Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Old MathJax webview Please try to answer within 30 minutes not 3 days later. 21 22 11 An investor who believes that markets are efficient

Old MathJax webview

Please try to answer within 30 minutes not 3 days later. 21

22

11

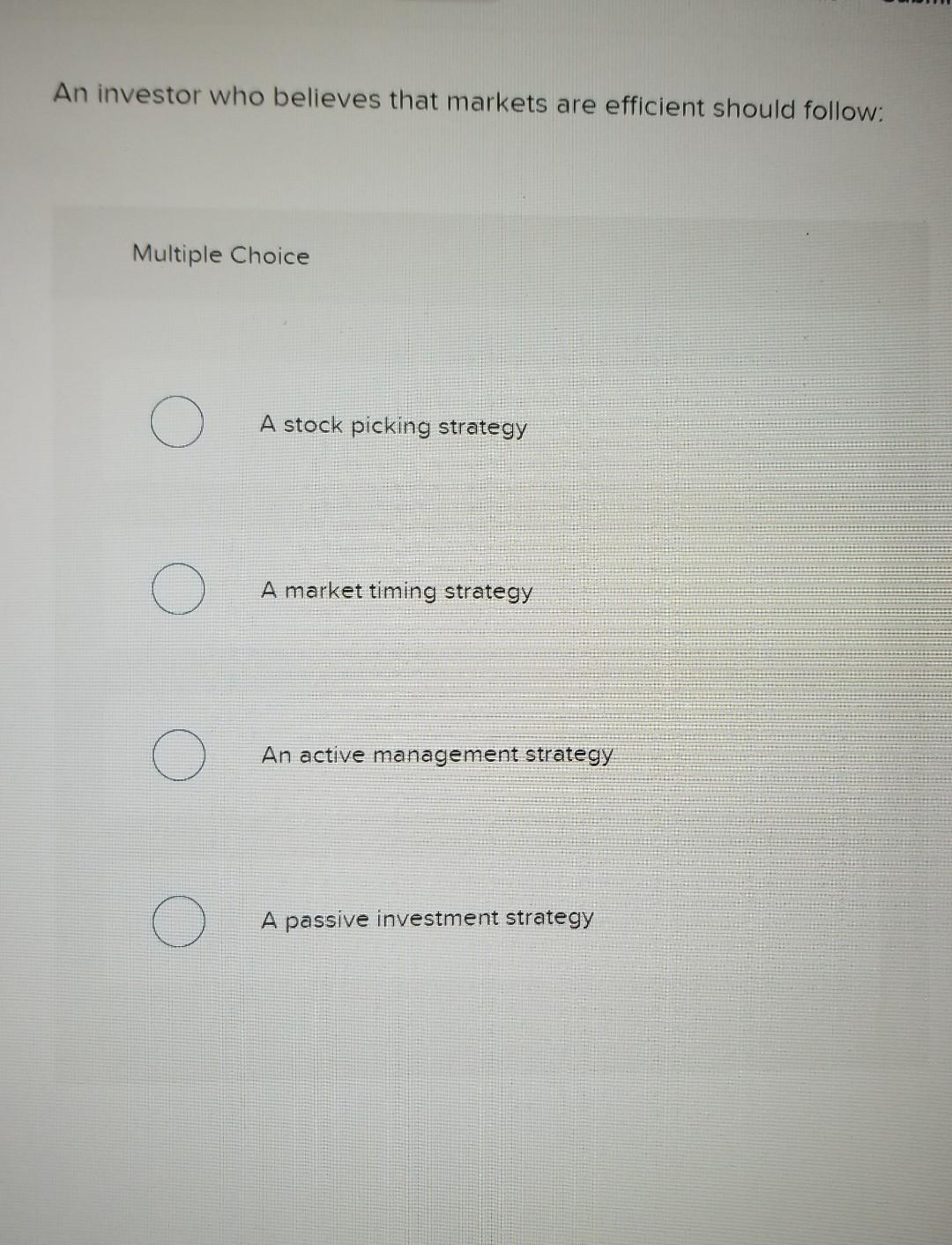

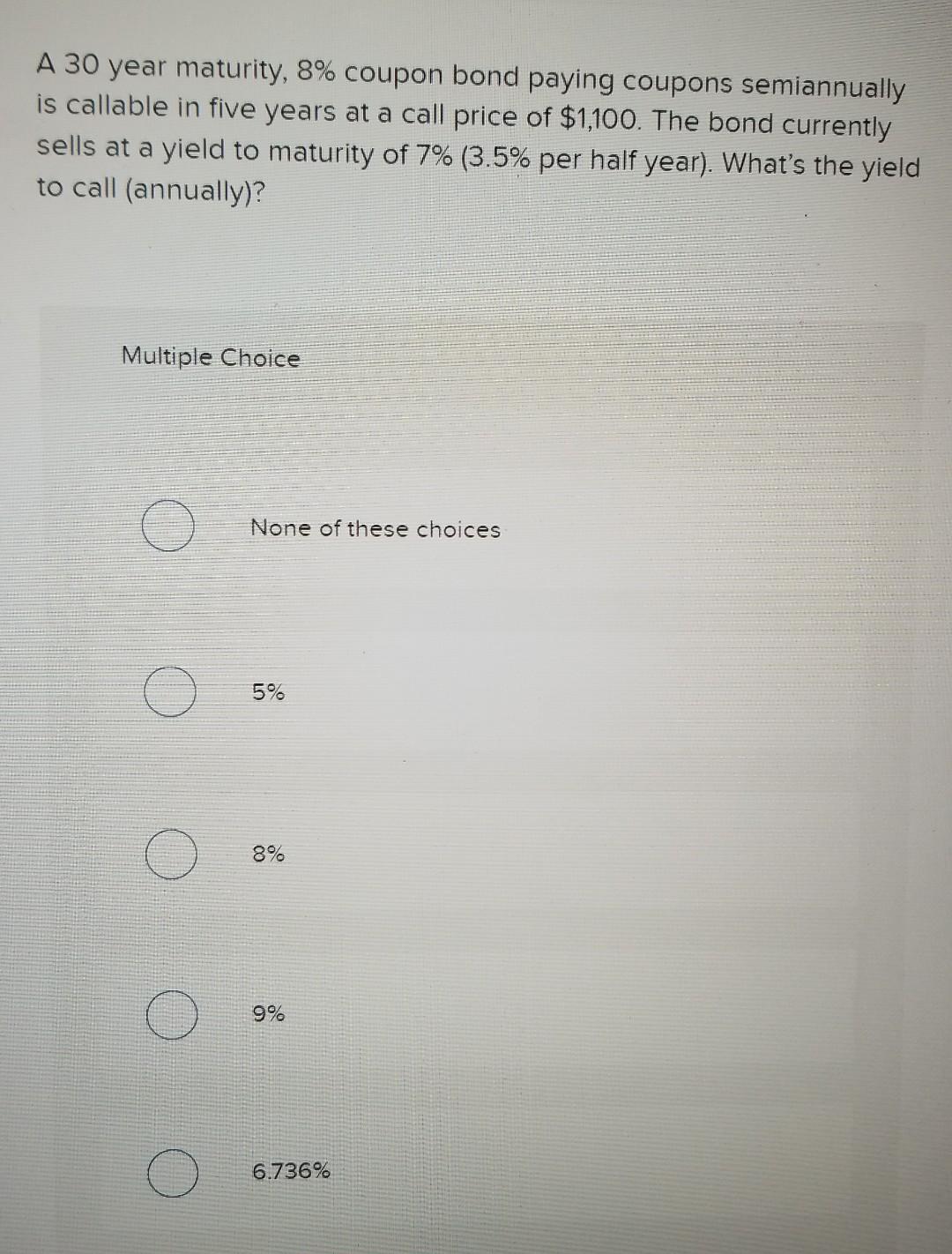

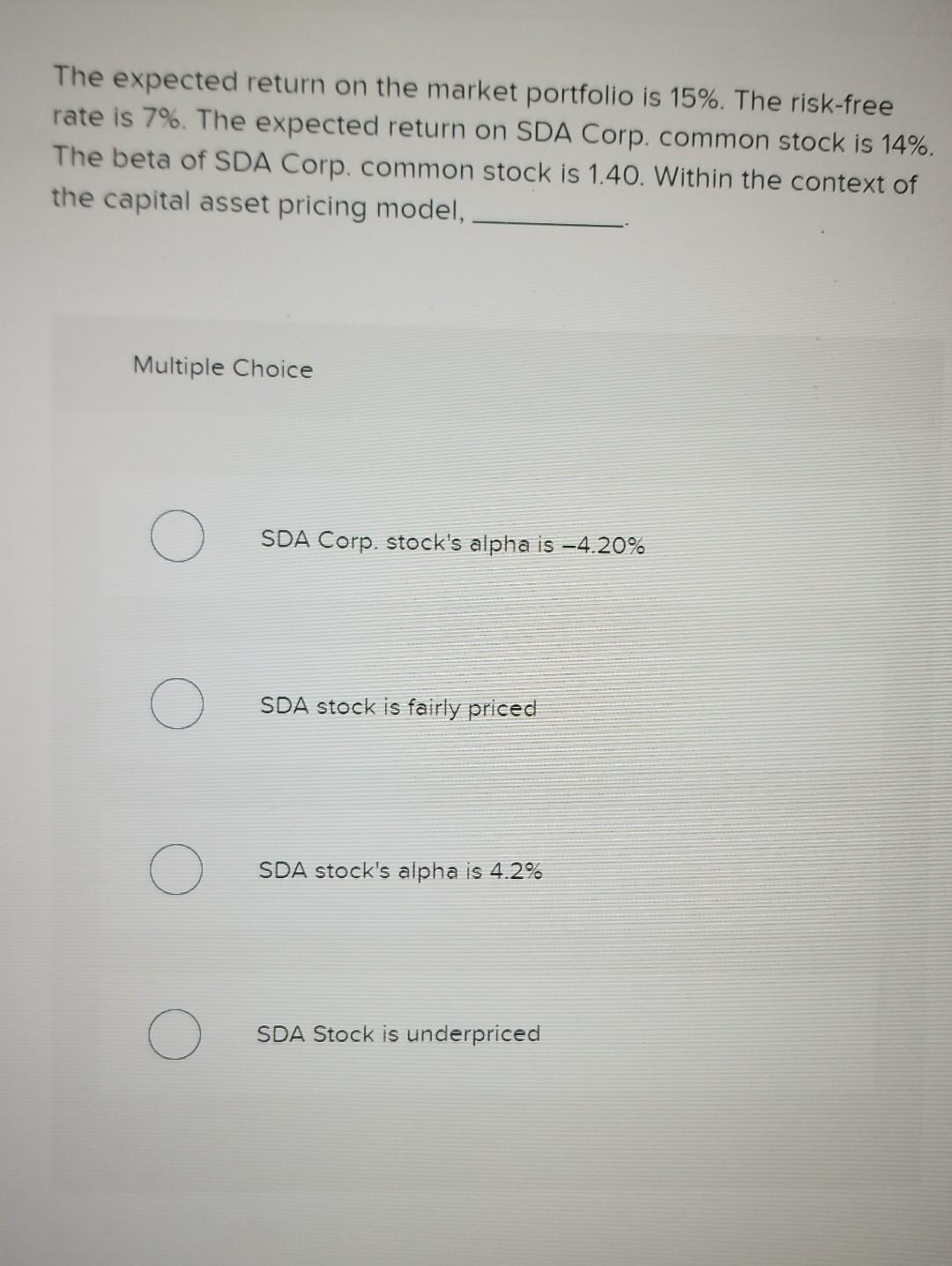

An investor who believes that markets are efficient should follow: Multiple Choice A stock picking strategy A market timing strategy ( ) An active management strategy A passive investment strategy A 30 year maturity, 8% coupon bond paying coupons semiannually is callable in five years at a call price of $1,100. The bond currently sells at a yield to maturity of 7% (3.5% per half year). What's the yield to call (annually)? Multiple Choice ( ) None of these choices ( ) 5% ( ) 8% 9% 6.736% The expected return on the market portfolio is 15%. The risk-free rate is 7%. The expected return on SDA Corp. common stock is 14%. The beta of SDA Corp. common stock is 1.40. Within the context of the capital asset pricing model, Multiple Choice SDA Corp. stock's alpha is -4.20% SDA stock is fairly priced SDA stock's alpha is 4.2% SDA Stock is underpriced

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started