Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PTER 20 COMPREHENSIVE ASSIGNMENT NOTE: Your solution should be submitted in Canvas. You may prepare your solution using Word, Excel, or a hand-written papter document

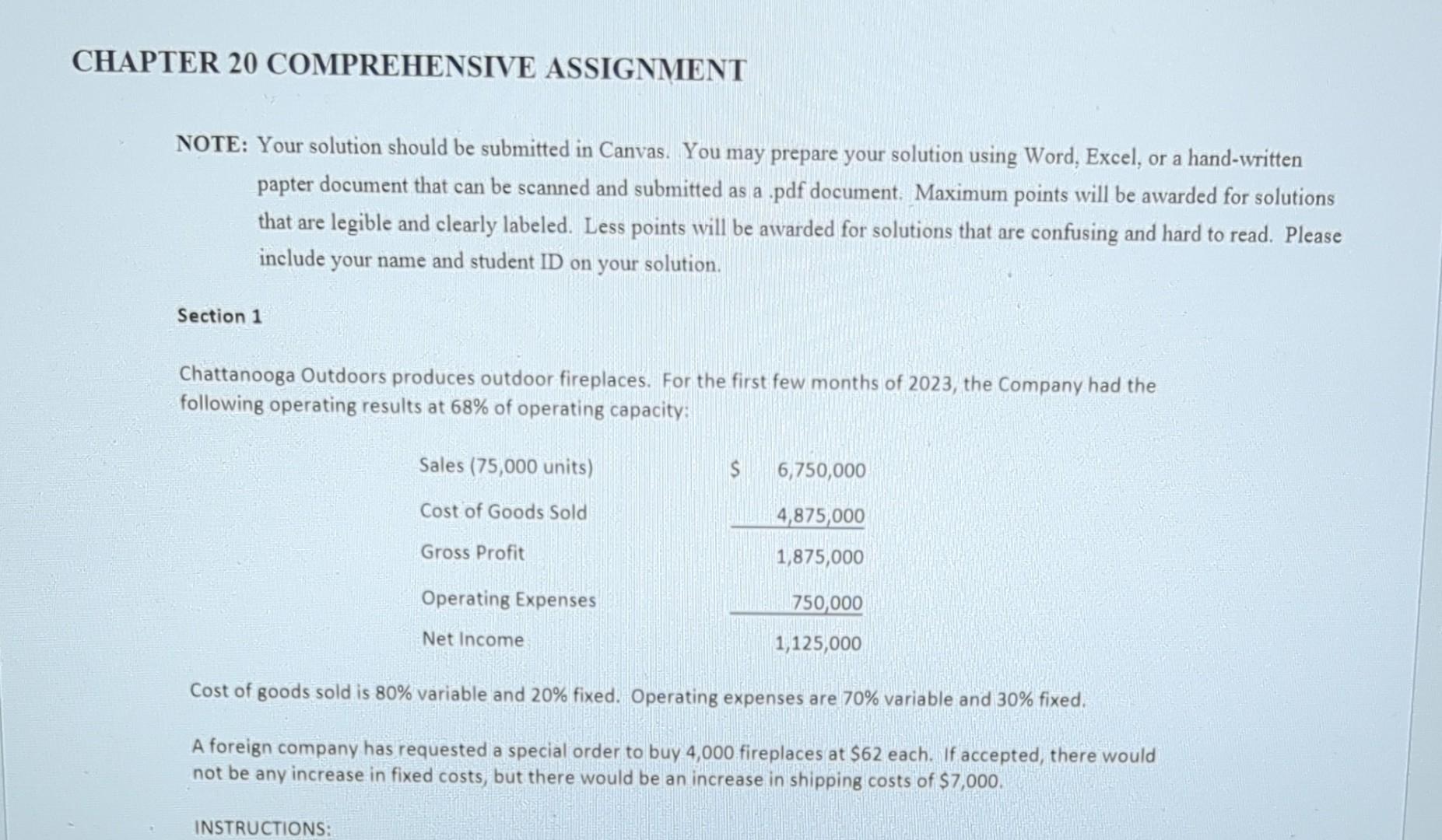

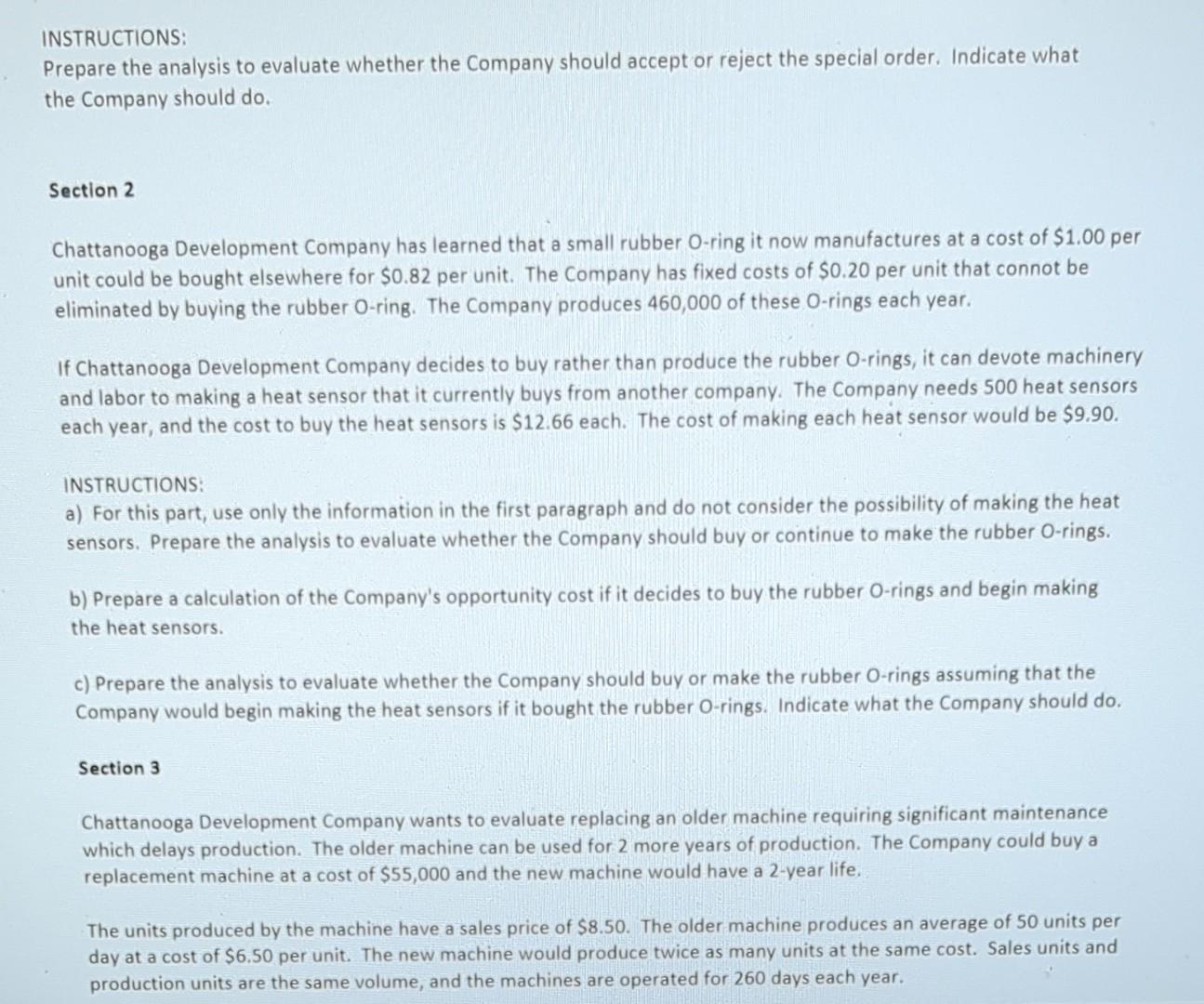

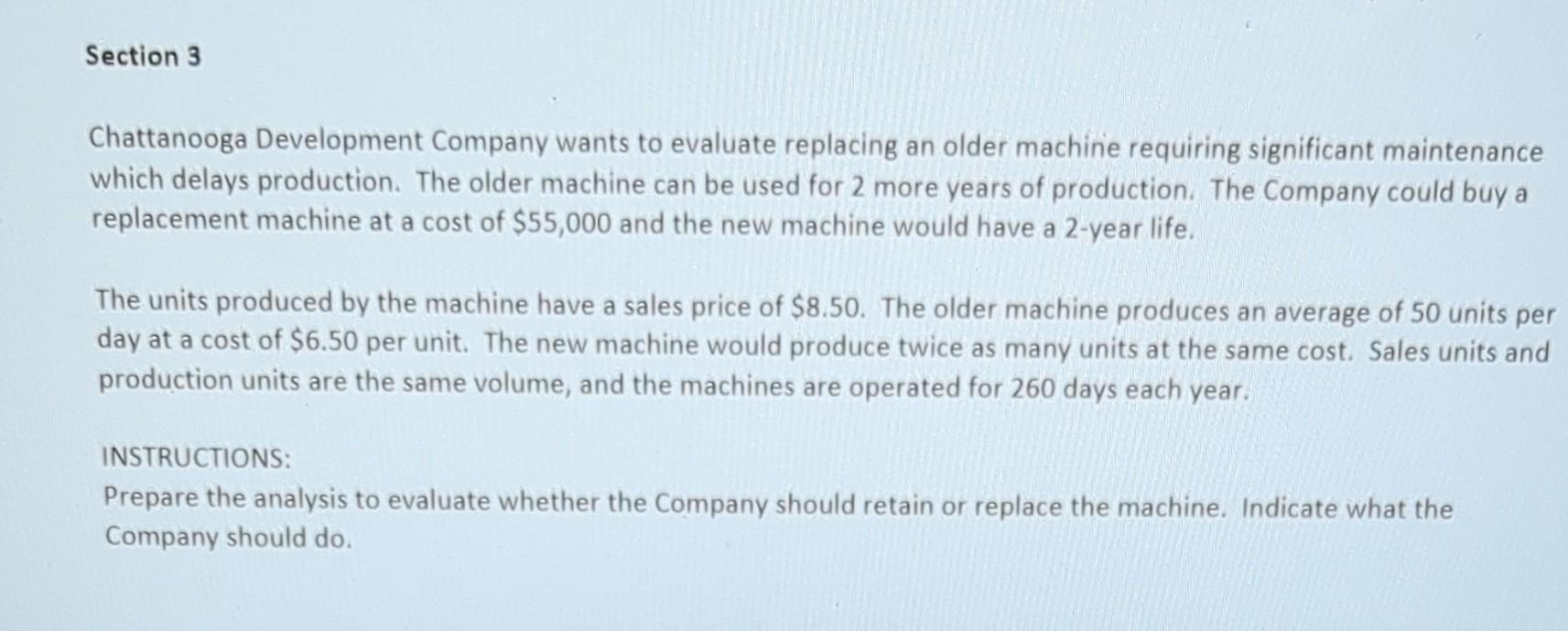

PTER 20 COMPREHENSIVE ASSIGNMENT NOTE: Your solution should be submitted in Canvas. You may prepare your solution using Word, Excel, or a hand-written papter document that can be scanned and submitted as a .pdf document. Maximum points will be awarded for solutions that are legible and clearly labeled. Less points will be awarded for solutions that are confusing and hard to read. Please include your name and student ID on your solution. Section 1 Chattanooga Outdoors produces outdoor fireplaces. For the first few months of 2023 , the Company had the following operating results at 68% of operating capacity: Cost of goods sold is 80% variable and 20% fixed. Operating expenses are 70% variable and 30% fixed. A foreign company has requested a special order to buy 4,000 fireplaces at $62 each. If accepted, there would not be any increase in fixed costs, but there would be an increase in shipping costs of $7,000. INSTRUCTIONS: Prepare the analysis to evaluate whether the Company should accept or reject the special order. Indicate what the Company should do. Section 2 Chattanooga Development Company has learned that a small rubber 0ring it now manufactures at a cost of $1.00 per unit could be bought elsewhere for $0.82 per unit. The Company has fixed costs of $0.20 per unit that connot be eliminated by buying the rubber 0 -ring. The Company produces 460,000 of these 0 -rings each year. If Chattanooga Development Company decides to buy rather than produce the rubber O-rings, it can devote machinery and labor to making a heat sensor that it currently buys from another company. The Company needs 500 heat sensors each year, and the cost to buy the heat sensors is $12.66 each. The cost of making each heat sensor would be $9.90. INSTRUCTIONS: a) For this part, use only the information in the first paragraph and do not consider the possibility of making the heat sensors. Prepare the analysis to evaluate whether the Company should buy or continue to make the rubber O-rings. b) Prepare a calculation of the Company's opportunity cost if it decides to buy the rubber O-rings and begin making the heat sensors. c) Prepare the analysis to evaluate whether the Company should buy or make the rubber O-rings assuming that the Company would begin making the heat sensors if it bought the rubber O-rings. Indicate what the Company should do. Section 3 Chattanooga Development Company wants to evaluate replacing an older machine requiring significant maintenance which delays production. The older machine can be used for 2 more years of production. The Company could buy a replacement machine at a cost of $55,000 and the new machine would have a 2-year life. The units produced by the machine have a sales price of $8.50. The older machine produces an average of 50 units per day at a cost of $6.50 per unit. The new machine would produce twice as many units at the same cost. Sales units and production units are the same volume, and the machines are operated for 260 days each year. Chattanooga Development Company wants to evaluate replacing an older machine requiring significant maintenance which delays production. The older machine can be used for 2 more years of production. The Company could buy a replacement machine at a cost of $55,000 and the new machine would have a 2-year life. The units produced by the machine have a sales price of $8.50. The older machine produces an average of 50 units per day at a cost of $6.50 per unit. The new machine would produce twice as many units at the same cost. Sales units and production units are the same volume, and the machines are operated for 260 days each year. INSTRUCTIONS: Prepare the analysis to evaluate whether the Company should retain or replace the machine. Indicate what the Company should do

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started