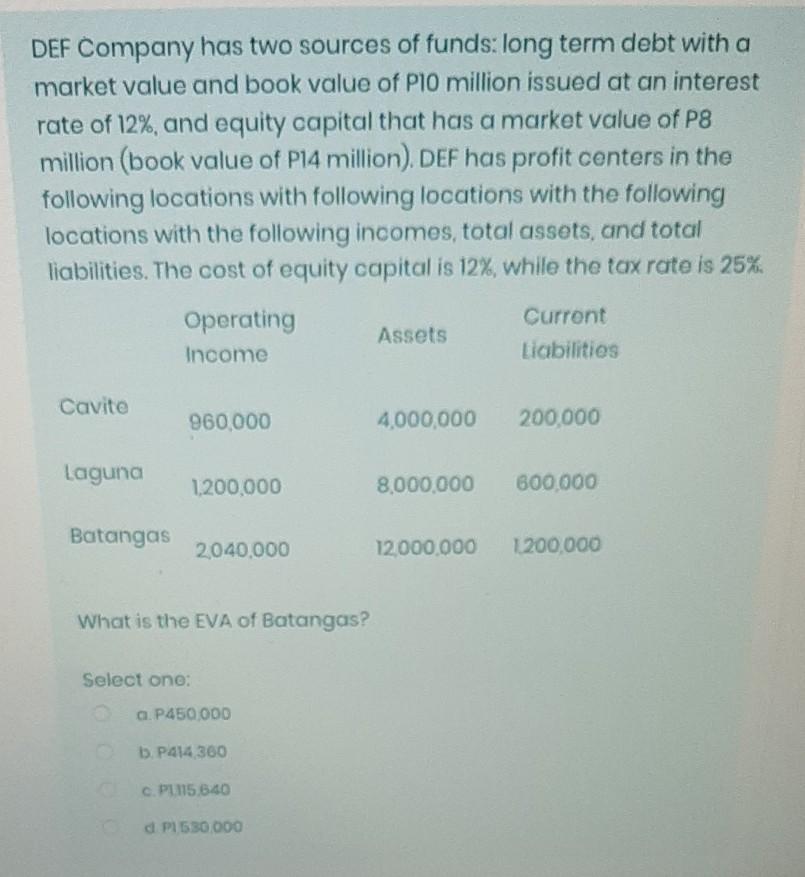

DEF Company has two sources of funds: long term debt with a market value and book value of PIO million issued at an interest rate of 12%, and equity capital that has a market value of P8 million (book value of P14 million). DEF has profit centers in the following locations with following locations with the following locations with the following incomes, total assets, and total liabilities. The cost of equity capital is 12%, while the tax rate is 25%. Operating Current Assets Income Liabilities Cavite 960,000 4,000,000 200,000 Laguna 1,200,000 8,000,000 600,000 Batangas 2,040,000 12,000,000 1,200,000 What is the EVA of Cavite? Select one: a. P720,000 b.P255,740 C. 392.540 d. P327,400 ..34 GHI Company manufactures two products that sell to the same market. Its budget and operating results for 2021 are as follows: Ted Budgeted Actual d out of Unit sales Product A 30,000 35,000 ag cion Product B 60,000 65,000 Unit contribution margin Product A P 4.00 P 3.00 Product B P10.00 P12.00 Unit selling price Product A P10.00 P12.00 Product B P25.00 P24.00 Industry volume was estimated to be 1500,000 units at the time the budget was prepared. Actual industry volume for the period was 2,000,000 units. The total flexible budget contribution margin variance is Select one: a. P130.000 F b P95,000 U c. P95 000 F Pin on DEF Company has two sources of funds: long term debt with a market value and book value of P10 million issued at an interest rate of 12%, and equity capital that has a market value of P8 million (book value of P14 million). DEF has profit centers in the following locations with following locations with the following locations with the following incomes, total assets, and total liabilities. The cost of equity capital is 12%, while the tax rate is 25%. Curront Operating Income Assets Liabilities Cavite 960,000 4,000,000 200,000 Laguna 1.200.000 8.000.000 600 000 Batangas 2040,000 12.000.000 1200,000 What is the EVA of Batangas? Select one: a P450.000 bP414 300 C. PU115,640 d P1530.000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started