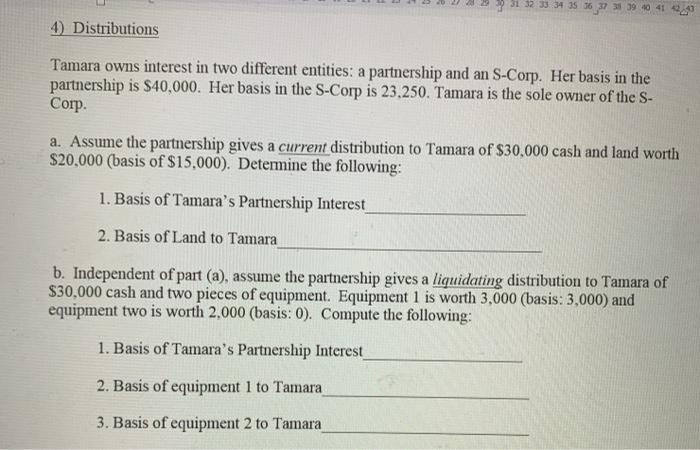

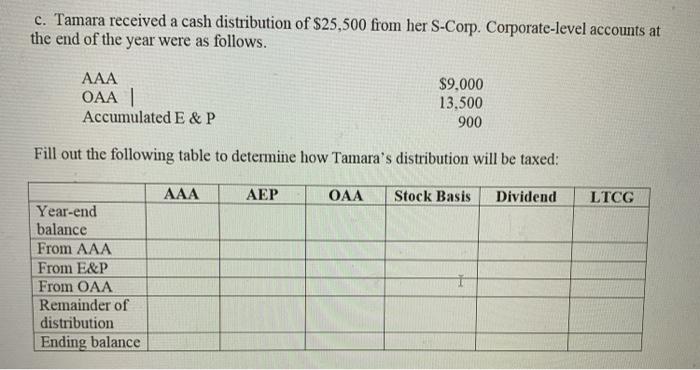

32 33 34 35 36 37 38 39 40 41 42 4) Distributions Tamara owns interest in two different entities: a partnership and an S-Corp. Her basis in the partnership is $40,000. Her basis in the S-Corp is 23.250. Tamara is the sole owner of the S- Corp. a. Assume the partnership gives a current distribution to Tamara of $30.000 cash and land worth $20,000 (basis of $15,000). Determine the following: 1. Basis of Tamara's Partnership Interest 2. Basis of Land to Tamara b. Independent of part (a), assume the partnership gives a liquidating distribution to Tamara of $30,000 cash and two pieces of equipment. Equipment 1 is worth 3,000 (basis: 3,000) and equipment two is worth 2,000 (basis: 0). Compute the following: 1. Basis of Tamara's Partnership Interest 2. Basis of equipment 1 to Tamara 3. Basis of equipment 2 to Tamara c. Tamara received a cash distribution of $25,500 from her S-Corp. Corporate-level accounts at the end of the year were as follows. AAA OAA | Accumulated E&P $9.000 13,500 900 Fill out the following table to determine how Tamara's distribution will be taxed: AAA AEP OAA Stock Basis Dividend LTCG Year-end balance From AAA From E&P From OAA Remainder of distribution Ending balance 1 Tamara owns interest in two different entities: a partnership and an S-Corp. Her basis in the partnership is $40,000. Her basis in the S-Corp is 23,250. Tamara is the sole owner of the S- Corp a. Assume the partnership gives a current distribution to Tamara of $30,000 cash and land worth $20.000 (basis of $15,000). Determine the following: 1. Basis of Tamara's Partnership Interest 2. Basis of Land to Tamara b. Independent of part (a), assume the partnership gives a liquidating distribution to Tamara of $30,000 cash and two pieces of equipment. Equipment 1 is worth 3,000 (basis: 3,000) and equipment two is worth 2,000 (basis: 0). Compute the following: 1. Basis of Tamara's Partnership Interest 2. Basis of equipment 1 to Tamara 3. Basis of equipment 2 to Tamara c. Tamara received a cash distribution of $25,500 from her S-Corp. Corporate-level accounts at the end of the year were as follows. AAA OAA Accumulated E & P $9,000 13,500 900 Fill out the following table to determine how Tamara's distribution will be taxed: AAA AEP OAA Stock Basis Dividend LTCG Year-end balance From AAA From E&P From OAA Remainder of distribution Ending balance