Answered step by step

Verified Expert Solution

Question

1 Approved Answer

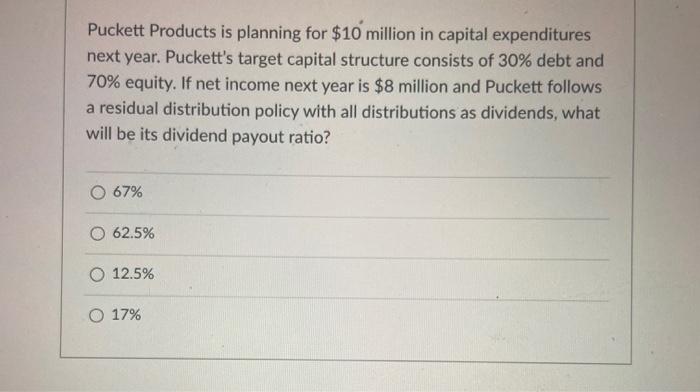

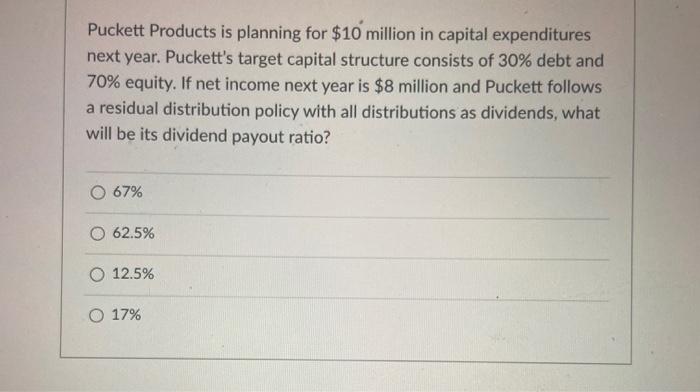

32 Part A Part B Puckett Products is planning for $10 million in capital expenditures next year. Puckett's target capital structure consists of 30% debt

32 Part A

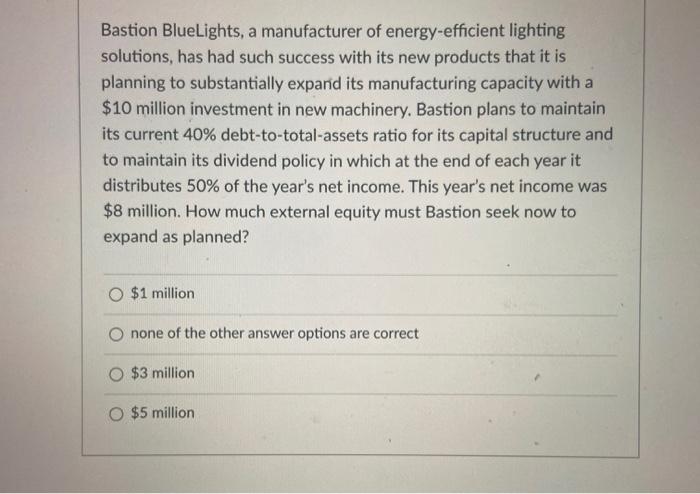

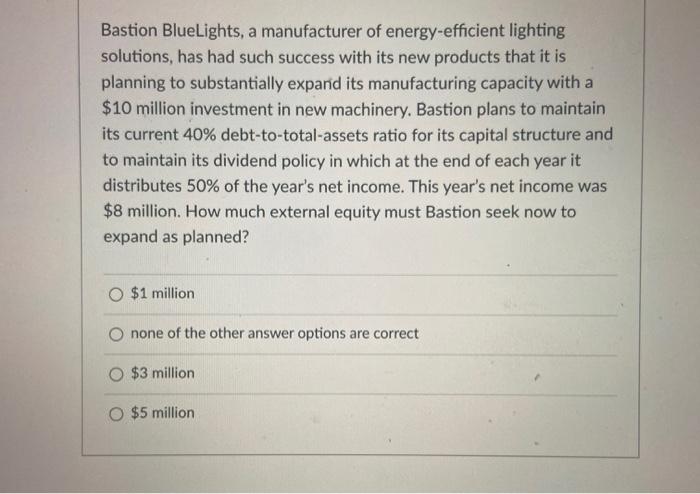

Puckett Products is planning for $10 million in capital expenditures next year. Puckett's target capital structure consists of 30% debt and 70% equity. If net income next year is $8 million and Puckett follows a residual distribution policy with all distributions as dividends, what will be its dividend payout ratio? 67% 62.5% 12.5% O 17% Bastion BlueLights, a manufacturer of energy-efficient lighting solutions, has had such success with its new products that it is planning to substantially expand its manufacturing capacity with a $10 million investment in new machinery, Bastion plans to maintain its current 40% debt-to-total-assets ratio for its capital structure and to maintain its dividend policy in which at the end of each year it distributes 50% of the year's net income. This year's net income was $8 million. How much external equity must Bastion seek now to expand as planned? $1 million none of the other answer options are correct $3 million O $5 million

Part B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started