Answered step by step

Verified Expert Solution

Question

1 Approved Answer

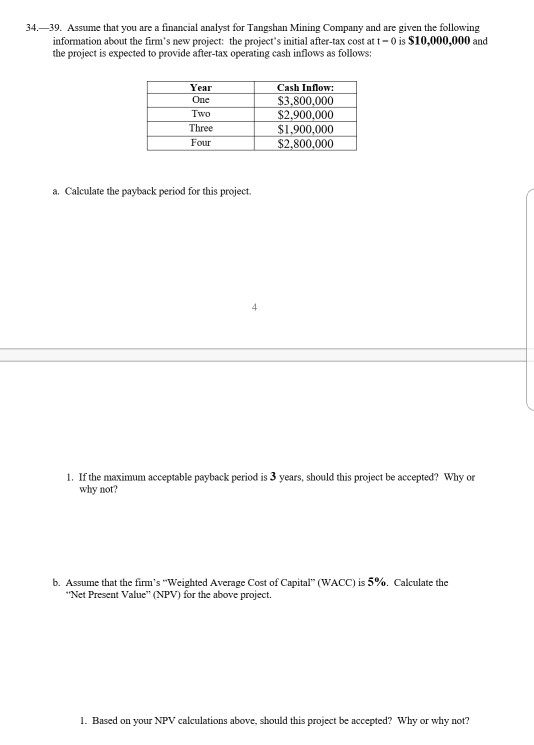

34.-39. Assume that you are a financial analyst for Tangshan Mining Company and are given the following information about the firm's new project: the project's

34.-39. Assume that you are a financial analyst for Tangshan Mining Company and are given the following information about the firm's new project: the project's initial after-tax cost at t-0 is $10,000,000 and the project is expected to provide after-tax operating cash inflows as follows: Year One Cash Inflow: $3,800,000 $2,900,000 $1,900,000 800,000 Three Four a. Calculate the payback period for this project 1. If the maximum acceptable payback period is 3 years, should this project be accepted? Why or why not? b. Assume that the firm's "Weighted Average Cost of Capital" (WACC) is 5%. Calculate the Net Presen Value"NPV) for the above project. 1. Based on your NPV calculations above, should this project be accepted? Why or why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started