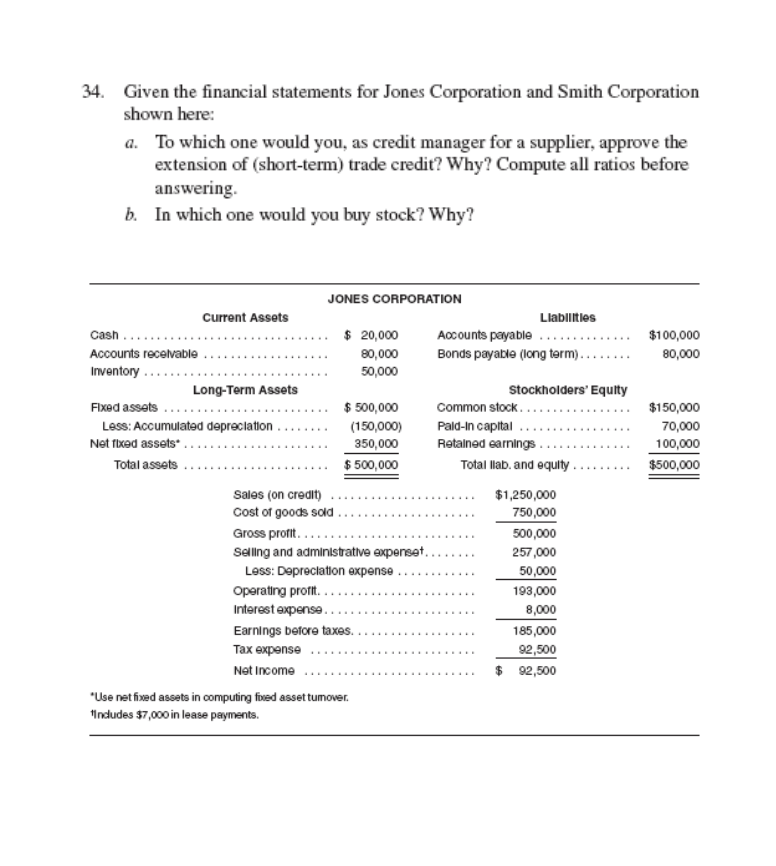

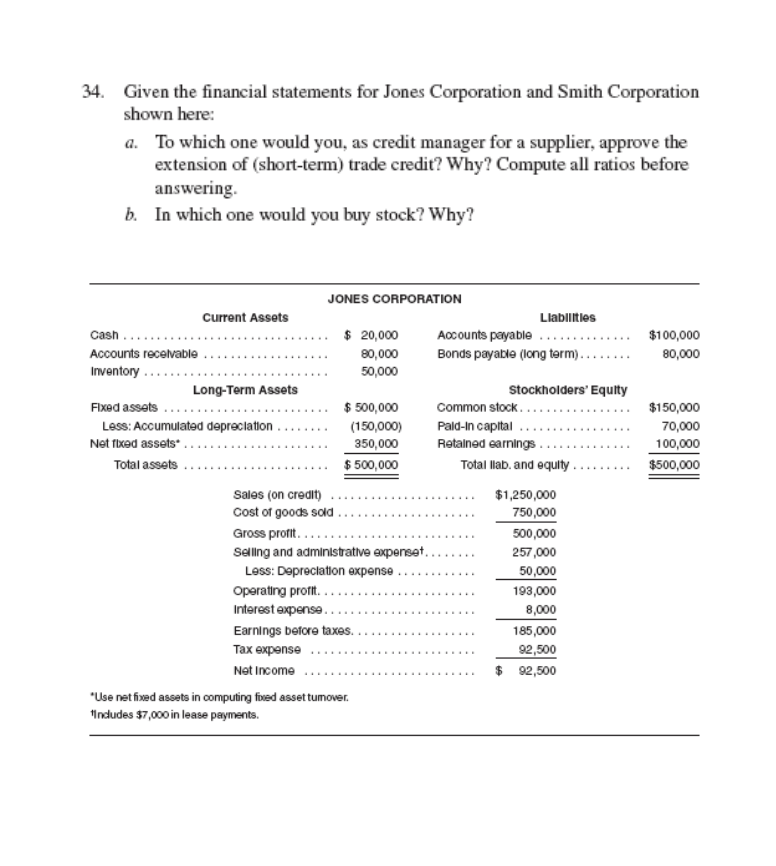

34. Given the financial statements for Jones Corporation and Smith Corporation shown here: a. To which one would you, as credit manager for a supplier, approve the extension of (short-term) trade credit? Why? Compute all ratios before answering b. In which one would you buy stock? Why? $100,000 80,000 $150,000 70,000 100,000 $500,000 JONES CORPORATION Current Assets Llabilities Cash $ 20,000 Accounts payable Accounts receivable 80,000 Bonds payable (long term). Inventory 50,000 Long-Term Assets Stockholders' Equity Fixed assets $ 500,000 Common stock.. Less: Accumulated depreciation (150,000) Pald-in capital Net fixed assets 350,000 Retained earnings Total assets $500,000 Total lab. and equity Sales (on credit) $1,250,000 Cost of goods sold 750,000 Gross profit 500,000 Selling and administrative expenset.. 257,000 Less: Depreciation expense 50,000 Operating profit... 193,000 Interest expense. 8,000 Earnings before taxes. 185,000 Tax expense 92,500 Net Income $ 92,500 *Use net fixed assets in computing fixed asset tumover. Indudes $7,000 in lease payments. 34. Given the financial statements for Jones Corporation and Smith Corporation shown here: a. To which one would you, as credit manager for a supplier, approve the extension of (short-term) trade credit? Why? Compute all ratios before answering b. In which one would you buy stock? Why? $100,000 80,000 $150,000 70,000 100,000 $500,000 JONES CORPORATION Current Assets Llabilities Cash $ 20,000 Accounts payable Accounts receivable 80,000 Bonds payable (long term). Inventory 50,000 Long-Term Assets Stockholders' Equity Fixed assets $ 500,000 Common stock.. Less: Accumulated depreciation (150,000) Pald-in capital Net fixed assets 350,000 Retained earnings Total assets $500,000 Total lab. and equity Sales (on credit) $1,250,000 Cost of goods sold 750,000 Gross profit 500,000 Selling and administrative expenset.. 257,000 Less: Depreciation expense 50,000 Operating profit... 193,000 Interest expense. 8,000 Earnings before taxes. 185,000 Tax expense 92,500 Net Income $ 92,500 *Use net fixed assets in computing fixed asset tumover. Indudes $7,000 in lease payments