Question

338 g election, corporate taxation Union Investments Corporation acquires all the shares of Minnesota Technologies, Inc. for $100 million from Enterprise, Inc. At the transaction

338 g election, corporate taxation

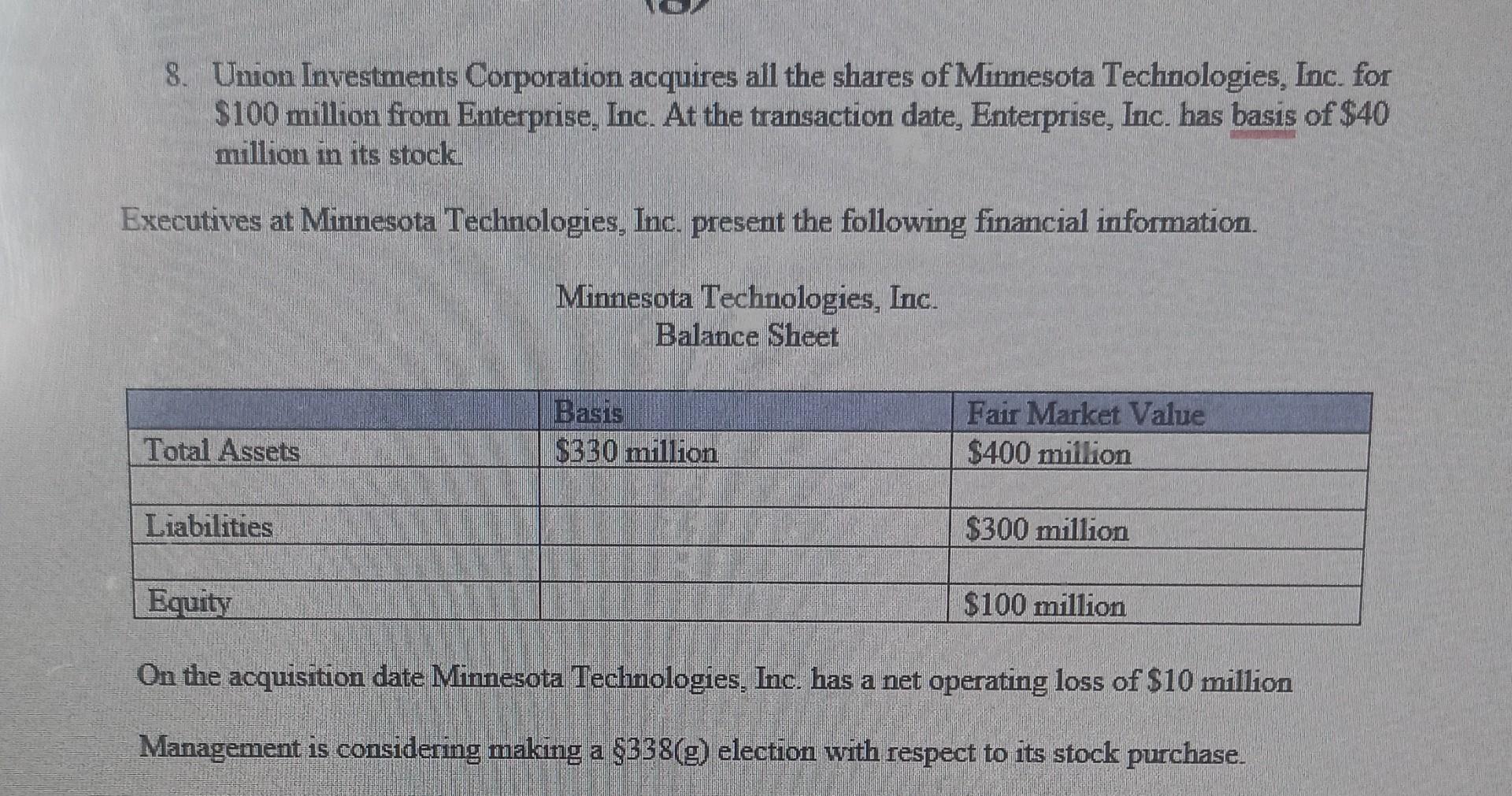

Union Investments Corporation acquires all the shares of Minnesota Technologies, Inc. for $100 million from Enterprise, Inc. At the transaction date, Enterprise, Inc. has basis of $40 million in its stock. Executives at Minnesota Technologies, Inc. present the following financial information.

Minnesota Technologies, Inc. Balance Sheet

Basis

Total Assets $330 million

Fair Market Value

Total Asset $400 million Liabilities $300 million Equity $100 million

On the acquisition date Minnesota Technologies, Inc. has a net operating loss of $10 million

Management is considering making a 338(g) election with respect to its stock purchase.

QUESTION

Determine the taxable income or gain to Enterprise, Inc. (Union Investment Corporation) from its stock sale and the 338(g) election filed by Minnesota Technologies, Inc.

8. Union Investments Corporation acquires all the shares of Minnesota Technologies, Inc. for $100 million from Enterprise, Inc. At the transaction date, Enterprise, Inc. has basis of $40 million in its stock. Executives at Minnesota Technologies, Inc. present the following financial information. Minnesota Technologies, Inc. Balance Sheet On the acquisition date Minnesota Technologies, Inc. has a net operating loss of $10 million Management is considering making a 338(g) election with respect to its stock purchaseStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started