Question

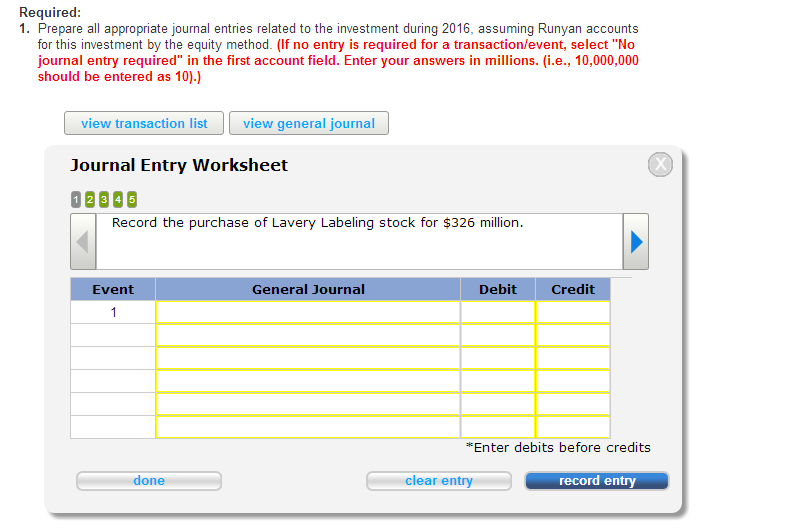

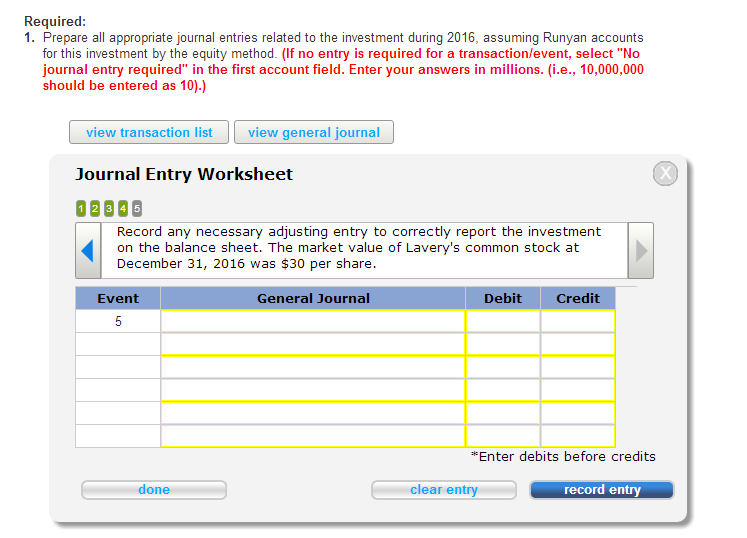

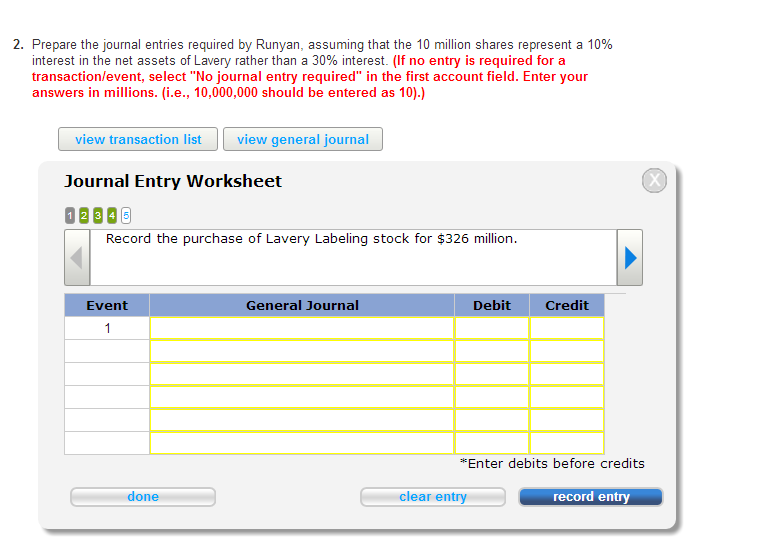

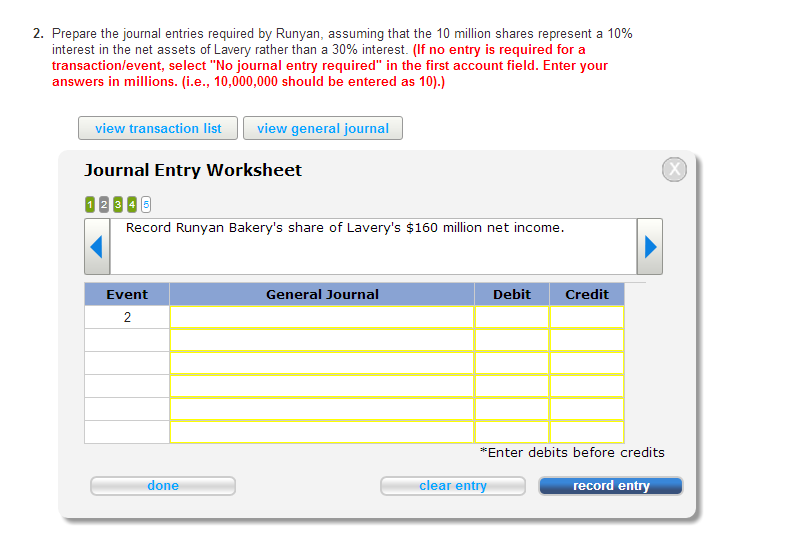

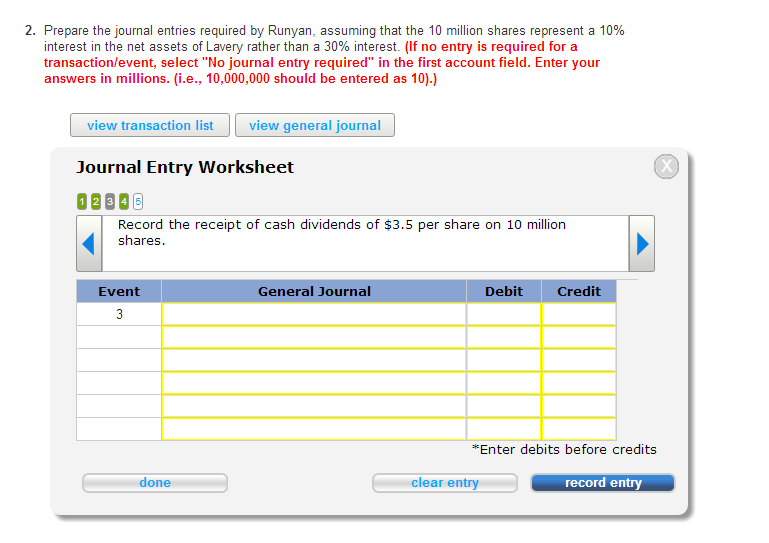

On January 4, 2016, Runyan Bakery paid $326 million for 10 million shares of Lavery Labeling Company common stock. The investment represents a 30% interest

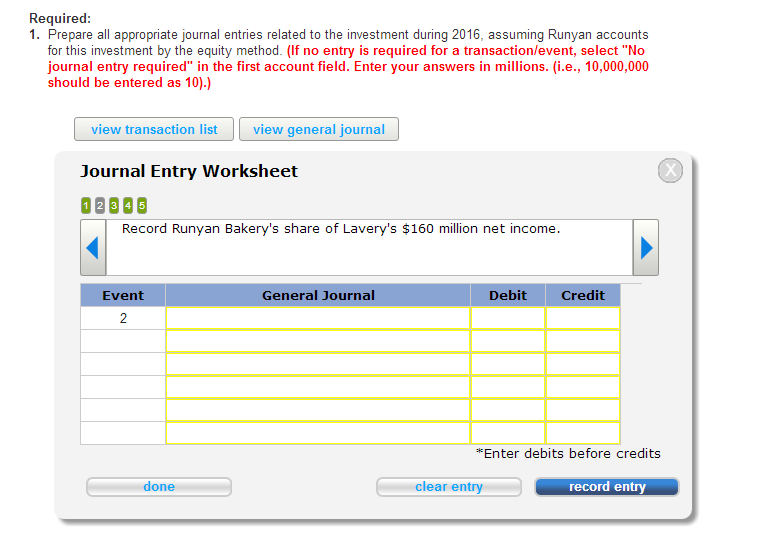

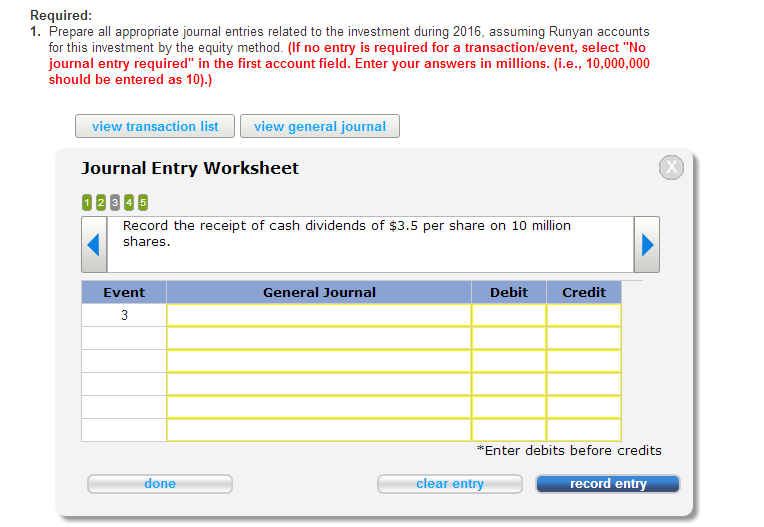

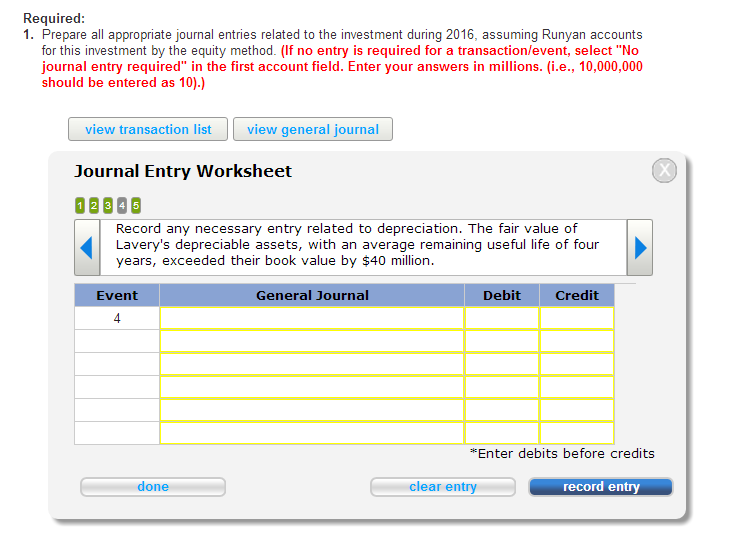

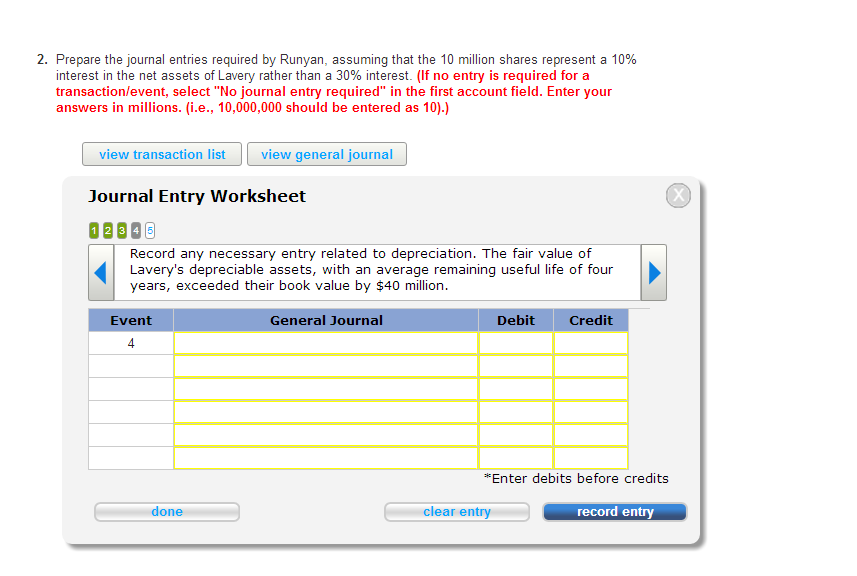

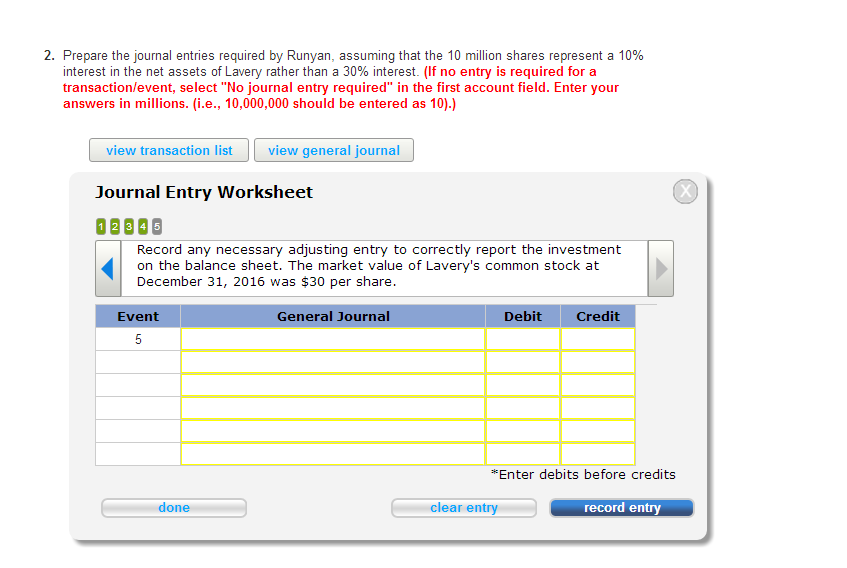

| On January 4, 2016, Runyan Bakery paid $326 million for 10 million shares of Lavery Labeling Company common stock. The investment represents a 30% interest in the net assets of Lavery and gave Runyan the ability to exercise significant influence over Lavery's operations. Runyan received dividends of $3.50 per share on December 15, 2016, and Lavery reported net income of $160 million for the year ended December 31, 2016. The market value of Lavery's common stock at December 31, 2016, was $30 per share. On the purchase date, the book value of Lavery's net assets was $810 million and: |

| a. | The fair value of Lavery's depreciable assets, with an average remaining useful life of four years, exceeded their book value by $40 million. | |||||||

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started