Answered step by step

Verified Expert Solution

Question

1 Approved Answer

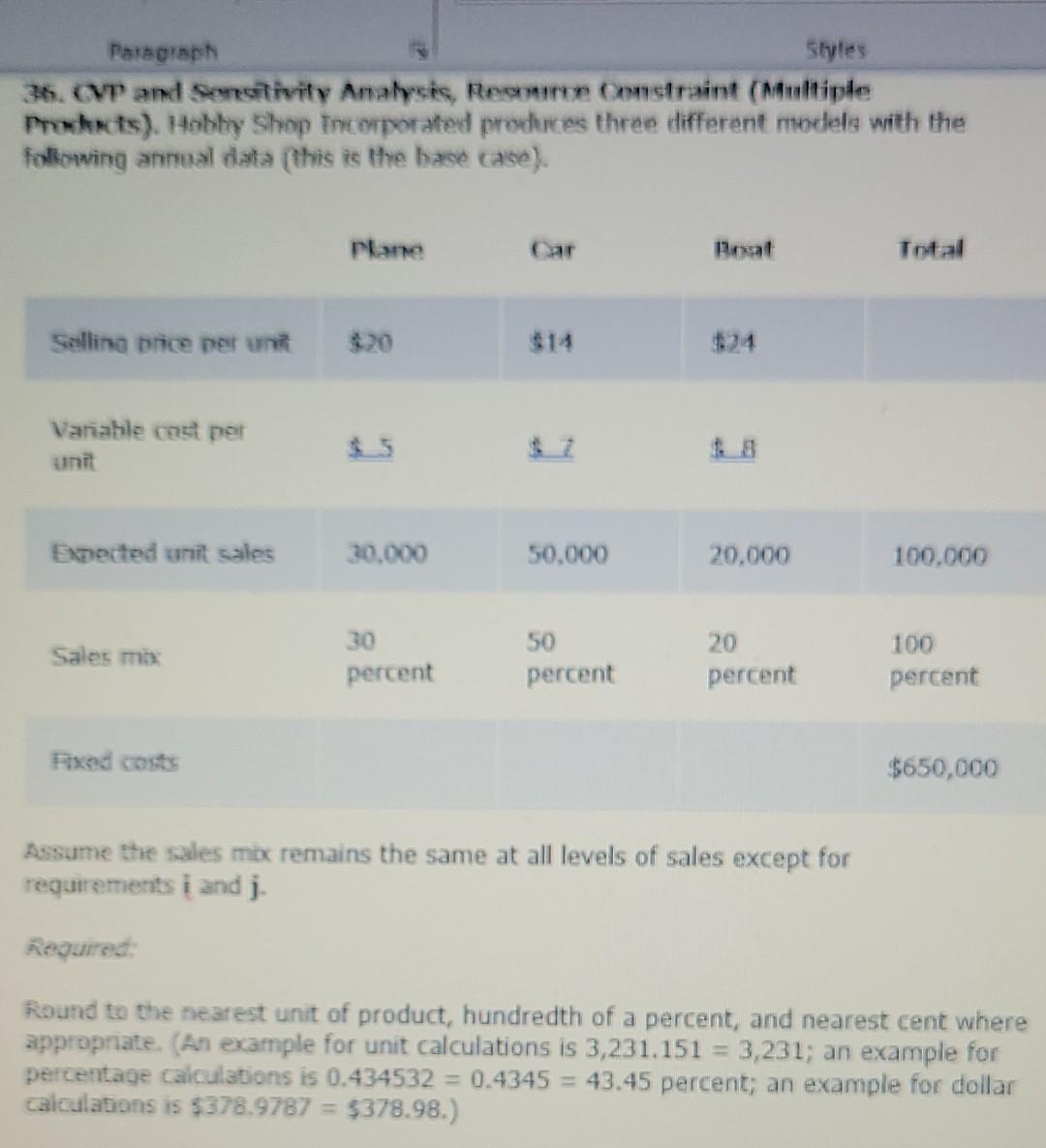

36. CVT and Sensetivity Amalycis, Roonurce Conmstraint (Mmamiple Prohnts). 14obly Shop Incorporated produrces three different models with the following annual data (thic is the base

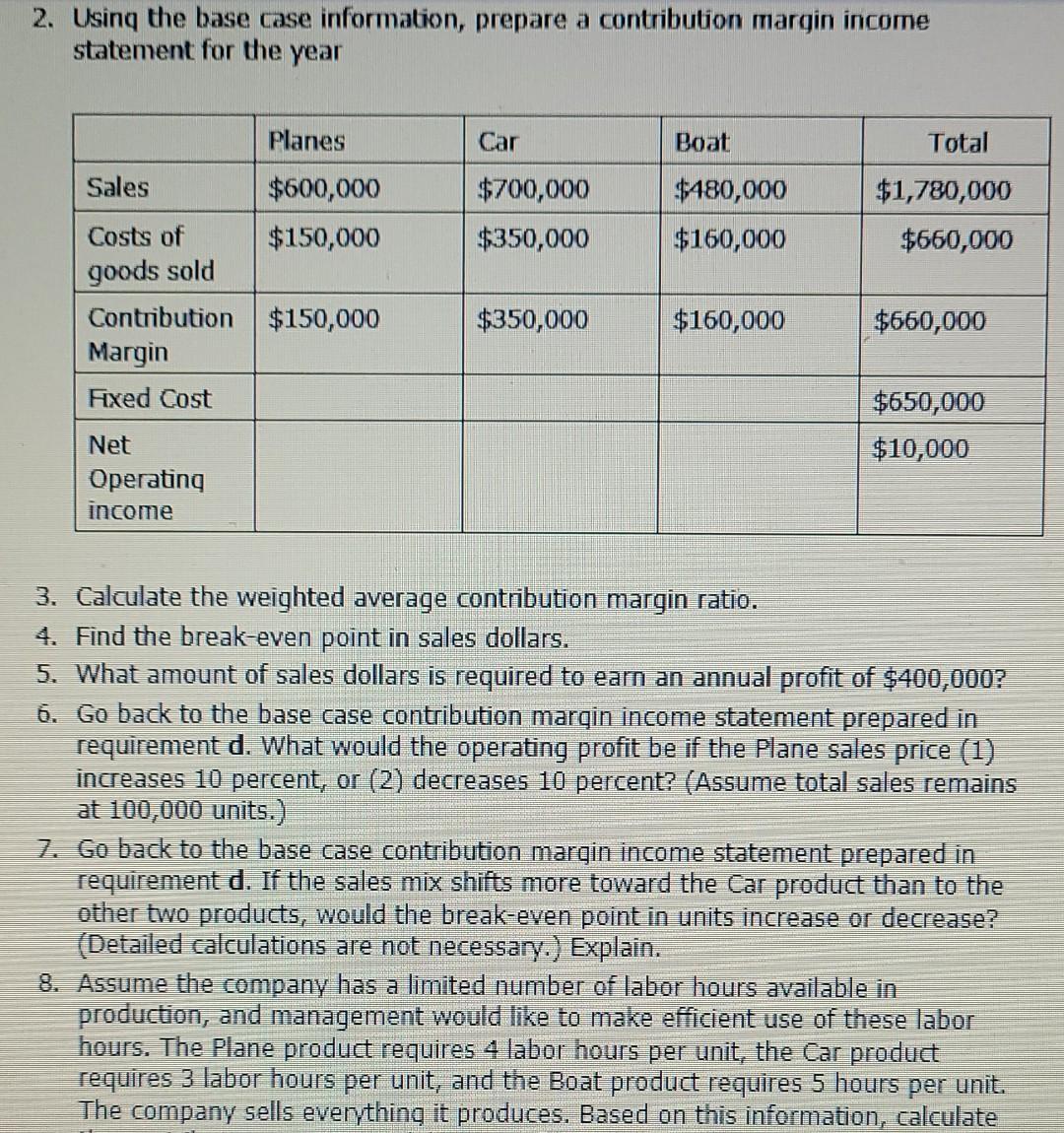

36. CVT and Sensetivity Amalycis, Roonurce Conmstraint (Mmamiple Prohnts). 14obly Shop Incorporated produrces three different models with the following annual data (thic is the base case). Assume the sales mix remains the same at all levels of sales except for regurements i and j eured: Raund to the nearest unit of product, hundredth of a percent, and nearest cent where appropnate. (An example for unit calculations is 3,231.151=3,231; an example for) percentage calculations is 0.434532=0.4345=43.45 percent; an example for dollar calculations is $378.9787=$378.98.) 2. Usinq the base case information, prepare a contribution margin income statement for the year 3. Calculate the weighted average contribution margin ratio. 4. Find the break-even point in sales dollars. 5. What amount of sales dollars is required to earn an annual profit of $400,000 ? 6. Go back to the base case contribution marqin income statement prepared in requirement d. What would the operating profit be if the Plane sales price (1) increases 10 percent, or (2) decreases 10 percent? (Assume total sales remains at 100,000 units.) 7. Go back to the base case contribution margin income statement prepared in requirement d. If the sales mix shifts more toward the Car product than to the other two products, would the break-even point in units increase or decrease? (Detailed calculations are not necessary.) Explain. 8. Assume the company has a limited number of labor hours available in production, and management would like to make efficient use of these labor hours. The Plane product requires 4 labor hours per unit, the Car product requires 3 labor hours per unit, and the Boat product requires 5 hours per unit. The company sells everything it produces. Based on this information, calculate 36. CVT and Sensetivity Amalycis, Roonurce Conmstraint (Mmamiple Prohnts). 14obly Shop Incorporated produrces three different models with the following annual data (thic is the base case). Assume the sales mix remains the same at all levels of sales except for regurements i and j eured: Raund to the nearest unit of product, hundredth of a percent, and nearest cent where appropnate. (An example for unit calculations is 3,231.151=3,231; an example for) percentage calculations is 0.434532=0.4345=43.45 percent; an example for dollar calculations is $378.9787=$378.98.) 2. Usinq the base case information, prepare a contribution margin income statement for the year 3. Calculate the weighted average contribution margin ratio. 4. Find the break-even point in sales dollars. 5. What amount of sales dollars is required to earn an annual profit of $400,000 ? 6. Go back to the base case contribution marqin income statement prepared in requirement d. What would the operating profit be if the Plane sales price (1) increases 10 percent, or (2) decreases 10 percent? (Assume total sales remains at 100,000 units.) 7. Go back to the base case contribution margin income statement prepared in requirement d. If the sales mix shifts more toward the Car product than to the other two products, would the break-even point in units increase or decrease? (Detailed calculations are not necessary.) Explain. 8. Assume the company has a limited number of labor hours available in production, and management would like to make efficient use of these labor hours. The Plane product requires 4 labor hours per unit, the Car product requires 3 labor hours per unit, and the Boat product requires 5 hours per unit. The company sells everything it produces. Based on this information, calculate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started