Answered step by step

Verified Expert Solution

Question

1 Approved Answer

33 32 31 PLEASE HELP ME I ONLY GOT THIS ONE QUESTION LEFT. PLEASE I BEG YOU You are bearish on Telecom and decide to

33

32

31

PLEASE HELP ME I ONLY GOT THIS ONE QUESTION LEFT. PLEASE I BEG YOU

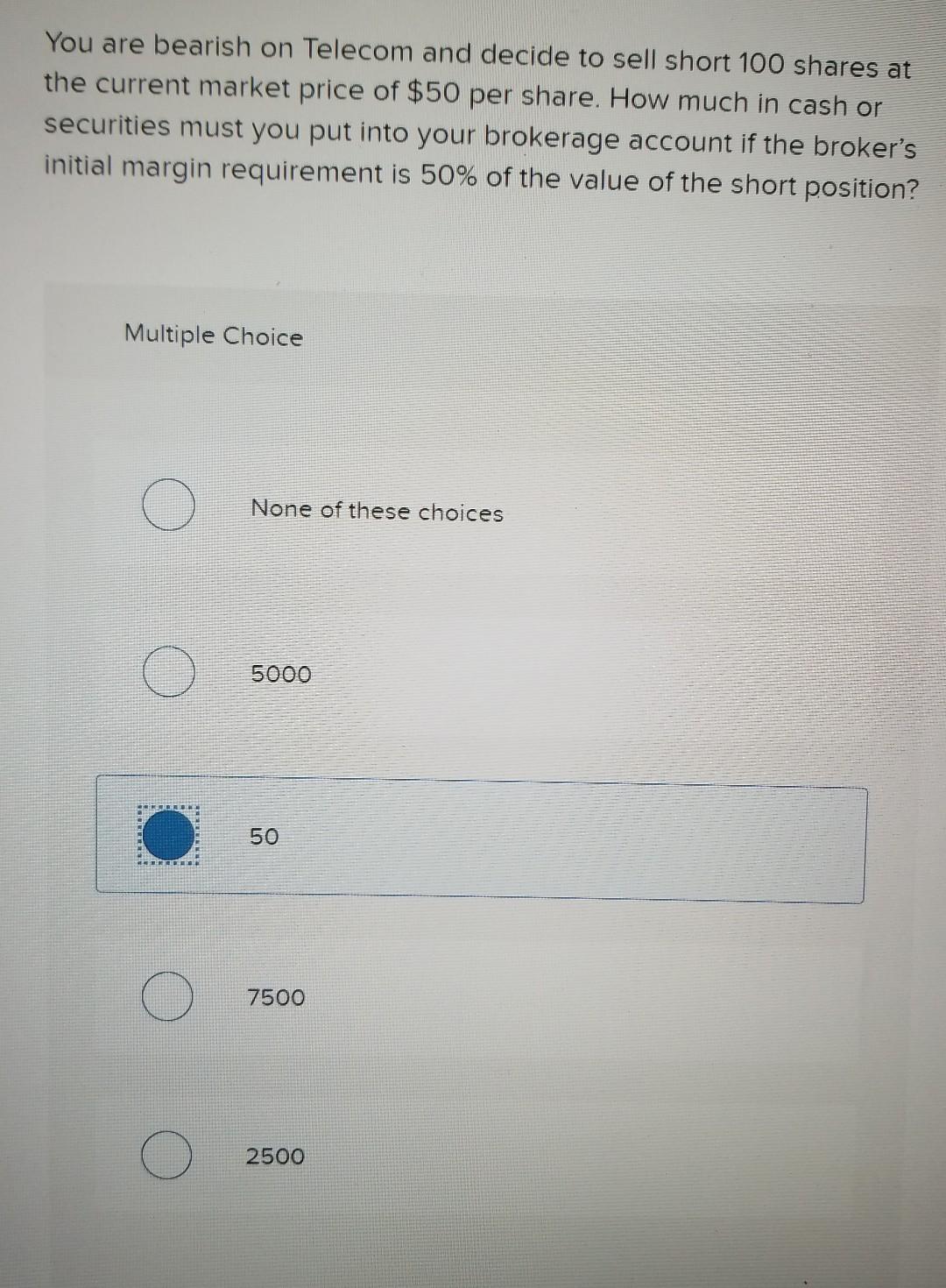

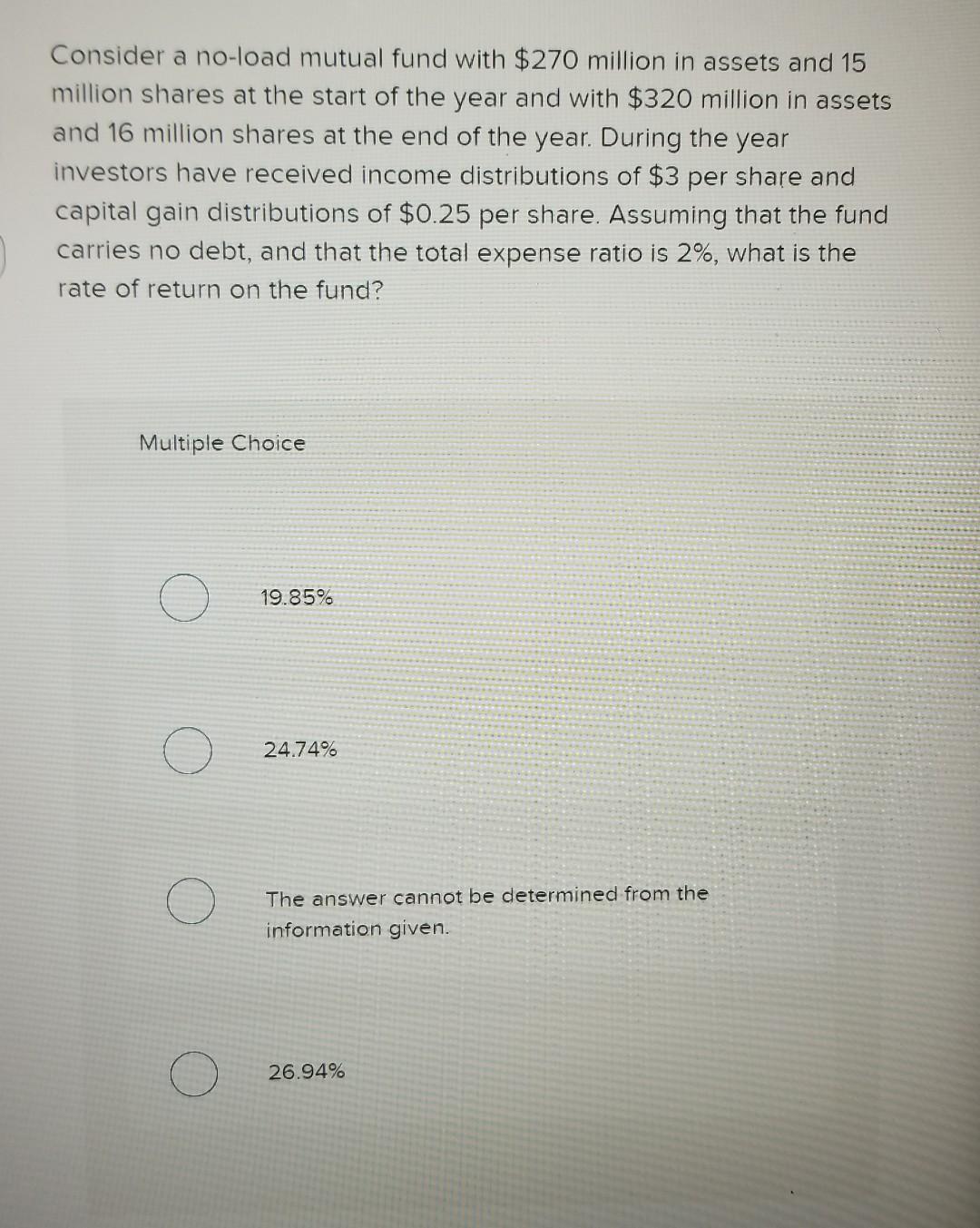

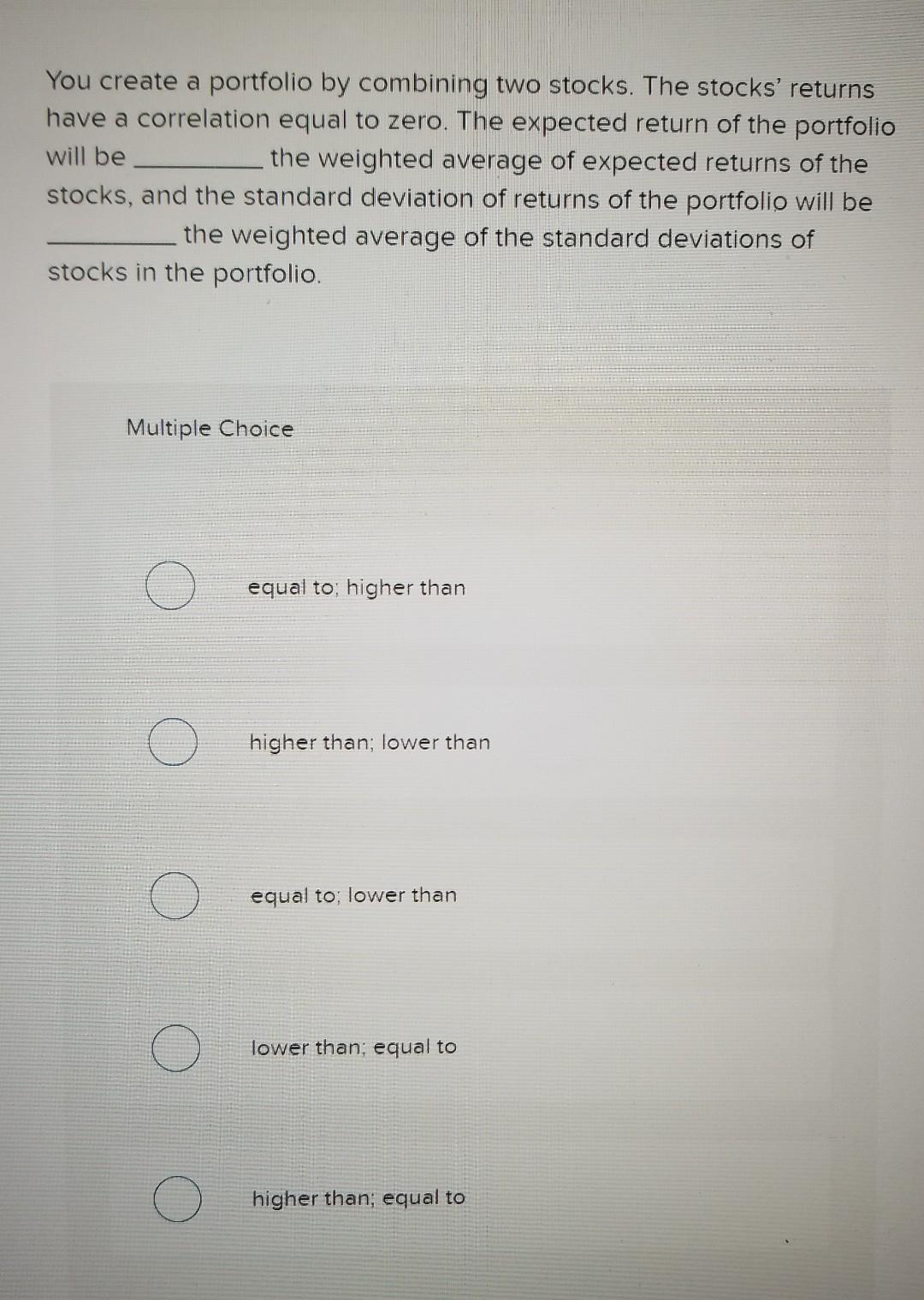

You are bearish on Telecom and decide to sell short 100 shares at the current market price of $50 per share. How much in cash or securities must you put into your brokerage account if the broker's initial margin requirement is 50% of the value of the short position? Multiple Choice None of these choices 5000 50 7500 2500 Consider a no-load mutual fund with $270 million in assets and 15 million shares at the start of the year and with $320 million in assets and 16 million shares at the end of the year. During the year investors have received income distributions of $3 per share and capital gain distributions of $0.25 per share. Assuming that the fund carries no debt, and that the total expense ratio is 2%, what is the rate of return on the fund? Multiple Choice 19.85% 24.74% The answer cannot be determined from the information given. 26.94% You create a portfolio by combining two stocks. The stocks' returns have a correlation equal to zero. The expected return of the portfolio will be the weighted average of expected returns of the stocks, and the standard deviation of returns of the portfolio will be the weighted average of the standard deviations of stocks in the portfolio. Multiple Choice equal to; higher than higher than; lower than equal to; lower than lower than; equal to higher than; equal toStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started