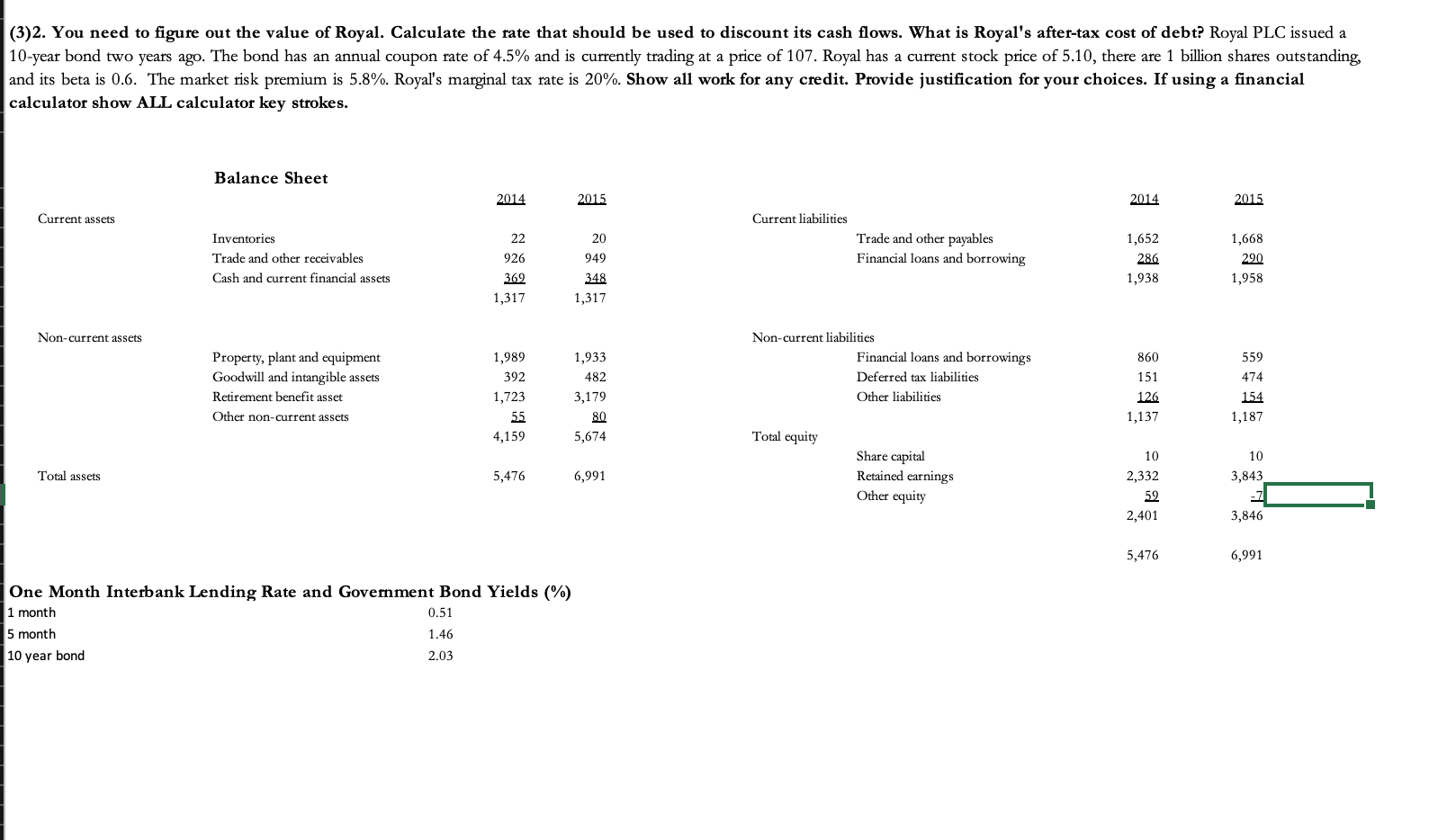

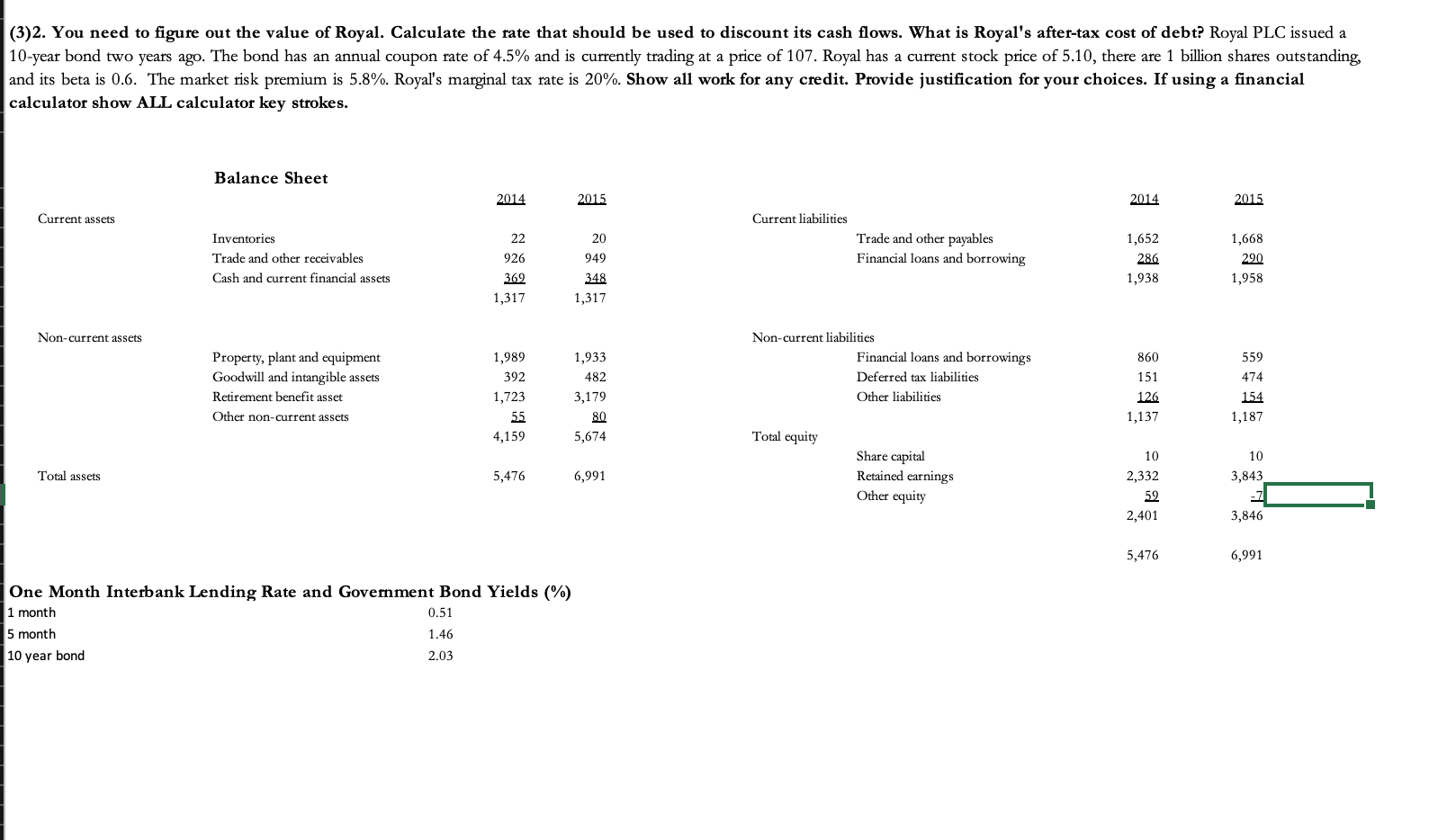

(3)2. You need to figure out the value of Royal. Calculate the rate that should be used to discount its cash flows. What is Royal's after-tax cost of debt? Royal PLC issued a 10-year bond two years ago. The bond has an annual coupon rate of 4.5% and is currently trading at a price of 107. Royal has a current stock price of 5.10, there are 1 billion shares outstanding, and its beta is 0.6. The market risk premium is 5.8%. Royal's marginal tax rate is 20%. Show all work for any credit. Provide justification for your choices. If using a financial calculator show ALL calculator key strokes. Balance Sheet 2014 2015 2014 2015 Current assets Current liabilities Inventories Trade and other receivables Cash and current financial assets 20 949 Trade and other payables Financial loans and borrowing 22 926 362 1,317 1,652 286 1,938 1,668 290 1,958 348 1,317 Non-current assets 860 Property, plant and equipment Goodwill and intangible assets Retirement benefit asset Other non-current assets 1,989 392 1,723 55 1,933 482 3,179 80 5,674 Non-current liabilities Financial loans and borrowings Deferred tax liabilities Other liabilities 151 126 1,137 559 474 154 1,187 4,159 Total equity 10 3,843 Total assets 5,476 Share capital Retained earnings Other equity 6,991 10 2,332 59 2,401 3,846 5,476 6,991 One Month Interbank Lending Rate and Government Bond Yields (%) 1 month 0.51 5 month 1.46 10 year bond 2.03 (3)2. You need to figure out the value of Royal. Calculate the rate that should be used to discount its cash flows. What is Royal's after-tax cost of debt? Royal PLC issued a 10-year bond two years ago. The bond has an annual coupon rate of 4.5% and is currently trading at a price of 107. Royal has a current stock price of 5.10, there are 1 billion shares outstanding, and its beta is 0.6. The market risk premium is 5.8%. Royal's marginal tax rate is 20%. Show all work for any credit. Provide justification for your choices. If using a financial calculator show ALL calculator key strokes. Balance Sheet 2014 2015 2014 2015 Current assets Current liabilities Inventories Trade and other receivables Cash and current financial assets 20 949 Trade and other payables Financial loans and borrowing 22 926 362 1,317 1,652 286 1,938 1,668 290 1,958 348 1,317 Non-current assets 860 Property, plant and equipment Goodwill and intangible assets Retirement benefit asset Other non-current assets 1,989 392 1,723 55 1,933 482 3,179 80 5,674 Non-current liabilities Financial loans and borrowings Deferred tax liabilities Other liabilities 151 126 1,137 559 474 154 1,187 4,159 Total equity 10 3,843 Total assets 5,476 Share capital Retained earnings Other equity 6,991 10 2,332 59 2,401 3,846 5,476 6,991 One Month Interbank Lending Rate and Government Bond Yields (%) 1 month 0.51 5 month 1.46 10 year bond 2.03