Answered step by step

Verified Expert Solution

Question

1 Approved Answer

= 33,000 lakhs + + 42.50 = $ 70.588 Lakhs So, amount of exchange difference will be = = 70.588 lakhs US $x2.50 R 42.50

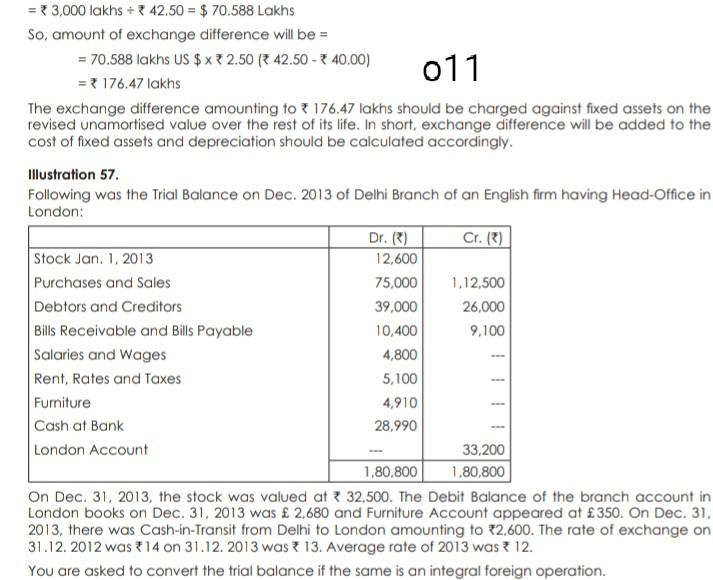

= 33,000 lakhs + + 42.50 = $ 70.588 Lakhs So, amount of exchange difference will be = = 70.588 lakhs US $x2.50 R 42.50 - 40.00) 011 = 3 176.47 lakhs The exchange difference amounting to 3 176.47 lakhs should be charged against fixed assets on the revised unamortised value over the rest of its life. In short, exchange difference will be added to the cost of fixed assets and depreciation should be calculated accordingly. Illustration 57. Following was the Trial Balance on Dec. 2013 of Delhi Branch of an English firm having Head-Office in London: Dr. () Cr. (3) Stock Jan. 1. 2013 12,600 Purchases and Sales 75,000 1.12,500 Debtors and Creditors 39,000 26,000 Bills Receivable and Bills Payable 10,400 9.100 Salaries and Wages 4,800 Rent, Rates and Taxes 5.100 Furniture 4,910 Cash at Bank 28,990 London Account 33,200 1,80.800 1,80,800 On Dec. 31, 2013, the stock was valued at 32,500. The Debit Balance of the branch account in London books on Dec. 31, 2013 was 2.680 and Furniture Account appeared at 350. On Dec. 31. 2013, there was Cash-in-Transit from Delhi to London amounting to 82,600. The rate of exchange on 31.12.2012 was 14 on 31.12.2013 was 13. Average rate of 2013 was? 12. You are asked to convert the trial balance if the same is an integral foreign operation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started