Answered step by step

Verified Expert Solution

Question

1 Approved Answer

31.-35. Pinnacle Products Inc. is comparing the cash flows generated by its current production facility with the estimated cash flows that may be generated

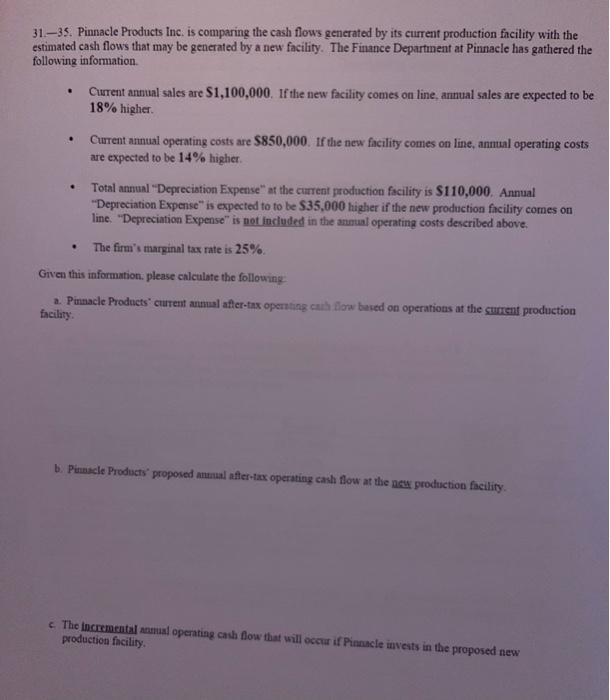

31.-35. Pinnacle Products Inc. is comparing the cash flows generated by its current production facility with the estimated cash flows that may be generated by a new facility. The Finance Department at Pinnacle has gathered the following information. . . . Current annual sales are $1,100,000. If the new facility comes on line, annual sales are expected to be 18% higher. Current annual operating costs are $850,000. If the new facility comes on line, annual operating costs are expected to be 14% higher. Total annual "Depreciation Expense" at the current production facility is $110,000. Annual "Depreciation Expense" is expected to to be $35,000 higher if the new production facility comes on line. "Depreciation Expense" is not included in the annual operating costs described above. The firm's marginal tax rate is 25%. Given this information, please calculate the following: a. Pinnacle Products current annual after-tax operating cash flow based on operations at the current production facility. b. Pinnacle Products proposed annual after-tax operating cash flow at the new production facility. c. The incremental anmual operating cash flow that will occur if Pinnacle invests in the proposed new production facility.

Step by Step Solution

★★★★★

3.45 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Current annual aftertax operating cash flow at the current production facility Operating Income Current annual sales Current annual operating costs ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started