Answered step by step

Verified Expert Solution

Question

1 Approved Answer

38. Which of the following involves taking a position in two or more options of the same type. For example, combining two calls or put

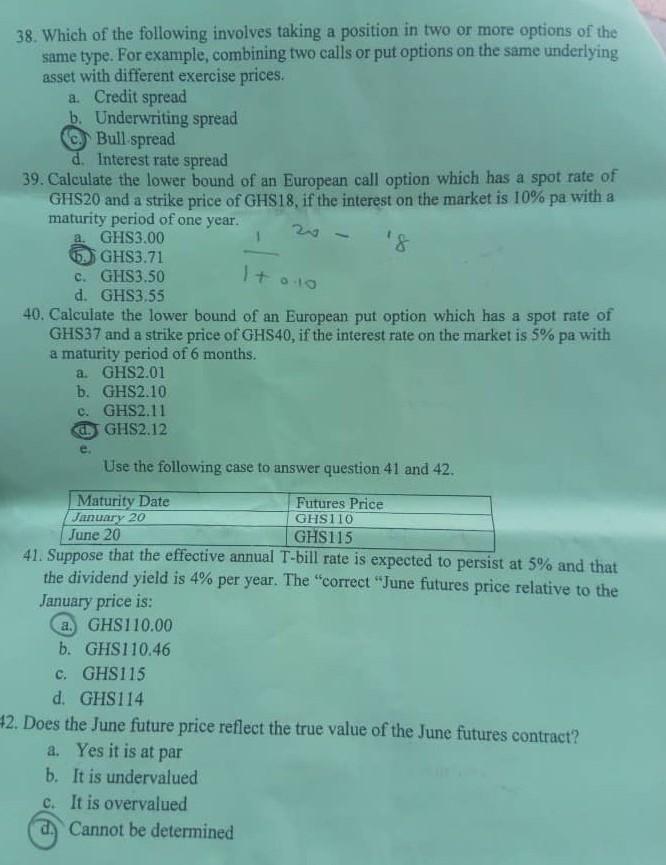

38. Which of the following involves taking a position in two or more options of the same type. For example, combining two calls or put options on the same underlying asset with different exercise prices. a. Credit spread b. Underwriting spread Bull-spread d. Interest rate spread 39. Calculate the lower bound of an European call option which has a spot rate of GHS20 and a strike price of GHS18, if the interest on the market is 10% pa with a maturity period of one year. 20 8 a. GHS3.00 5 GHS3.71 c. GHS3.50 1 + 0.10 d. GHS3.55 40. Calculate the lower bound of an European put option which has a spot rate of GHS37 and a strike price of GHS40, if the interest rate on the market is 5% pa with a maturity period of 6 months. a. GHS2.01 b. GHS2.10 c. GHS2.11 GHS2.12 e. Use the following case to answer question 41 and 42. Maturity Date Futures Price January 20 GHS110 June 20 GHS115 41. Suppose that the effective annual T-bill rate is expected to persist at 5% and that the dividend yield is 4% per year. The "correct "June futures price relative to the January price is: a. GHS110.00 b. GHS110.46 c. GHS115 d. GHS114 42. Does the June future price reflect the true value of the June futures contract? a. Yes it is at par b. It is undervalued c. It is overvalued d Cannot be determined 38. Which of the following involves taking a position in two or more options of the same type. For example, combining two calls or put options on the same underlying asset with different exercise prices. a. Credit spread b. Underwriting spread Bull-spread d. Interest rate spread 39. Calculate the lower bound of an European call option which has a spot rate of GHS20 and a strike price of GHS18, if the interest on the market is 10% pa with a maturity period of one year. 20 8 a. GHS3.00 5 GHS3.71 c. GHS3.50 1 + 0.10 d. GHS3.55 40. Calculate the lower bound of an European put option which has a spot rate of GHS37 and a strike price of GHS40, if the interest rate on the market is 5% pa with a maturity period of 6 months. a. GHS2.01 b. GHS2.10 c. GHS2.11 GHS2.12 e. Use the following case to answer question 41 and 42. Maturity Date Futures Price January 20 GHS110 June 20 GHS115 41. Suppose that the effective annual T-bill rate is expected to persist at 5% and that the dividend yield is 4% per year. The "correct "June futures price relative to the January price is: a. GHS110.00 b. GHS110.46 c. GHS115 d. GHS114 42. Does the June future price reflect the true value of the June futures contract? a. Yes it is at par b. It is undervalued c. It is overvalued d Cannot be determined

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started