Answered step by step

Verified Expert Solution

Question

1 Approved Answer

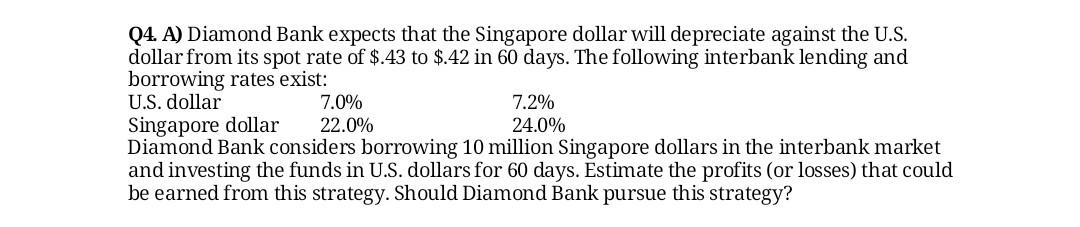

Q4. A) Diamond Bank expects that the Singapore dollar will depreciate against the U.S. dollar from its spot rate of $.43 to $.42 in 60

Q4. A) Diamond Bank expects that the Singapore dollar will depreciate against the U.S. dollar from its spot rate of $.43 to $.42 in 60 days. The following interbank lending and borrowing rates exist: U.S. dollar 7.0% 7.2% Singapore dollar 22.0% 24.0% Diamond Bank considers borrowing 10 million Singapore dollars in the interbank market and investing the funds in U.S. dollars for 60 days. Estimate the profits (or losses) that could be earned from this strategy. Should Diamond Bank pursue this strategy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started