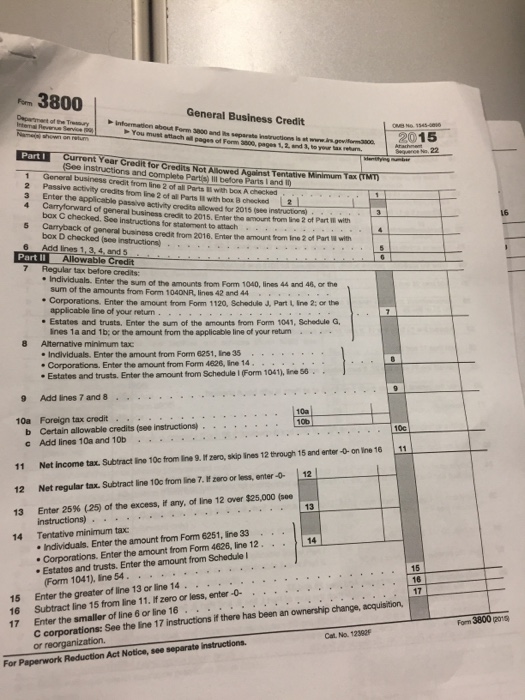

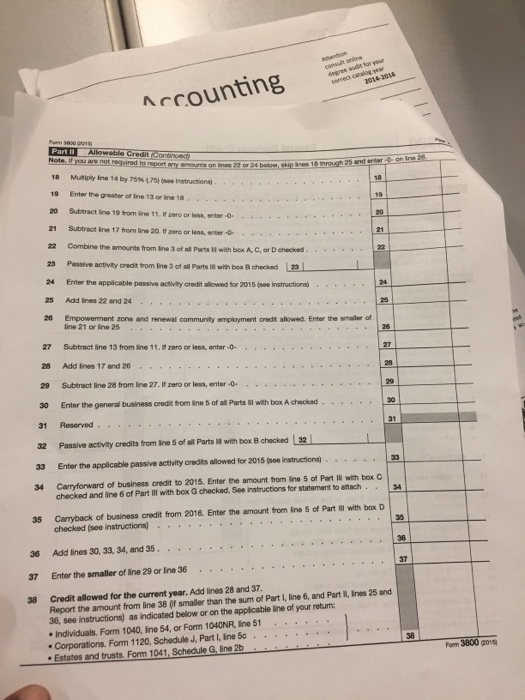

3800 General Business Credit Form 3000 20 15 last Part I Current Year credit for credits Not A owea Tentativewnimum Complete Parts ll before Parts land 0 2 Passive activity credits from line 2 of al Parts u wthbox B checked L2 Enter the passive activity oredito allowed for 2015 (see 4 ward of general ered to 2015. Enter the amount from line 2 of Part with box C instructions statement to attach for 5 general business oredr from 2016, Enter the amount Pan w with box D checked from Ine2 of Add lines 1, and 5 Part I Allowable Credit Regular tax before credits: Individuals. Enter the sum of the amounts from Form 1040, lines 44 and 46, or the sum of the amounts from Form 1040NR, lines 42 and 44 Corporations. Enter the amount from Form 1120, schedule J. Part LIne 2: or the applicable line of your return Estates and trusts, Enter the sum of the amounts from Form 1041, Schedule G. lines la and 1b; or the amount from the applicable line of your retum Alternative minimum tax Individuals. Enter the amount from Form 6251, Ine 35 Corporations. Enter the amount from 14 es and trusts. Enter the amount from Schedule Form 1041,Ines6 9 Add lines 7 and 8 10a 10a Foreign tax credit 10b b Certain allowable credits (see instructions c Add lines 10a and 10b 11 Net income tax subtract line 10c from Ine 9.lfzero, skip ines 12through 15 and enter on ine 16 11 12 Net regular tax. Subtract line 10c from line 7.lfzero or less, enter -0- 12 13 Enter 25% (25 of the excess, if any, of line 12 over $25.000 (see 13 14 Tentative minimum tax 6251, ine 33 Individuals. Enter the amount from Form 4626, line 12 Enter the amount from Form Schedule l .Estates and trusts. Enter the amount from 14 15 (Form 1041), line 54. 15 Enter the greater of line 13 line 14 less, enter -0- acquisition, or 16 Subtract line 15 from line 11. lfzero or ownership change, 17 Enter the smaller of line 6 or line 16 has been an C ons: See the line 17 instructions if there 129a or reorganization. Cat No. For Paperwork Reduction Act Notice, see separate instructions. 3800 General Business Credit Form 3000 20 15 last Part I Current Year credit for credits Not A owea Tentativewnimum Complete Parts ll before Parts land 0 2 Passive activity credits from line 2 of al Parts u wthbox B checked L2 Enter the passive activity oredito allowed for 2015 (see 4 ward of general ered to 2015. Enter the amount from line 2 of Part with box C instructions statement to attach for 5 general business oredr from 2016, Enter the amount Pan w with box D checked from Ine2 of Add lines 1, and 5 Part I Allowable Credit Regular tax before credits: Individuals. Enter the sum of the amounts from Form 1040, lines 44 and 46, or the sum of the amounts from Form 1040NR, lines 42 and 44 Corporations. Enter the amount from Form 1120, schedule J. Part LIne 2: or the applicable line of your return Estates and trusts, Enter the sum of the amounts from Form 1041, Schedule G. lines la and 1b; or the amount from the applicable line of your retum Alternative minimum tax Individuals. Enter the amount from Form 6251, Ine 35 Corporations. Enter the amount from 14 es and trusts. Enter the amount from Schedule Form 1041,Ines6 9 Add lines 7 and 8 10a 10a Foreign tax credit 10b b Certain allowable credits (see instructions c Add lines 10a and 10b 11 Net income tax subtract line 10c from Ine 9.lfzero, skip ines 12through 15 and enter on ine 16 11 12 Net regular tax. Subtract line 10c from line 7.lfzero or less, enter -0- 12 13 Enter 25% (25 of the excess, if any, of line 12 over $25.000 (see 13 14 Tentative minimum tax 6251, ine 33 Individuals. Enter the amount from Form 4626, line 12 Enter the amount from Form Schedule l .Estates and trusts. Enter the amount from 14 15 (Form 1041), line 54. 15 Enter the greater of line 13 line 14 less, enter -0- acquisition, or 16 Subtract line 15 from line 11. lfzero or ownership change, 17 Enter the smaller of line 6 or line 16 has been an C ons: See the line 17 instructions if there 129a or reorganization. Cat No. For Paperwork Reduction Act Notice, see separate instructions