Answered step by step

Verified Expert Solution

Question

1 Approved Answer

36,37,38,39,40 just need the answers that's all no explanation thanks in advance you rock Which of the following is a major drawbacks of mean-variance optimization

36,37,38,39,40

just need the answers that's all no explanation thanks in advance you rock

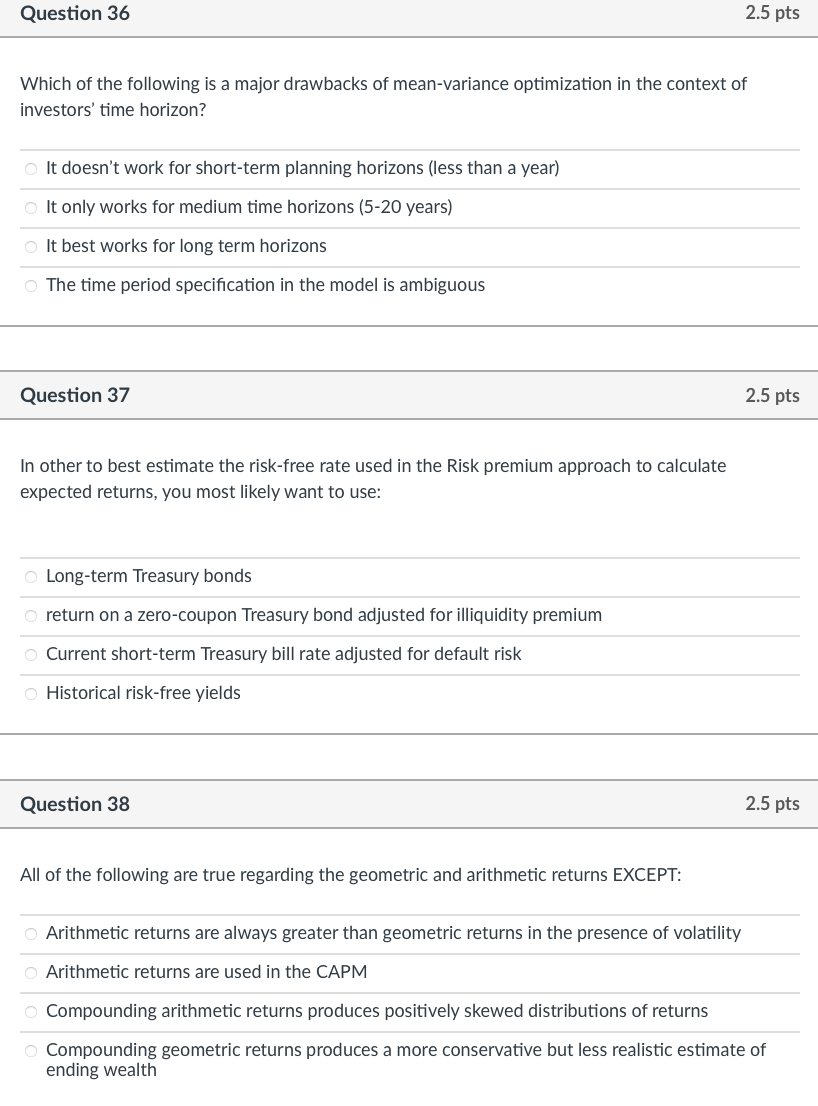

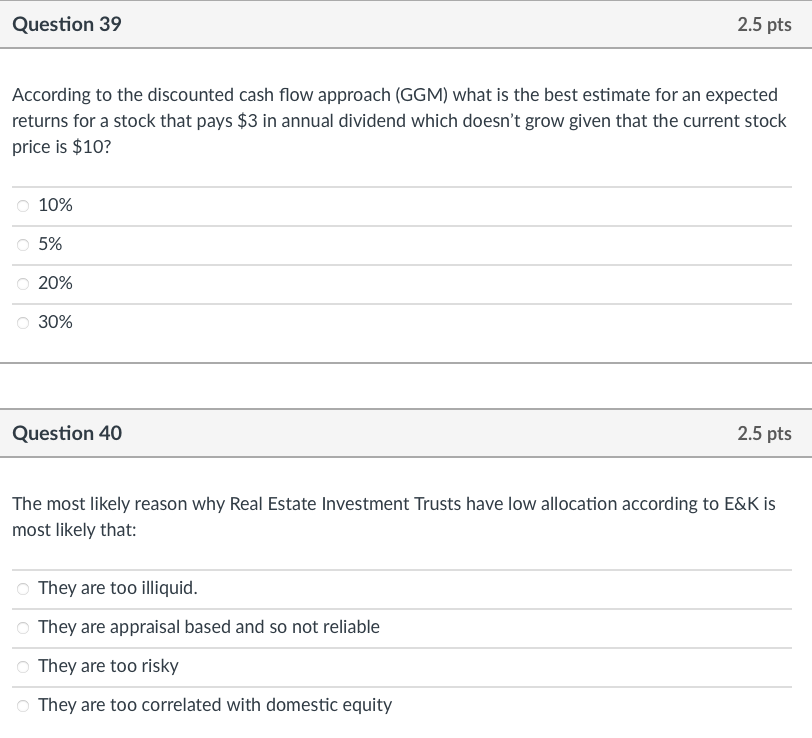

Which of the following is a major drawbacks of mean-variance optimization in the context of investors' time horizon? It doesn't work for short-term planning horizons (less than a year) It only works for medium time horizons (5-20 years) It best works for long term horizons The time period specification in the model is ambiguous Question 37 2.5pts In other to best estimate the risk-free rate used in the Risk premium approach to calculate expected returns, you most likely want to use: Long-term Treasury bonds return on a zero-coupon Treasury bond adjusted for illiquidity premium Current short-term Treasury bill rate adjusted for default risk Historical risk-free yields Question 38 2.5pts All of the following are true regarding the geometric and arithmetic returns EXCEPT: Arithmetic returns are always greater than geometric returns in the presence of volatility Arithmetic returns are used in the CAPM Compounding arithmetic returns produces positively skewed distributions of returns Compounding geometric returns produces a more conservative but less realistic estimate of ending wealth According to the discounted cash flow approach (GGM) what is the best estimate for an expected returns for a stock that pays $3 in annual dividend which doesn't grow given that the current stock price is $10? \begin{tabular}{l} \hline 10% \\ \hline 5% \\ \hline 20% \\ \hline 30% \end{tabular} Question 40 2.5 pts The most likely reason why Real Estate Investment Trusts have low allocation according to E\&K is most likely that: They are too illiquid. They are appraisal based and so not reliable They are too risky They are too correlated with domestic equity

Which of the following is a major drawbacks of mean-variance optimization in the context of investors' time horizon? It doesn't work for short-term planning horizons (less than a year) It only works for medium time horizons (5-20 years) It best works for long term horizons The time period specification in the model is ambiguous Question 37 2.5pts In other to best estimate the risk-free rate used in the Risk premium approach to calculate expected returns, you most likely want to use: Long-term Treasury bonds return on a zero-coupon Treasury bond adjusted for illiquidity premium Current short-term Treasury bill rate adjusted for default risk Historical risk-free yields Question 38 2.5pts All of the following are true regarding the geometric and arithmetic returns EXCEPT: Arithmetic returns are always greater than geometric returns in the presence of volatility Arithmetic returns are used in the CAPM Compounding arithmetic returns produces positively skewed distributions of returns Compounding geometric returns produces a more conservative but less realistic estimate of ending wealth According to the discounted cash flow approach (GGM) what is the best estimate for an expected returns for a stock that pays $3 in annual dividend which doesn't grow given that the current stock price is $10? \begin{tabular}{l} \hline 10% \\ \hline 5% \\ \hline 20% \\ \hline 30% \end{tabular} Question 40 2.5 pts The most likely reason why Real Estate Investment Trusts have low allocation according to E\&K is most likely that: They are too illiquid. They are appraisal based and so not reliable They are too risky They are too correlated with domestic equity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started