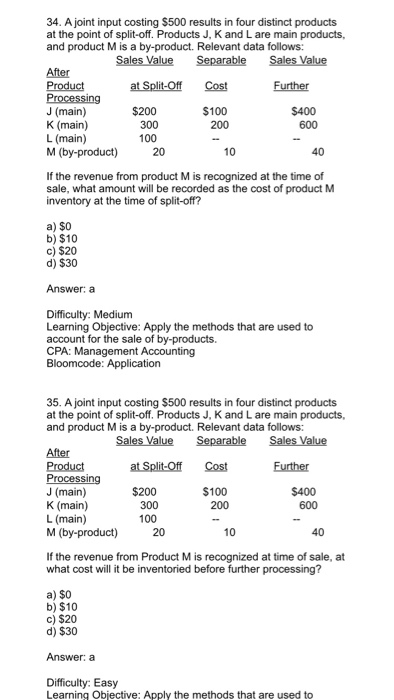

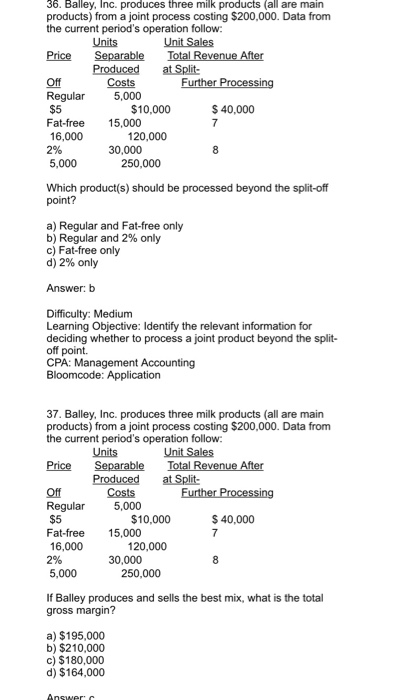

34. A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows: at Split-Off Cost J (main) K (main) L (main) M (by-product) $200 300 100 S100 200 $400 600 20 10 If the revenue from product M is recognized at the time of sale, what amount will be recorded as the cost of product M inventory at the time of split-off? a) $0 b) $10 c) $20 d) $30 Answer: a Difficulty: Medium Learning Objective: Apply the methods that are used to account for the sale of by-products. CPA: Management Accounting 35. A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows: at Split-Off Cost J (main) K (main) L (main) M (by-product) $200 300 100 $100 200 600 20 10 40 If the revenue from Product M is recognized at time of sale, at what cost will it be inventoried before further processing? a) $0 b) $10 c) $20 d) $30 Answer: a Difficulty: Easy Learning Objective: Apply the methods that are used to 34. A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows: at Split-Off Cost J (main) K (main) L (main) M (by-product) $200 300 100 S100 200 $400 600 20 10 If the revenue from product M is recognized at the time of sale, what amount will be recorded as the cost of product M inventory at the time of split-off? a) $0 b) $10 c) $20 d) $30 Answer: a Difficulty: Medium Learning Objective: Apply the methods that are used to account for the sale of by-products. CPA: Management Accounting 35. A joint input costing $500 results in four distinct products at the point of split-off. Products J, K and L are main products, and product M is a by-product. Relevant data follows: at Split-Off Cost J (main) K (main) L (main) M (by-product) $200 300 100 $100 200 600 20 10 40 If the revenue from Product M is recognized at time of sale, at what cost will it be inventoried before further processing? a) $0 b) $10 c) $20 d) $30 Answer: a Difficulty: Easy Learning Objective: Apply the methods that are used to