Answered step by step

Verified Expert Solution

Question

1 Approved Answer

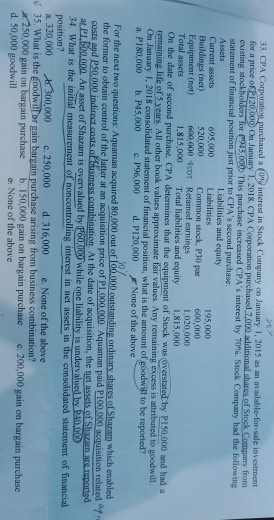

#34 and #35 33. CPA Corporation purchased a 0 interest in Stock Company on January 1, 2015 as an available for sale investment for a

#34 and #35

33. CPA Corporation purchased a 0 interest in Stock Company on January 1, 2015 as an available for sale investment for a price of P120.000 On January 1. 2018, CPA Corporation purchased 7.000 additional shares of Stock Company from existing stockholders for 45,00 This purchase increased CPA's interest by 70%. Stock Company had the following statement of financial position just prior to CPA's second purchase: Assets Liabilities and equity Curentassels 695.000 Liabilities 195,000 Buildings (net) 520,000 20,000 Common stock, P30 por 600.000 Equipment (net) 0401 Retained emings 1,020.000 Total assets 1,815,000 Total liabilities and equity 1,815,000 On the date of second purchase, CPA determines that the equipment of Stock was overstated by P150.000 and had a remaining life of 5 years. All other book values approximate fair values. Any remaining excess is attributed to goodwill On January 1, 2018 consolidated statement of financial position, what is the amount of goodwill to be reported? a P180,000 b P45,000 .P96,000 d. P120,000 None of the above For the next two questions: Aquaman acquired 80,000 out of 100.000 outstanding ordinary shares o Shazam which enabled the former to obtain control of the latter at an acquisition price of P1.000.000. Aquaman paid P100,000 acquisition related costs and 50.000 indirect costs of business.combination. At the date of acquisition, the net assets of Sharmatport at P1.000.000 An asset of Shazam is overvalued by P60000 while one liability is undervalued by 40.000 34. What is the initial measurement of noncontrolling interest in net assets in the consolidated statement of financial position? a. 320,000 $300,000 250,000 d. 316,000 e. None of the above 35. What is the goodwill or gain bargain purchase arising from business combination 250,000 gain on bargain purchase b. 150,000 gain on bargain purchase c. 200,000 gain on bargain purchase d. 50,000 goodwill : None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started