Answered step by step

Verified Expert Solution

Question

1 Approved Answer

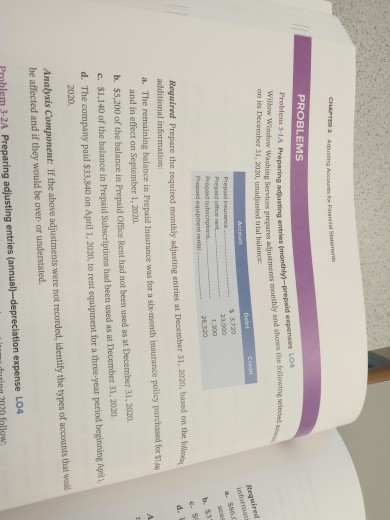

3-1a CHAPTER 2 A ng Actor PROBLEMS Willow Window Washing Services prepares A Preparing adjusting entries ( monthly-prepaid expren on its December 31, 2020, unadjusted

3-1a

CHAPTER 2 A ng Actor PROBLEMS Willow Window Washing Services prepares A Preparing adjusting entries ( monthly-prepaid expren on its December 31, 2020, unadjusted trial balance Wishing Services prepares adjustments monthly and shows the following the Debit C Required $ 3.720 a. Presidrun Prepaid L. Prepaid subscription. Prepaid equipment Rental 26,320 y red Prepare the required monthly adjusting entries at December 31, 2 , on the Wow additional information: alThe remaining balance in Prepaid Insurance was for a six-month insumnce policy purchase and in effect on September 1, 2020. b. $5,200 of the balance in Prepaid Office Rent had not been used as at December 31, 2020 c. $1,140 of the balance in Prepaid Subscriptions had been used as at December 31, 2020 d. The company paid $33,840 on April 1, 2020, to rent equipment for a three-year period beginning April 2020 Analysis Component: If the above adjustments were not recorded, identify the types of accounts that we be affected and if they would be over- or understated. Problem 3-2A Preparing adjusting entries (annual)-depreciation expense L04 during 2020 follow: CHAPTER 2 A ng Actor PROBLEMS Willow Window Washing Services prepares A Preparing adjusting entries ( monthly-prepaid expren on its December 31, 2020, unadjusted trial balance Wishing Services prepares adjustments monthly and shows the following the Debit C Required $ 3.720 a. Presidrun Prepaid L. Prepaid subscription. Prepaid equipment Rental 26,320 y red Prepare the required monthly adjusting entries at December 31, 2 , on the Wow additional information: alThe remaining balance in Prepaid Insurance was for a six-month insumnce policy purchase and in effect on September 1, 2020. b. $5,200 of the balance in Prepaid Office Rent had not been used as at December 31, 2020 c. $1,140 of the balance in Prepaid Subscriptions had been used as at December 31, 2020 d. The company paid $33,840 on April 1, 2020, to rent equipment for a three-year period beginning April 2020 Analysis Component: If the above adjustments were not recorded, identify the types of accounts that we be affected and if they would be over- or understated. Problem 3-2A Preparing adjusting entries (annual)-depreciation expense L04 during 2020 followStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started