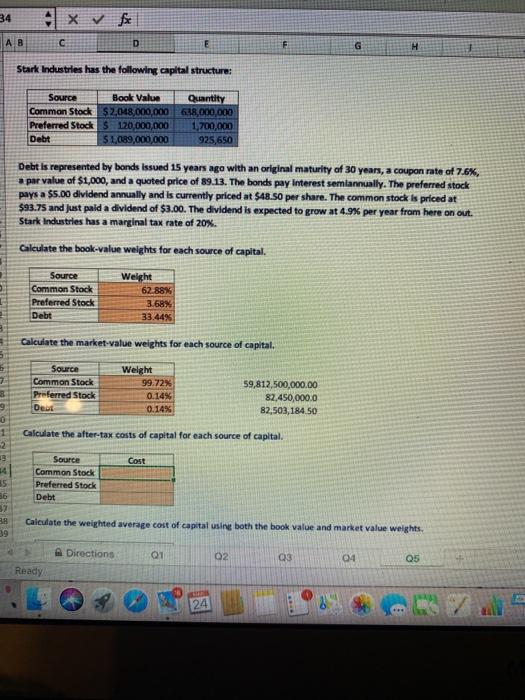

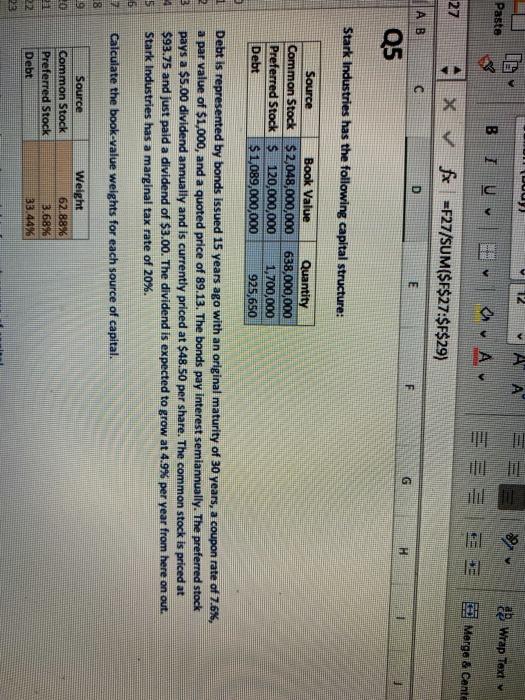

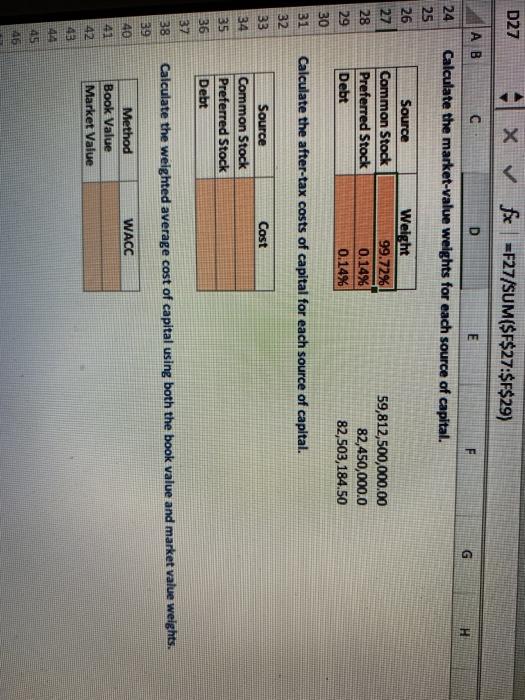

34 x fx AB D G H Stark Industries has the following capital structure: Source Book Value Quantity Common Stock $2.048,000,000 618,000,000 Preferred Stock $ 120,000,000 1,700,000 Debt $1,089,000,000 925,650 Debt is represented by bonds issued 15 years ago with an original maturity of 30 years, a coupon rate of 7.6%, a par value of $1,000, and a quoted price of 89.13. The bonds pay interest semiannually. The preferred stock pays a $5.00 dividend annually and is currently priced at $48.50 per share. The common stock is priced at $93.75 and just paid a dividend of $3.00. The dividend is expected to grow at 4.9% per year from here on out. Stark Industries has a marginal tax rate of 20%. Calculate the book-value weights for each source of capital. Source Common Stock Preferred Stock Debt Weight 62.88% 3.689 33.44% Calculate the market value weights for each source of capital. 7 3 Source Common Stock Preferred Stock Det Weight 99.72% 0.14% 0.14% 59,812,500,000.00 82.450,000.0 82,503,184.50 1 2 Calculate the after-tax costs of capital for each source of capital Cost Source Common Stock Preferred Stock Debt 4 35 36 37 38 39 Calculate the weighted average cost of capital using both the book value and market value weights Directions Q1 02 Q3 04 Q5 Ready 24 BILA RUU LG A A Paste v BI U a. A 29 Wrap Text Mergo & Cante 27 x fx =F27/SUM($F$27:$F$29) AB G D E F G H Q5 Stark Industries has the following capital structure: Source Book Value Quantity Common Stock $2,048,000,000 638,000,000 Preferred Stock $ 120,000,000 1,700,000 Debt $ 1,089,000,000 925,650 1 2 Debt is represented by bonds issued 15 years ago with an original maturity of 30 years, a coupon rate of 7.6%, a par value of $1,000, and a quoted price of 89.13. The bonds pay interest semiannually. The preferred stock pays a $5.00 dividend annually and is currently priced at $48.50 per share. The common stock is priced at $93.75 and just paid a dividend of $3.00. The dividend is expected to grow at 4.9% per year from here on out. Stark Industries has a marginal tax rate of 20%. 5 6 Calculate the book-value weights for each source of capital. 18 Source Common Stock Preferred Stock Debt Weight 62.88% 3.68% 33.44% D27 XV fx =F27/SUM($F$27:$F$29) AB C D E F G H Calculate the market value weights for each source of capital. 24 25 26 27 28 29 30 31 Source Common Stock Preferred Stock Debt Weight 99.72% 0.14% 0.14% 59,812,500,000.00 82,450,000.0 82,503,184.50 Calculate the after-tax costs of capital for each source of capital. 32 Cost Source Common Stock Preferred Stock Debt 33 34 35 36 37 38 39 40 141 42 Calculate the weighted average cost of capital using both the book value and market value weights. WACC Method Book Value Market Value 46