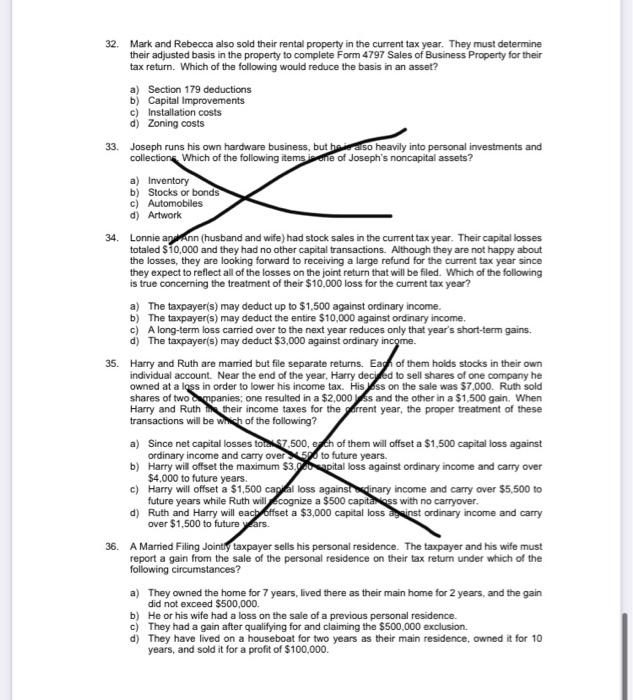

32. Mark and Rebecca also sold their rental property in the current tax year. They must determine their adjusted basis in the property to complete Form 4797 Sales of Business Property for their tax return. Which of the following would reduce the basis in an asset? a) Section 179 deductions b) Capital Improvements c) Installation costs d) Zoning costs 33. Joseph runs his own hardware business, but he also heavily into personal investments and collections Which of the following items one of Joseph's noncapital assets? a) Inventory b) Stocks or bonds c) Automobiles d) Artwork 34. Lonnie and Ann (husband and wife) had stock sales in the current tax year. Their capital losses totaled $10,000 and they had no other capital transactions. Although they are not happy about the losses, they are looking forward to receiving a large refund for the current tax year since they expect to reflect all of the losses on the joint return that will be filed. Which of the following is true concerning the treatment of their $10,000 loss for the current tax year? a) The taxpayer(s) may deduct up to $1.500 against ordinary income. b) The taxpayer(s) may deduct the entire $10,000 against ordinary income. c) A long-term loss carried over to the next year reduces only that year's short-term gains. d) The taxpayer(s) may deduct $3,000 against ordinary income. 35. Harry and Ruth are married but file separate returns. Eagh of them hoids stocks in their own individual account. Near the end of the year, Harry decked to sell shares of one company he owned at a loss in order to lower his income tax. Hisss on the sale was $7,000. Ruth sold shares of two campanies, one resulted in a $2,000 ss and the other in a $1,500 gain. When Harry and Ruth their income taxes for the parent year, the proper treatment of these transactions will be which of the following? a) Since net capital losses tolak 7.500, efth of them will offset a $1,500 capital loss against ordinary income and carry over to future years. b) Harry will offset the maximum $3.pital loss against ordinary income and carry over $4,000 to future years. c) Harry will offset a $1,500 cacual loss against a dinary income and carry over $5,500 to future years while Ruth will cognize a $500 capitaness with no carryover. d) Ruth and Harry will each otiset a $3,000 capital loss einst ordinary income and carry over $1,500 to future years. 36. A Married Filing Jointly taxpayer sells his personal residence. The taxpayer and his wife must report a gain from the sale of the personal residence on their tax return under which of the following circumstances? a) They owned the home for 7 years, lived there as their main home for 2 years, and the gain did not exceed $500,000 b) He or his wife had a loss on the sale of a previous personal residence. c) They had a gain after qualifying for and claiming the $500,000 exclusion d) They have lived on a houseboat for two years as their main residence, owned it for 10 years, and sold it for a profit of $100,000