Question

32. 32. I need the answers and how to work them!! THANKS A salesman with a marketing degree from the business school wants to retire

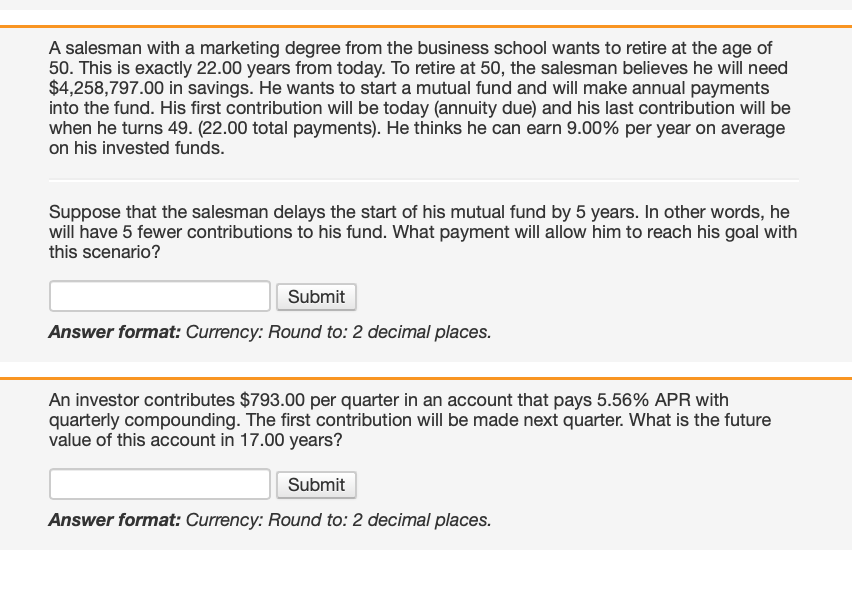

32. 32. I need the answers and how to work them!! THANKS  A salesman with a marketing degree from the business school wants to retire at the age of 50. This is exactly 22.00 years from today. To retire at 50 , the salesman believes he will need $4,258,797.00 in savings. He wants to start a mutual fund and will make annual payments into the fund. His first contribution will be today (annuity due) and his last contribution will be when he turns 49 . (22.00 total payments). He thinks he can earn 9.00% per year on average on his invested funds. Suppose that the salesman delays the start of his mutual fund by 5 years. In other words, he will have 5 fewer contributions to his fund. What payment will allow him to reach his goal with this scenario? Answer format: Currency: Round to: 2 decimal places. An investor contributes $793.00 per quarter in an account that pays 5.56% APR with quarterly compounding. The first contribution will be made next quarter. What is the future value of this account in 17.00 years? Answer format: Currency: Round to: 2 decimal places

A salesman with a marketing degree from the business school wants to retire at the age of 50. This is exactly 22.00 years from today. To retire at 50 , the salesman believes he will need $4,258,797.00 in savings. He wants to start a mutual fund and will make annual payments into the fund. His first contribution will be today (annuity due) and his last contribution will be when he turns 49 . (22.00 total payments). He thinks he can earn 9.00% per year on average on his invested funds. Suppose that the salesman delays the start of his mutual fund by 5 years. In other words, he will have 5 fewer contributions to his fund. What payment will allow him to reach his goal with this scenario? Answer format: Currency: Round to: 2 decimal places. An investor contributes $793.00 per quarter in an account that pays 5.56% APR with quarterly compounding. The first contribution will be made next quarter. What is the future value of this account in 17.00 years? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started