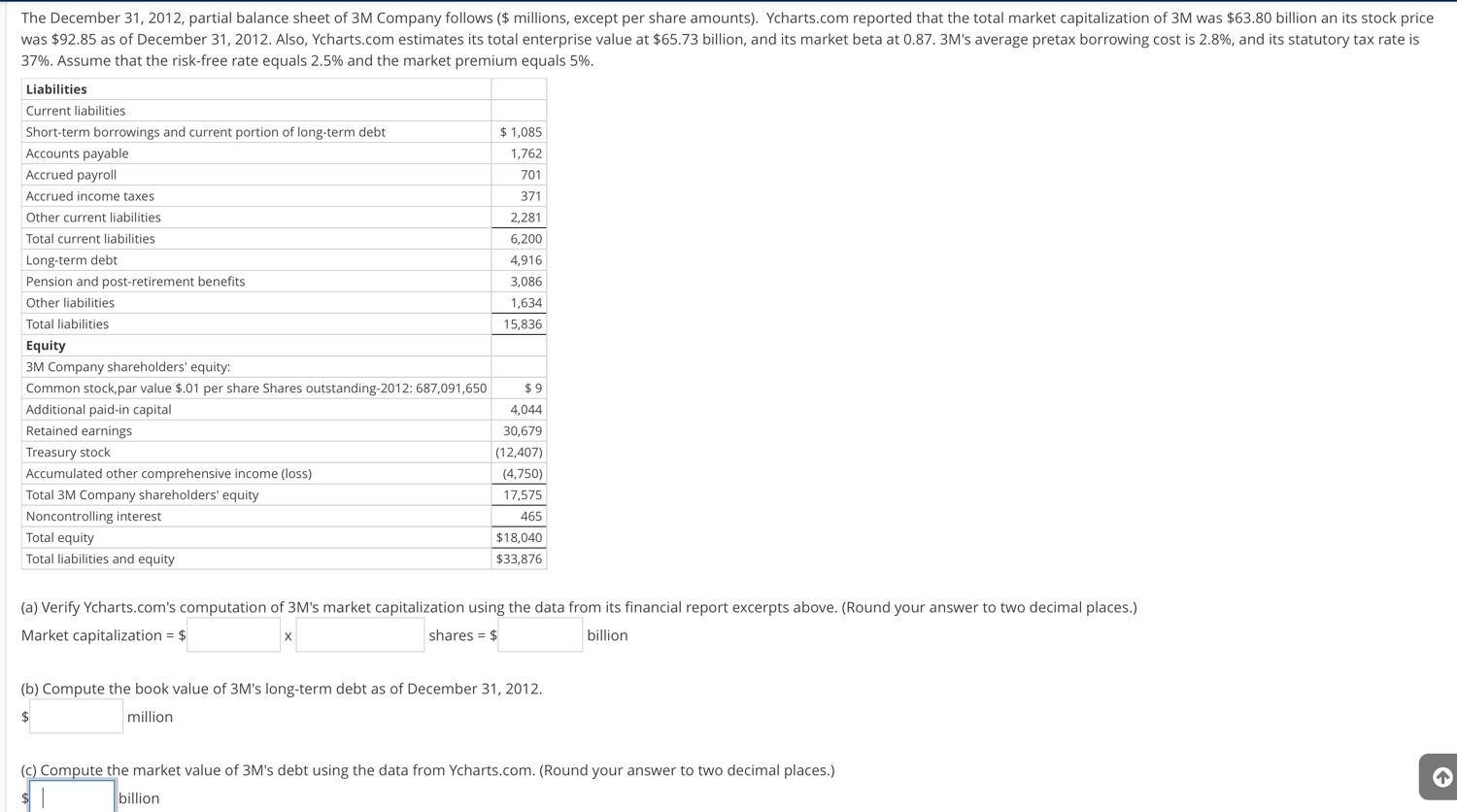

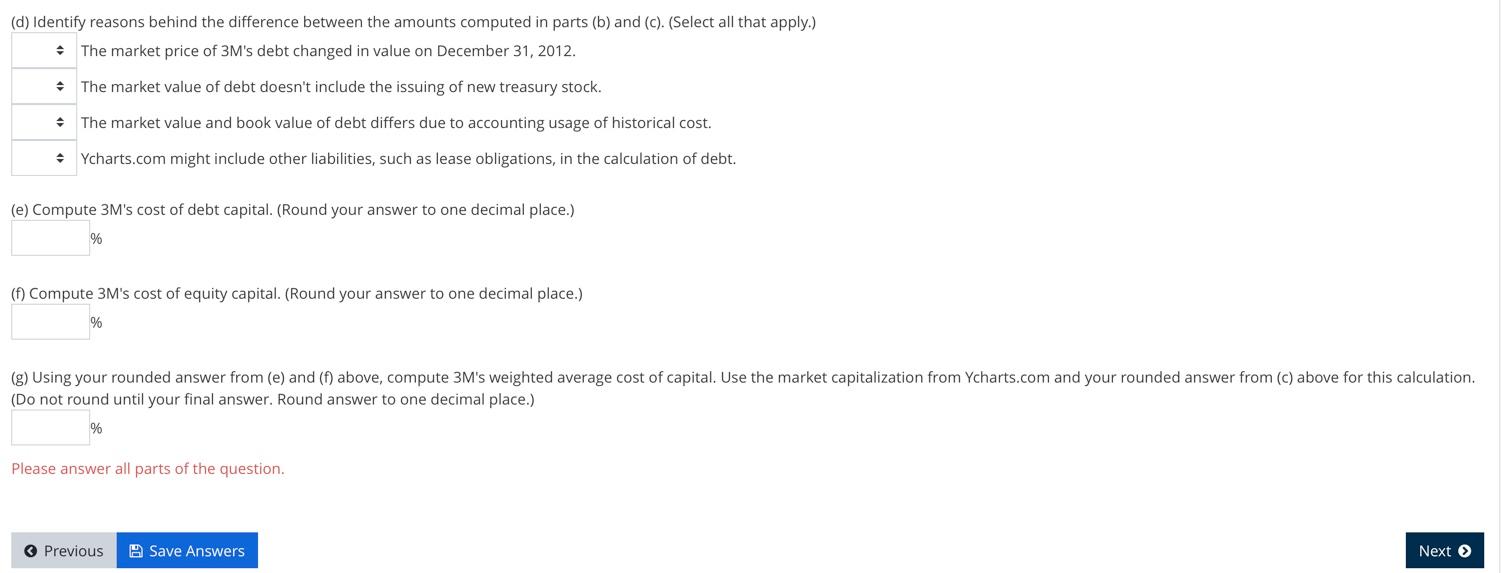

37%. Assume that the risk-free rate equals 2.5% and the market premium equals 5%. (a) Verify Ycharts.com's computation of 3M's market capitalization using the data from its financial report excerpts above. (Round your answer to two decimal places.) Market capitalization =$ shares =$ billion (b) Compute the book value of 3M's long-term debt as of December 31, 2012. million (c) Compute the market value of 3M 's debt using the data from Ycharts.com. (Round your answer to two decimal places.) billion (d) Identify reasons behind the difference between the amounts computed in parts (b) and (c). (Select all that apply.) The market price of 3M's debt changed in value on December 31, 2012. The market value of debt doesn't include the issuing of new treasury stock. The market value and book value of debt differs due to accounting usage of historical cost. Ycharts.com might include other liabilities, such as lease obligations, in the calculation of debt. (e) Compute 3M's cost of debt capital. (Round your answer to one decimal place.) 16 (f) Compute 3M's cost of equity capital. (Round your answer to one decimal place.) % (Do not round until your final answer. Round answer to one decimal place.) 1% Please answer all parts of the question. 37%. Assume that the risk-free rate equals 2.5% and the market premium equals 5%. (a) Verify Ycharts.com's computation of 3M's market capitalization using the data from its financial report excerpts above. (Round your answer to two decimal places.) Market capitalization =$ shares =$ billion (b) Compute the book value of 3M's long-term debt as of December 31, 2012. million (c) Compute the market value of 3M 's debt using the data from Ycharts.com. (Round your answer to two decimal places.) billion (d) Identify reasons behind the difference between the amounts computed in parts (b) and (c). (Select all that apply.) The market price of 3M's debt changed in value on December 31, 2012. The market value of debt doesn't include the issuing of new treasury stock. The market value and book value of debt differs due to accounting usage of historical cost. Ycharts.com might include other liabilities, such as lease obligations, in the calculation of debt. (e) Compute 3M's cost of debt capital. (Round your answer to one decimal place.) 16 (f) Compute 3M's cost of equity capital. (Round your answer to one decimal place.) % (Do not round until your final answer. Round answer to one decimal place.) 1% Please answer all parts of the