Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3,4,6,9, 10 3. Valuing Bonds [LO2] Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual

3,4,6,9, 10

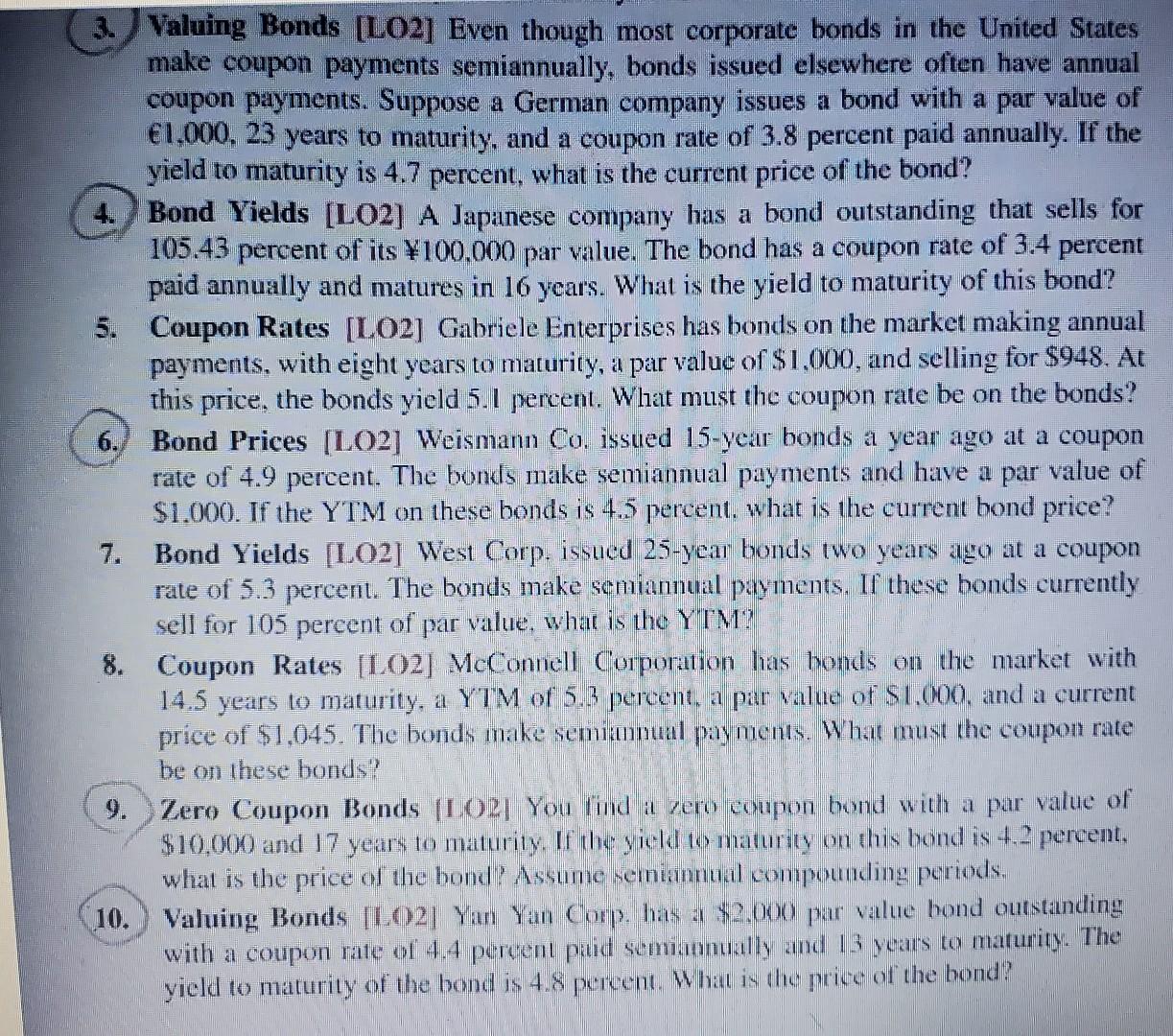

3. Valuing Bonds [LO2] Even though most corporate bonds in the United States make coupon payments semiannually, bonds issued elsewhere often have annual coupon payments. Suppose a German company issues a bond with a par value of 1,000,23 years to maturity, and a coupon rate of 3.8 percent paid annually. If the yield to maturity is 4.7 percent, what is the current price of the bond? 4. Bond Yields [LO2] A Japanese company has a bond outstanding that sells for 105.43 percent of its 100.000 par value. The bond has a coupon rate of 3.4 percent paid annually and matures in 16 years. What is the yield to maturity of this bond? 5. Coupon Rates [LO2] Gabriele Enterprises has bonds on the market making annual payments, with eight years to maturity, a par value of $1,000, and selling for $948. At this price, the bonds yield 5.1 percent. What must the coupon rate be on the bonds? 6. Bond Prices [LO2] Weismann Co. issued 15-year bonds a year ago at a coupon rate of 4.9 percent. The bonds make semiannual payments and have a par value of $1.000. If the YTM on these bonds is 4.5 percent, what is the current bond price? 7. Bond Yields [LO2] West Corp. issued 25-year bonds two years ago at a coupon rate of 5.3 percent. The bonds make semiannual payments. If these bonds currently sell for 105 pereent of par value, what is the YTM? 8. Coupon Rates [LO2] McConnell Corporation has bonds on the market with 14.5 years to maturity, a YTM of 5.3 percent, a par value of S1.000, and a current price of $1,045. The bonds make semiamnual pay ments. What must the coupon rate be on these bonds? 9. Zero Coupon Bonds [1.02 You lind a zero coupon bond with a par value of $10,000 and 17 years to maturity. If the yicld to maturity on this bond is 4.2 percent, what is the price of the bond? Assume semiannual compounding periods. 10. Vahuing Bonds [1.02] Yan Yan Corp. has a \$2.000 par value bond outstanding with a coupon rate of 4.4 percent paid semianmally and 13 years to maturity. The yield to maturity of the bond is 4.8 percent. What is the price of the bondStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started