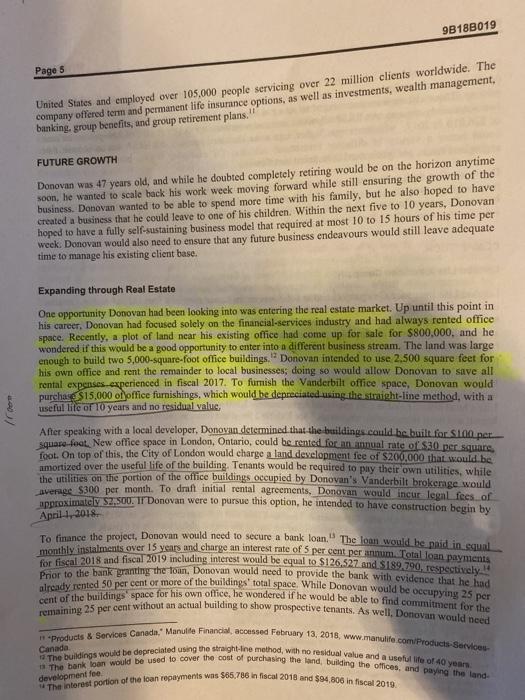

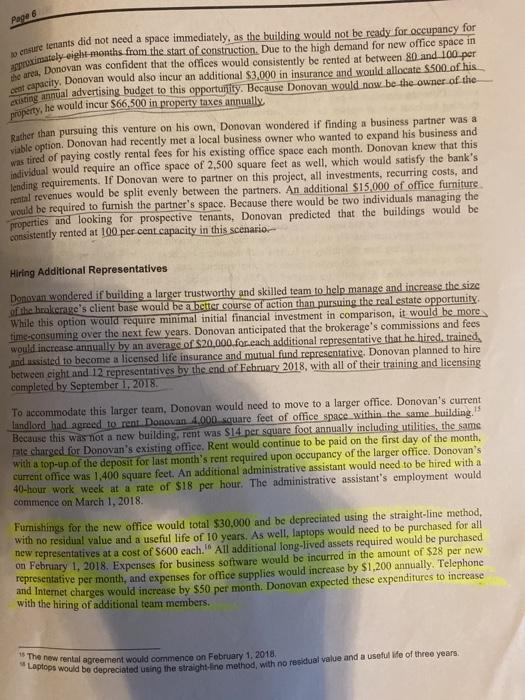

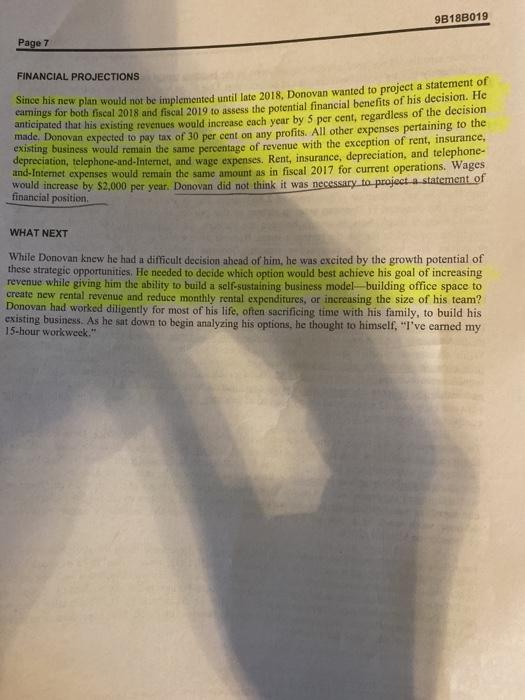

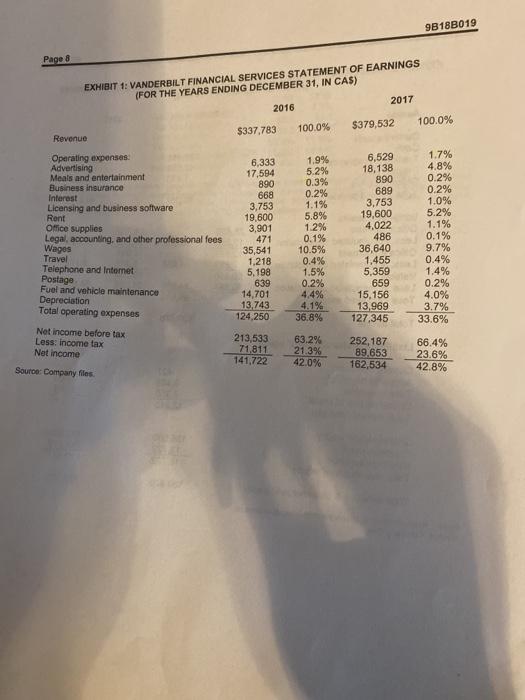

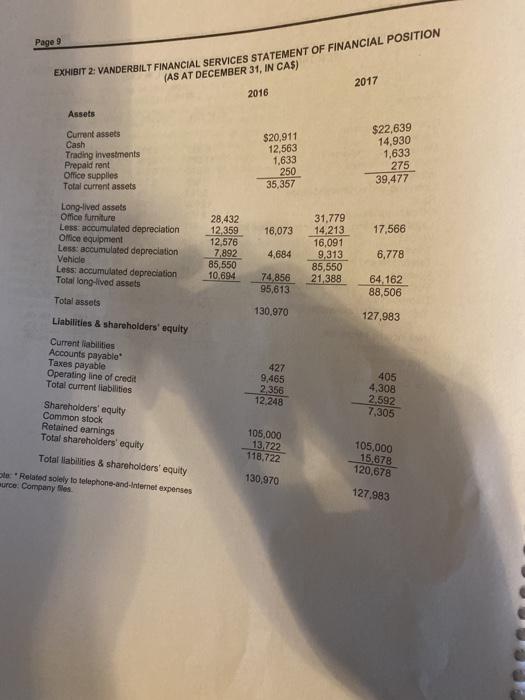

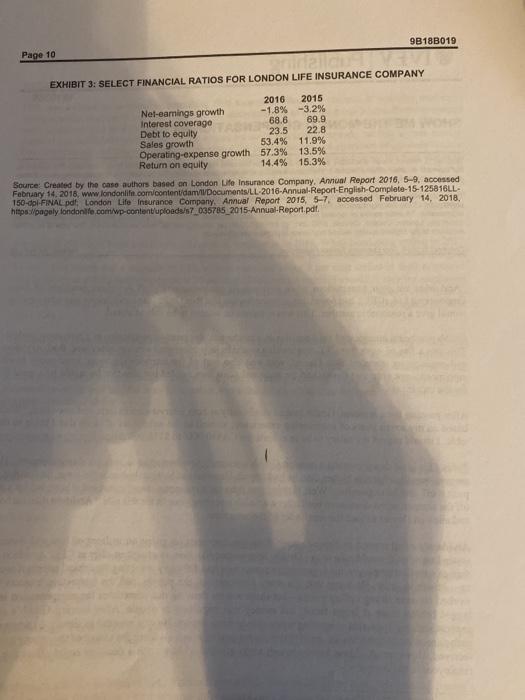

34 Standalone 2001 Ivey Publishing W1B727 VANDERBILT FINANCIAL SERVICES: ASSESSING FUTURE OPPORTUNITIES com ww ws Draw or con The din names and the proteconly De won the authors may have disguised The on my own moderne product is any form or by any meant without Per to competere mate colectie ding vay Business School Westom contra Cara Govers We www wscasos.com Version 2010-10-29 It was January 12, 2018, and Jeff Donovan, owner, branch manager, and sole shareholder of a Vanderbilt Financial Services (Vanderbilt brokerage in London, Ontario, had just finished reviewing his financials from the previous fiscal year (see Exhibits 1 and 2 Donovan had experienced one of his most profitable fiscal years to date, but he was concerned that he had not accomplished as much as he could with his current business strategy. Donovan had been looking into other opportunities to expand or diversity his existing business, and he wondered if now was the time to enter into real estate. To determine if this was a feasible option for the Vanderbilt brokerage, Donovan would need to complete an assessment of the financial services industry and Vanderbilt's past financial performance, as well as assess the future financial opportunities of his new plan FINANCIAL SERVICES INDUSTRY The financial-planning segment of the financial services industry employed financial advisors whose job was to provide investment, tax, and insurance advice. Financial advisors helped individuals and families maximize their financial assets through a variety of different products, including, but not limited to, mutual funds, life insurance, retirement plans, and education savings plans. A mutual fund was an investment vehicle made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, boods, and money market instruments. These types of funds were managed by a professional and allowed the owners to share in profits through dividends, interest, or investment appreciation. Retirement plans helped individuals plan for a regular income once they had ccased employment. Education plans helped individuals save for their child's post-secondary education Life insurance required policyholders to make regular payments (monthly or annually) to an insurance company so that in the case of their death, their dependents would be protected against the loss of the policyholder's income. Policyholders would name a beneficiary who, after the policyholder's death, would receive the proceeds agreed upon at the inception of the life insurance policy. Insurance companies offered two broad types of insurance products: term insurance and permanent insurance. Term insurance A brokerage is a financial institution that facts the buying and selling of francial securities between a buyer and a seller Mutual Fund Definition, Investopedia, accessed February 13, 2018, www investopedia conterms mmutustundasp. 9B18B019 Sostegy and Policy Cone Studies 2001 Page 3 A Vanderbilt clione's goals always came first. Prior to recommending any type of insurance or investment chicle, agents of Vanderbilt were required to complete an analysis of the client's financial needs. This analysis would help to determine the types of products most beneficial to the client by looking at the client's need for debt solutions, retirement income, education funding, and income protection. Each client had different financial needs that were best determined using a holistic approach. Vanderbilt was a member of the Mutual Fund Dealers Association of Canada (MFDA), a national self- regulatory organization for the distribution side of the Canadian mutual fund industry. The MFDA was established in 1998 to improve investor protection and increase public confidence in the Canadian mutual found industry by regulating the operations, standards of practice, and business conducts of its members and their representatives. Donovan started with Vanderbilt in 1991, and by 1992, he had become a provincially licensed life insurance agent. By 1993, Donovan had become licensed to sell mutual funds, allowing him to offer his clients additional financial services. Enger so become his own boss, Donovan completed the provincial licensing required to become a branch manager and opened his own Vanderbilt financial services brokerage in 1994 Since then, Donovan had opened seven additional brokerages in Ontario, which were operated by Vanderbilt representatives that he had personally hired and trained. In addition to revenue camed through his main brokerage, Donovan earned a portion of all revenue cared at these seven brokerages. In 2003, Vanderbilt began expanding to the United Kingdom, with plans to continue expanding to Europe. Donovan was selected as one of the company's founders and opened two offices in Basingstoke between 2003 and 2007. Basingstoke was a town in England approximately 87 kilometres from the country's capital, London Until Donovan's return from England in late 2007, Donovan's wife, Teresa, managed the business in London, Ontario CONSUMERS Financial advisors helped clients maximize their financial assets while looking for ways to mitigate their financial risks. Typically, Vanderbilt helped clients minimize the financial risks associated with dying too soon or living too long. Donovan categorized these consumers into two groups: young clients with many financial responsibilities and older, more established clients with fewer financial responsibilities. For providing protection against the financial risk of dying too soon, purchasing life insurance was often the solution. Typically, life insurance was a temporary need for younger clients who had many financial responsibilities, such as mortgages and children. These individuals wanted to ensure that their death would not leave their dependents in a position of financial hardship. While these clients were young and less established, Donovan would always recommend that they plan for retirement as early as possible, retire with, getting people thinking about retirement early in their career was something Donovan was investing as little as CA $25 per month. While this would never accumulate to a sufficient amount to ndamant about. Since term life insurance was the only life insurance product Vanderbilt offered, it allowed these individuals to experience Towerave cilsurance premiums compared to the permanent the loss of their life insurance coverage. premiums, which resulted in higher retums on their savings and access to their funds, il necessary. Page 4 Once Donovan addressed his client's life insurance needs, the relationship began to focus more on preparing the client for retirement. As Donovan's clients aged, retirement preparation became more of a priority. These clients were encouraged to set up a Registered Retirement Savings Plan (RRSP), if they had not already done so. An RRSP allowed clients to contribute up to 18 per cent of their pre-tax income or $26.010 in 2017.' whichever was higher into a tax-sheltered account. An RRSP was an account that could hoose variety of different investment vehicles for example, stocks, bonds, mutual funds, segregated funds, and guaranteed investment certificates Donovan often dealt with clients on the verge of retirement who were unsure of how to proceed once they received their pension. Donovan would help ensure these clients maximized their employer pensions by helping them plan the best withdrawal schedule to minimize tax consequences and invest the remainder in vehicles that would allow for continued growth. COMPETITION London Life Insurance Company London Life Insurance Company (London Life) was an insurance company founded in London, Ontario, in 1874. In 1997, the company was acquired by the Great-West Life Assurance Company (Great-West), but it continued as a separate subsidiary, with its head office remaining in London. London Life offered several different types of financial products, such as individual insurance, wealth management, group benefits, group retirement, savings, and income replacement. London Life offered both term and permanent life insurance In April 2017. Great-West announced that 13 per cent of its total workforce, representing 1.500 employees, would be laid off in an effort to save costs. Or these positions, approximately 430 would be from London Life's head office. London Life employed approximately 3,300 individuals and represented one of London's largest and most recognizable employers." See Exhibit 3 for select financial ratios of London Life. Stevenson & Hunt Insurance Brokers Limited Stevenson & Hunt Insurance Brokers Limited (Stevenson & Hunt) was a brokerage-consulting firm founded in 1935. The company's head office was also in London, Ontario, and the firm had branch offices throughout the province of Ontario. It offered clients insurance and risk-management services including commercial insurance, personal insurance, group-benefit consulting, group-pension consulting, and financial services. Throughout Ontario, Stevenson & Hunt had over 180 full-time employees. In 2015, the company became part of Arthur J. Gallagher Canada Limited, one of the largest global brokers in Canada. Manulife Financial Manulife Financial was founded in Canada in 1887, with Canada's first prime minister, Sir John A. Macdonald, serving as the company's first president. The company operated in Canada, Asia, and the Government of Canada, "MP. DB, RRSP. and TFSA Limits and the YMPE, Canada.ca, December 21, 2018. accessed February 13, 2018, www.canada.ca/en/revenue-agency/services aregistered-plane-administrators/pspa/mp-trap-dpap-tsa limits-ympe.html individual Insurance, London Life, accessed February 13, 2018 www.londonlife.com our products Individual-insurance html Mark Daniszewski, "Great-West Life Cutting 13% of Workforce, about 1,500 Jobsincluding at London Life, The London Free Press. April 25, 2017 accessed February 13, 2018 www.press.com/2017/04/25/great west-to-cutting-13-of- Stevenson & Hunt. About Us Arthur J Gallagher Canada Limited, accolsed February 13, 2018, www.sthunt.com/about.un 9B18B019 Page 5 United States and employed over 105.000 people servicing over 22 million clients worldwide. The company offered term and permanent life insurance options, as well as investments, wealth management, banking, group benefits, and group retirement plans." FUTURE GROWTH Donovan was 47 years old, and while he doubted completely retiring would be on the horizon anytime soon, he wanted to scale back his work week moving forward while still ensuring the growth of the business. Donovan wanted to be able to spend more time with his family, but he also hoped to have created a business that he could leave to one of his children. Within the next five to 10 years, Donovan hoped to have a fully self-sustaining business model that required at most 10 to 15 hours of his time per week. Donovan would also need to ensure that any future business endeavours would still leave adequate time to manage his existing client base. Expanding through Real Estate One opportunity Donovan had been looking into was entering the real estate market. Up until this point in his career. Donovan had focused solely on the financial services industry and had always rented office space. Recently, a plot of land near his existing office had come up for sale for $800,000, and he wondered if this would be a good opportunity to enter into a different business stream. The land was large enough to build two 5,000-square-foot office buildings. Donovan intended to use 2.500 square feet for his own office and rent the remainder to local businesses; doing so would allow Donovan to save all rental expenses experienced in fiscal 2017. To furnish the Vanderbilt office space, Donovan would purchase $15,000 of office furnishings, which would be depreciated using the straight-line method, with a useful life of 10 years and no residual value After speaking with a local developer. Donovan determined that the buildings could be built for S100 per square foot. New office space in London, Ontario, could be rented for an anual rate of S30 per square foot. On top of this, the City of London would charge a land development fee of $200.000 that would be amortized over the useful life of the building. Tenants would be required to pay their own utilities, while the utilities on the portion of the office buildings occupied by Donovan's Vanderbilt brokerage would average $300 per month. To draft initial rental agreements, Donovan would incur legal fees of approximately $2,500. Ir Donovan were to pursue this option, he intended to have construction begin by April 1, 2018 To finance the project, Donovan would need to secure a bank loan." The loan would be paid in con monthly instalments over 15 years and charge an interest rate of super cent per annum Total loan payments for fiscal 2018 and fiscal 2019 including interest would be equal to $126.527 and $189.790, respectively Prior to the bank granting the foun, Donovan would need to provide the bank with evidence that he had cent of the buildings Space for his own office, he wondered if he would be able to find commitment for the already sented 50 per cent or more of the buildings total space. While Donovan would be occupying 25 per remaining 25 per cent without an actual building to show prospective tenants. As well, Donovan would need 1 Products & Services Canada," Manulle Financial, accessed February 13, 2018, www.manulife com/Products Services The buildings would be depreciated using the straight-line method, with no residual value and a useful le of 40 year 1 The bank loan would be used to cover the cost of purchasing the land, building the offices, and paying the land The interest portion of the loan repayments was $65.786 in fiscal 2018 and $94 806 in fiscal 2019 Canada for Page 6 o essere tenants did not need a space immediately, as the building would not be ready for occupancy for ainarely eighi-months from the start of construction. Due to the high demand for new office space in area, Donovan was confident that the offices would consistently be rented at between 80 and 100 per et capacity. Donovan would also incur an additional $3.000 in insurance and would allocate $500 of his esting annual advertising budget to this opportunity. Because Donovan would now be the owner of the property, he would incur S66,500 in property taxes annually Rather than pursuing this venture on his own, Donovan wondered if finding a business partner was a vuble option. Donovan had recently met a local business owner who wanted to expand his business and was tired of paying costly rental fees for his existing office space each month. Donovan know that this dividual would require an office space of 2,500 square feet as well, which would satisfy the bank's Jending requirements. If Donovan were to partner on this project, all investments, recurring costs, and rental revenues would be split evenly between the partners. An additional $15,000 of office furniture would be required to furnish the partner's space. Because there would be two individuals managing the properties and looking for prospective tenants, Donovan predicted that the buildings would be consistently rented at 100 per cent capacity in this scenario. Hiring Additional Representatives Donovan wondered if building a larger trustworthy and skilled team to help manage and increase the size of the brokerage's client base would be a better course of action than pursuing the real estate opportunity While this option would require minimal initial financial investment in comparison, it would be more time-consuming over the next few years. Donovan anticipated that the brokerage's commissions and fees would increase annually by an average of $20,000.for.cach additional representative that he hired, trained, and assisted to become a licensed life insurance and mutual fund representative, Donovan planned to hire between eight and 12 representatives by the end of February 2018, with all of their training and licensing completed by September 1, 2018 To accommodate this larger team, Donovan would need to move to a larger office. Donovan's current landlord had agreed to rent Donovan 4,000 square feet of office space within the same buildings Because this was not a new building, rent was $14.per square foot annually including utilities, the same rate charged for Donovan's existing office, Rent would continue to be paid on the first day of the month, with a top-up of the deposit for last month's rent required upon occupancy of the larger office. Donovan's current office was 1,400 square feet. An additional administrative assistant would need to be hired with a 40-hour work week at a rate of $18 per hour. The administrative assistant's employment would commence on March 1, 2018. Furnishings for the new office would total $30,000 and be depreciated using the straight-line method, with no residual value and a useful life of 10 years. As well, laptops would need to be purchased for all new representatives at a cost of $600 each. All additional long-lived assets required would be purchased on February 1, 2018. Expenses for business software would be incurred in the amount of $28 per new representative per month, and expenses for office supplies would increase by $1,200 annually. Telephone and Internet charges would increase by $50 per month. Donovan expected these expenditures to increase with the hiring of additional team members. new agreement would February 1, 2018 * Laptops would be depreciated with commence on Febrero 2014 no residual value and a useful lite of three years. 9B18B019 Page 7 FINANCIAL PROJECTIONS Since his new plan would not be implemented until late 2018, Donovan wanted to project a statement of camings for both fiscal 2018 and fiscal 2019 to assess the potential financial benefits of his decision. He made. Donovan expected to pay tax of 30 per cent on any profits. All other expenses pertaining to the anticipated that his existing revenues would increase each year by 5 per cent, regardless of the decision existing business would remain the same percentage of revenue with the exception of rent, insurance, depreciation, telephone-and-Internet, and wage expenses. Rent, insurance, depreciation, and telephone- and Internet expenses would remain the same amount as in fiscal 2017 for current operations. Wages would increase by $2,000 per year. Donovan did not think it was necessary to project a statement of financial position WHAT NEXT While Donovan knew he had a difficult decision ahead of him, he was excited by the growth potential of these strategic opportunities. He needed to decide which option would best achieve his goal of increasing revenue while giving him the ability to build a self-sustaining business model-building office space to create new rental revenue and reduce monthly rental expenditures, or increasing the size of his team? Donovan had worked diligently for most of his life, often sacrificing time with his family, to build his existing business. As he sat down to begin analyzing his options, he thought to himself, "I've earned my 15-hour workweek." 9818B019 Page 8 EXHIBIT 1: VANDERBILT FINANCIAL SERVICES STATEMENT OF EARNINGS (FOR THE YEARS ENDING DECEMBER 31, IN CAS) 2017 2016 $379,532 100.0% $337,783 100.0% Revenue Operating expenses: Advertising Meals and entertainment Business Insurance Interest Licensing and business software Ront Office supplies Legal accounting, and other professional fees Wagos Travel Telephone and Internet Postage Fuel and vehicle maintenance Depreciation Total operating expenses Net income before tax Less: income tax Not income 6,333 17,594 890 668 3,753 19,600 3,901 471 35,541 1.218 5,198 639 14,701 13,743 124,250 1.9% 5.2% 0.3% 0.2% 1.1% 5.8% 12% 0.1% 10.5% 0.4% 1.5% 0.2% 4.4% 4.1% 36.8% 6,529 18,138 890 689 3,753 19,600 4,022 486 36,640 1,455 5.359 659 15.156 13,969 127,345 1.7% 4.8% 0.2% 0.2% 1.0% 5.2% 1.1% 0.1% 9.7% 0.4% 1.4% 0.2% 4.0% 3.7% 33.6% 213,533 71 811 141,722 63.2% 213% 42,0% 252,187 89,653 162,534 66.4% 23.6% 42.8% Source: Company files Page 9 EXHIBIT 2: VANDERBILT FINANCIAL SERVICES STATEMENT OF FINANCIAL POSITION (AS AT DECEMBER 31, IN CAS) 2017 2016 Assets Current assets Cash Trading investments Prepaid rent Orice supplies Total current assets $20,911 12,563 1,633 250 35,357 $22,639 14,930 1,633 275 39.477 16,073 17,566 Long-lived assets Office furniture Less: accumulated depreciation Omice equipment Less accumulated depreciation Vehicle Less: accumulated depreciation Total long-lived assets Total assets 28,432 12,359 12,576 7,892 85,550 10,694 4,684 31,779 14,213 16,091 9,313 85,550 21,388 6,778 74,856 95,613 64,162 88,506 130,970 127,983 Liabilities & shareholders' equity Current abilities Accounts payable Taxes payable Operating line of credit Total current liabilities 427 9,465 2356 12 248 405 4,308 2.592 7.305 Shareholders' equity Common stock Retained earnings Total shareholders' equity Total liabilities & shareholders' equity Related solely to telephone-and-Internet expenses aurce Companyes 105,000 13.722 118,722 105,000 15,678 120,678 130,970 127,983 9B18B019 Page 10 EXHIBIT 3: SELECT FINANCIAL RATIOS FOR LONDON LIFE INSURANCE COMPANY 2016 2015 Nel-eamings growth -1.8% -3.2% Interest coverage 68.6 69.9 Debt to equity 23.5 22.8 Sales growth 53,4% 11.9% Operating-expense growth 57.3% 13.5% Return on equity 14.4% 15.3% Source: Created by the case authors based on London Life Insurance Company, Annual Report 2016, 5-9, accessed February 14, 2018, www.londonlife.com/content/dam/Documents LL-2016-Annual Report-English-Complate-15-125816LL- 150-do-FINAL pdf London Life Insurance Company Annual Report 2015, 5-7 accessed February 14, 2018 https/pagely londoni fe.com/wp-content/uploads7 035785_2015 Annual Report.pdf 34 Standalone 2001 Ivey Publishing W1B727 VANDERBILT FINANCIAL SERVICES: ASSESSING FUTURE OPPORTUNITIES com ww ws Draw or con The din names and the proteconly De won the authors may have disguised The on my own moderne product is any form or by any meant without Per to competere mate colectie ding vay Business School Westom contra Cara Govers We www wscasos.com Version 2010-10-29 It was January 12, 2018, and Jeff Donovan, owner, branch manager, and sole shareholder of a Vanderbilt Financial Services (Vanderbilt brokerage in London, Ontario, had just finished reviewing his financials from the previous fiscal year (see Exhibits 1 and 2 Donovan had experienced one of his most profitable fiscal years to date, but he was concerned that he had not accomplished as much as he could with his current business strategy. Donovan had been looking into other opportunities to expand or diversity his existing business, and he wondered if now was the time to enter into real estate. To determine if this was a feasible option for the Vanderbilt brokerage, Donovan would need to complete an assessment of the financial services industry and Vanderbilt's past financial performance, as well as assess the future financial opportunities of his new plan FINANCIAL SERVICES INDUSTRY The financial-planning segment of the financial services industry employed financial advisors whose job was to provide investment, tax, and insurance advice. Financial advisors helped individuals and families maximize their financial assets through a variety of different products, including, but not limited to, mutual funds, life insurance, retirement plans, and education savings plans. A mutual fund was an investment vehicle made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, boods, and money market instruments. These types of funds were managed by a professional and allowed the owners to share in profits through dividends, interest, or investment appreciation. Retirement plans helped individuals plan for a regular income once they had ccased employment. Education plans helped individuals save for their child's post-secondary education Life insurance required policyholders to make regular payments (monthly or annually) to an insurance company so that in the case of their death, their dependents would be protected against the loss of the policyholder's income. Policyholders would name a beneficiary who, after the policyholder's death, would receive the proceeds agreed upon at the inception of the life insurance policy. Insurance companies offered two broad types of insurance products: term insurance and permanent insurance. Term insurance A brokerage is a financial institution that facts the buying and selling of francial securities between a buyer and a seller Mutual Fund Definition, Investopedia, accessed February 13, 2018, www investopedia conterms mmutustundasp. 9B18B019 Sostegy and Policy Cone Studies 2001 Page 3 A Vanderbilt clione's goals always came first. Prior to recommending any type of insurance or investment chicle, agents of Vanderbilt were required to complete an analysis of the client's financial needs. This analysis would help to determine the types of products most beneficial to the client by looking at the client's need for debt solutions, retirement income, education funding, and income protection. Each client had different financial needs that were best determined using a holistic approach. Vanderbilt was a member of the Mutual Fund Dealers Association of Canada (MFDA), a national self- regulatory organization for the distribution side of the Canadian mutual fund industry. The MFDA was established in 1998 to improve investor protection and increase public confidence in the Canadian mutual found industry by regulating the operations, standards of practice, and business conducts of its members and their representatives. Donovan started with Vanderbilt in 1991, and by 1992, he had become a provincially licensed life insurance agent. By 1993, Donovan had become licensed to sell mutual funds, allowing him to offer his clients additional financial services. Enger so become his own boss, Donovan completed the provincial licensing required to become a branch manager and opened his own Vanderbilt financial services brokerage in 1994 Since then, Donovan had opened seven additional brokerages in Ontario, which were operated by Vanderbilt representatives that he had personally hired and trained. In addition to revenue camed through his main brokerage, Donovan earned a portion of all revenue cared at these seven brokerages. In 2003, Vanderbilt began expanding to the United Kingdom, with plans to continue expanding to Europe. Donovan was selected as one of the company's founders and opened two offices in Basingstoke between 2003 and 2007. Basingstoke was a town in England approximately 87 kilometres from the country's capital, London Until Donovan's return from England in late 2007, Donovan's wife, Teresa, managed the business in London, Ontario CONSUMERS Financial advisors helped clients maximize their financial assets while looking for ways to mitigate their financial risks. Typically, Vanderbilt helped clients minimize the financial risks associated with dying too soon or living too long. Donovan categorized these consumers into two groups: young clients with many financial responsibilities and older, more established clients with fewer financial responsibilities. For providing protection against the financial risk of dying too soon, purchasing life insurance was often the solution. Typically, life insurance was a temporary need for younger clients who had many financial responsibilities, such as mortgages and children. These individuals wanted to ensure that their death would not leave their dependents in a position of financial hardship. While these clients were young and less established, Donovan would always recommend that they plan for retirement as early as possible, retire with, getting people thinking about retirement early in their career was something Donovan was investing as little as CA $25 per month. While this would never accumulate to a sufficient amount to ndamant about. Since term life insurance was the only life insurance product Vanderbilt offered, it allowed these individuals to experience Towerave cilsurance premiums compared to the permanent the loss of their life insurance coverage. premiums, which resulted in higher retums on their savings and access to their funds, il necessary. Page 4 Once Donovan addressed his client's life insurance needs, the relationship began to focus more on preparing the client for retirement. As Donovan's clients aged, retirement preparation became more of a priority. These clients were encouraged to set up a Registered Retirement Savings Plan (RRSP), if they had not already done so. An RRSP allowed clients to contribute up to 18 per cent of their pre-tax income or $26.010 in 2017.' whichever was higher into a tax-sheltered account. An RRSP was an account that could hoose variety of different investment vehicles for example, stocks, bonds, mutual funds, segregated funds, and guaranteed investment certificates Donovan often dealt with clients on the verge of retirement who were unsure of how to proceed once they received their pension. Donovan would help ensure these clients maximized their employer pensions by helping them plan the best withdrawal schedule to minimize tax consequences and invest the remainder in vehicles that would allow for continued growth. COMPETITION London Life Insurance Company London Life Insurance Company (London Life) was an insurance company founded in London, Ontario, in 1874. In 1997, the company was acquired by the Great-West Life Assurance Company (Great-West), but it continued as a separate subsidiary, with its head office remaining in London. London Life offered several different types of financial products, such as individual insurance, wealth management, group benefits, group retirement, savings, and income replacement. London Life offered both term and permanent life insurance In April 2017. Great-West announced that 13 per cent of its total workforce, representing 1.500 employees, would be laid off in an effort to save costs. Or these positions, approximately 430 would be from London Life's head office. London Life employed approximately 3,300 individuals and represented one of London's largest and most recognizable employers." See Exhibit 3 for select financial ratios of London Life. Stevenson & Hunt Insurance Brokers Limited Stevenson & Hunt Insurance Brokers Limited (Stevenson & Hunt) was a brokerage-consulting firm founded in 1935. The company's head office was also in London, Ontario, and the firm had branch offices throughout the province of Ontario. It offered clients insurance and risk-management services including commercial insurance, personal insurance, group-benefit consulting, group-pension consulting, and financial services. Throughout Ontario, Stevenson & Hunt had over 180 full-time employees. In 2015, the company became part of Arthur J. Gallagher Canada Limited, one of the largest global brokers in Canada. Manulife Financial Manulife Financial was founded in Canada in 1887, with Canada's first prime minister, Sir John A. Macdonald, serving as the company's first president. The company operated in Canada, Asia, and the Government of Canada, "MP. DB, RRSP. and TFSA Limits and the YMPE, Canada.ca, December 21, 2018. accessed February 13, 2018, www.canada.ca/en/revenue-agency/services aregistered-plane-administrators/pspa/mp-trap-dpap-tsa limits-ympe.html individual Insurance, London Life, accessed February 13, 2018 www.londonlife.com our products Individual-insurance html Mark Daniszewski, "Great-West Life Cutting 13% of Workforce, about 1,500 Jobsincluding at London Life, The London Free Press. April 25, 2017 accessed February 13, 2018 www.press.com/2017/04/25/great west-to-cutting-13-of- Stevenson & Hunt. About Us Arthur J Gallagher Canada Limited, accolsed February 13, 2018, www.sthunt.com/about.un 9B18B019 Page 5 United States and employed over 105.000 people servicing over 22 million clients worldwide. The company offered term and permanent life insurance options, as well as investments, wealth management, banking, group benefits, and group retirement plans." FUTURE GROWTH Donovan was 47 years old, and while he doubted completely retiring would be on the horizon anytime soon, he wanted to scale back his work week moving forward while still ensuring the growth of the business. Donovan wanted to be able to spend more time with his family, but he also hoped to have created a business that he could leave to one of his children. Within the next five to 10 years, Donovan hoped to have a fully self-sustaining business model that required at most 10 to 15 hours of his time per week. Donovan would also need to ensure that any future business endeavours would still leave adequate time to manage his existing client base. Expanding through Real Estate One opportunity Donovan had been looking into was entering the real estate market. Up until this point in his career. Donovan had focused solely on the financial services industry and had always rented office space. Recently, a plot of land near his existing office had come up for sale for $800,000, and he wondered if this would be a good opportunity to enter into a different business stream. The land was large enough to build two 5,000-square-foot office buildings. Donovan intended to use 2.500 square feet for his own office and rent the remainder to local businesses; doing so would allow Donovan to save all rental expenses experienced in fiscal 2017. To furnish the Vanderbilt office space, Donovan would purchase $15,000 of office furnishings, which would be depreciated using the straight-line method, with a useful life of 10 years and no residual value After speaking with a local developer. Donovan determined that the buildings could be built for S100 per square foot. New office space in London, Ontario, could be rented for an anual rate of S30 per square foot. On top of this, the City of London would charge a land development fee of $200.000 that would be amortized over the useful life of the building. Tenants would be required to pay their own utilities, while the utilities on the portion of the office buildings occupied by Donovan's Vanderbilt brokerage would average $300 per month. To draft initial rental agreements, Donovan would incur legal fees of approximately $2,500. Ir Donovan were to pursue this option, he intended to have construction begin by April 1, 2018 To finance the project, Donovan would need to secure a bank loan." The loan would be paid in con monthly instalments over 15 years and charge an interest rate of super cent per annum Total loan payments for fiscal 2018 and fiscal 2019 including interest would be equal to $126.527 and $189.790, respectively Prior to the bank granting the foun, Donovan would need to provide the bank with evidence that he had cent of the buildings Space for his own office, he wondered if he would be able to find commitment for the already sented 50 per cent or more of the buildings total space. While Donovan would be occupying 25 per remaining 25 per cent without an actual building to show prospective tenants. As well, Donovan would need 1 Products & Services Canada," Manulle Financial, accessed February 13, 2018, www.manulife com/Products Services The buildings would be depreciated using the straight-line method, with no residual value and a useful le of 40 year 1 The bank loan would be used to cover the cost of purchasing the land, building the offices, and paying the land The interest portion of the loan repayments was $65.786 in fiscal 2018 and $94 806 in fiscal 2019 Canada for Page 6 o essere tenants did not need a space immediately, as the building would not be ready for occupancy for ainarely eighi-months from the start of construction. Due to the high demand for new office space in area, Donovan was confident that the offices would consistently be rented at between 80 and 100 per et capacity. Donovan would also incur an additional $3.000 in insurance and would allocate $500 of his esting annual advertising budget to this opportunity. Because Donovan would now be the owner of the property, he would incur S66,500 in property taxes annually Rather than pursuing this venture on his own, Donovan wondered if finding a business partner was a vuble option. Donovan had recently met a local business owner who wanted to expand his business and was tired of paying costly rental fees for his existing office space each month. Donovan know that this dividual would require an office space of 2,500 square feet as well, which would satisfy the bank's Jending requirements. If Donovan were to partner on this project, all investments, recurring costs, and rental revenues would be split evenly between the partners. An additional $15,000 of office furniture would be required to furnish the partner's space. Because there would be two individuals managing the properties and looking for prospective tenants, Donovan predicted that the buildings would be consistently rented at 100 per cent capacity in this scenario. Hiring Additional Representatives Donovan wondered if building a larger trustworthy and skilled team to help manage and increase the size of the brokerage's client base would be a better course of action than pursuing the real estate opportunity While this option would require minimal initial financial investment in comparison, it would be more time-consuming over the next few years. Donovan anticipated that the brokerage's commissions and fees would increase annually by an average of $20,000.for.cach additional representative that he hired, trained, and assisted to become a licensed life insurance and mutual fund representative, Donovan planned to hire between eight and 12 representatives by the end of February 2018, with all of their training and licensing completed by September 1, 2018 To accommodate this larger team, Donovan would need to move to a larger office. Donovan's current landlord had agreed to rent Donovan 4,000 square feet of office space within the same buildings Because this was not a new building, rent was $14.per square foot annually including utilities, the same rate charged for Donovan's existing office, Rent would continue to be paid on the first day of the month, with a top-up of the deposit for last month's rent required upon occupancy of the larger office. Donovan's current office was 1,400 square feet. An additional administrative assistant would need to be hired with a 40-hour work week at a rate of $18 per hour. The administrative assistant's employment would commence on March 1, 2018. Furnishings for the new office would total $30,000 and be depreciated using the straight-line method, with no residual value and a useful life of 10 years. As well, laptops would need to be purchased for all new representatives at a cost of $600 each. All additional long-lived assets required would be purchased on February 1, 2018. Expenses for business software would be incurred in the amount of $28 per new representative per month, and expenses for office supplies would increase by $1,200 annually. Telephone and Internet charges would increase by $50 per month. Donovan expected these expenditures to increase with the hiring of additional team members. new agreement would February 1, 2018 * Laptops would be depreciated with commence on Febrero 2014 no residual value and a useful lite of three years. 9B18B019 Page 7 FINANCIAL PROJECTIONS Since his new plan would not be implemented until late 2018, Donovan wanted to project a statement of camings for both fiscal 2018 and fiscal 2019 to assess the potential financial benefits of his decision. He made. Donovan expected to pay tax of 30 per cent on any profits. All other expenses pertaining to the anticipated that his existing revenues would increase each year by 5 per cent, regardless of the decision existing business would remain the same percentage of revenue with the exception of rent, insurance, depreciation, telephone-and-Internet, and wage expenses. Rent, insurance, depreciation, and telephone- and Internet expenses would remain the same amount as in fiscal 2017 for current operations. Wages would increase by $2,000 per year. Donovan did not think it was necessary to project a statement of financial position WHAT NEXT While Donovan knew he had a difficult decision ahead of him, he was excited by the growth potential of these strategic opportunities. He needed to decide which option would best achieve his goal of increasing revenue while giving him the ability to build a self-sustaining business model-building office space to create new rental revenue and reduce monthly rental expenditures, or increasing the size of his team? Donovan had worked diligently for most of his life, often sacrificing time with his family, to build his existing business. As he sat down to begin analyzing his options, he thought to himself, "I've earned my 15-hour workweek." 9818B019 Page 8 EXHIBIT 1: VANDERBILT FINANCIAL SERVICES STATEMENT OF EARNINGS (FOR THE YEARS ENDING DECEMBER 31, IN CAS) 2017 2016 $379,532 100.0% $337,783 100.0% Revenue Operating expenses: Advertising Meals and entertainment Business Insurance Interest Licensing and business software Ront Office supplies Legal accounting, and other professional fees Wagos Travel Telephone and Internet Postage Fuel and vehicle maintenance Depreciation Total operating expenses Net income before tax Less: income tax Not income 6,333 17,594 890 668 3,753 19,600 3,901 471 35,541 1.218 5,198 639 14,701 13,743 124,250 1.9% 5.2% 0.3% 0.2% 1.1% 5.8% 12% 0.1% 10.5% 0.4% 1.5% 0.2% 4.4% 4.1% 36.8% 6,529 18,138 890 689 3,753 19,600 4,022 486 36,640 1,455 5.359 659 15.156 13,969 127,345 1.7% 4.8% 0.2% 0.2% 1.0% 5.2% 1.1% 0.1% 9.7% 0.4% 1.4% 0.2% 4.0% 3.7% 33.6% 213,533 71 811 141,722 63.2% 213% 42,0% 252,187 89,653 162,534 66.4% 23.6% 42.8% Source: Company files Page 9 EXHIBIT 2: VANDERBILT FINANCIAL SERVICES STATEMENT OF FINANCIAL POSITION (AS AT DECEMBER 31, IN CAS) 2017 2016 Assets Current assets Cash Trading investments Prepaid rent Orice supplies Total current assets $20,911 12,563 1,633 250 35,357 $22,639 14,930 1,633 275 39.477 16,073 17,566 Long-lived assets Office furniture Less: accumulated depreciation Omice equipment Less accumulated depreciation Vehicle Less: accumulated depreciation Total long-lived assets Total assets 28,432 12,359 12,576 7,892 85,550 10,694 4,684 31,779 14,213 16,091 9,313 85,550 21,388 6,778 74,856 95,613 64,162 88,506 130,970 127,983 Liabilities & shareholders' equity Current abilities Accounts payable Taxes payable Operating line of credit Total current liabilities 427 9,465 2356 12 248 405 4,308 2.592 7.305 Shareholders' equity Common stock Retained earnings Total shareholders' equity Total liabilities & shareholders' equity Related solely to telephone-and-Internet expenses aurce Companyes 105,000 13.722 118,722 105,000 15,678 120,678 130,970 127,983 9B18B019 Page 10 EXHIBIT 3: SELECT FINANCIAL RATIOS FOR LONDON LIFE INSURANCE COMPANY 2016 2015 Nel-eamings growth -1.8% -3.2% Interest coverage 68.6 69.9 Debt to equity 23.5 22.8 Sales growth 53,4% 11.9% Operating-expense growth 57.3% 13.5% Return on equity 14.4% 15.3% Source: Created by the case authors based on London Life Insurance Company, Annual Report 2016, 5-9, accessed February 14, 2018, www.londonlife.com/content/dam/Documents LL-2016-Annual Report-English-Complate-15-125816LL- 150-do-FINAL pdf London Life Insurance Company Annual Report 2015, 5-7 accessed February 14, 2018 https/pagely londoni fe.com/wp-content/uploads7 035785_2015 Annual Report.pdf